MPC meet: RBI hikes repo rate by 50bps to 4.9%; retains FY23 GDP forecast at 7.2%

ADVERTISEMENT

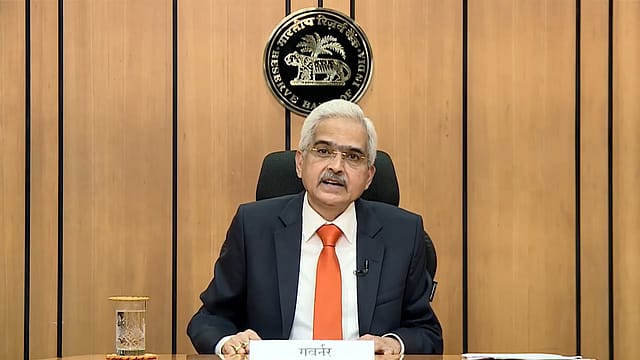

RBI governor Shaktikanta Das-led Monetary Policy Committee (MPC) has decided to hike the repo rate by 50 basis points to 4.9% in order to contain spiralling inflation. The MPC decided to remain focused on the withdrawal of the "accommodative" policy stance to support the economy battered by Covid-19 and the crisis that emerged due to the Russia-Ukraine war.

Marginal standing facility rate and bank rate have been increased to 5.15% from 4.65%, respectively.While making the policy announcement, Das says the RBI panel unanimously decided to keep the policy stance withdrawal of accommodation. With the increase in key lending rates, interest on loans is also set to rise as retail loans are benchmarked to an external rate, mostly to the RBI’s repo rate, with a quarterly reset clause.

The RBI expects inflation is likely to remain in the upper tolerance band in the first three quarters of FY23, which is why stronger measures were required, says Das. The MPC increased CPI inflation forecasts for all the quarters of FY23, with the full fiscal year inflation revised upwards to 6.7% from 5.7% earlier. For Q1, Q2, Q3, and Q4 of FY23, the retail inflation is estimated at 7.5%, 7.4%, 6.2% and 5.8%, respectively.

This is well beyond the RBI's target of 4%, with lower and upper limits of 2% and 6%, respectively.

Retail inflation at 7.79% in April soared to an eight-year high of over 4.23% in the same month the previous year, primarily due to the high prices of vegetables and oils. In March 2022, headline CPI inflation surged to 7% from 6.1% in February.

The MPC thinks India's GDP will grow at 7.2% in FY23, which means there's no change in the RBI's GDP growth projection. Das says MPC thinks India's GDP will grow 16.2% in April-June quarter, while the economy is expected to grow at 6.2% in July-September quarter of FY23. In October-December quarter of the fiscal year, the economy is expected to grow at 4.1%.

The central bank in its earlier forecast had estimated the GDP growth at 7.2% in FY23. Before the war broke out, the central bank had projected the GDP to grow at 7.8% for FY23. The government's recent report reveals India's economy grew by 4.1% year-on-year during the January-March quarter.

The country's GDP growth for the full fiscal 2021-22 stood at 8.7%, against a contraction of 6.6% in the previous fiscal.In May, the MPC had held an off-cycle meeting to take on the evolving inflation-growth dynamics. The MPC also voted unanimously to increase the policy repo rate by 40 basis points to 4.40%.

The SDF rate was adjusted to 4.15% and the marginal standing facility (MSF) rate and the bank rate were adjusted to 4.65%. The MPC had, however, decided unanimously to remain "accommodative", but assured it'll focus on withdrawal of accommodation to keep inflation within the target.