North South

ADVERTISEMENT

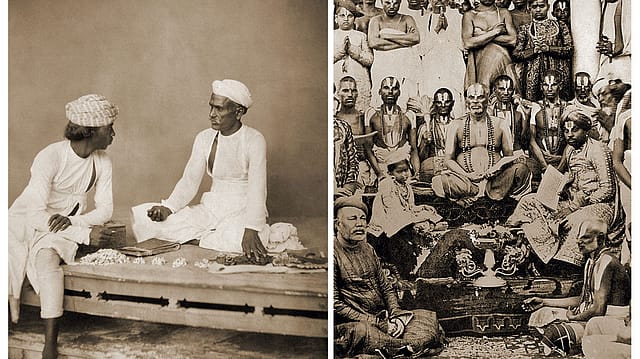

JASMINE, FILTER COFFEE, temple bells, and professional nerds, versus tandoori chicken, raucous music, and street-smart go-getters. That’s the stereotypical view of the land on either side of the Vindhyas, a 1,000 km range of mountains popularly seen as dividing North and South India. The great divide is even more evident when it comes to business. Companies in the South are seen as generally conservative, non-aggressive and reactive, while their counterparts in the North are considered aggressive risk takers. The differences north and south of the Vindhyas are sometimes so stark that they seem like two different countries. That’s an outcome of history, tradition, and cultural ethos.

South India—Andhra Pradesh, Karnataka, Kerala, and Tamil Nadu—has a few business communities to its name. Its polar opposite, which includes Maharashtra, Bihar, Uttar Pradesh, and all the other states north of Andhra Pradesh and Karnataka, is host to a wide variety of them. There are the Partition refugees, such as Raunaq Singh, who founded Apollo Tyres (current revenue of Rs 8,033 crore), and Hari Prasad Nanda, who came to the country with nothing and set up Escorts (current revenue of Rs 2,612 crore). Then there are other successful business communities, notably those in what is now Mumbai—Parsis, Jains, Bhatias, and others—who virtually built the city of Bombay. There were also Jews such as David Sassoon, who fled from Ottoman Iraq to set up a flourishing trading house (exporting Indian yarn and opium to China) in Bombay. Most of the communities who set up businesses there had their roots in other states or even countries, which is why Bombay was always a cosmopolitan, rather than a Maharashtrian, city. To be sure, there were a few well-known Maharashtrian business families (including the likes of Jagannath Shankarshet), but they formed a small part of the whole.

January 2026

Netflix, which has been in India for a decade, has successfully struck a balance between high-class premium content and pricing that attracts a range of customers. Find out how the U.S. streaming giant evolved in India, plus an exclusive interview with CEO Ted Sarandos. Also read about the Best Investments for 2026, and how rising growth and easing inflation will come in handy for finance minister Nirmala Sitharaman as she prepares Budget 2026.

The fortunes of these communities rose with the British empire in India, but it would not be fair to give the British full credit for the success of “native” businessmen. Even under the constraints of colonial rule, Indian capital flourished wherever it found the opportunity, sometimes overcoming substantial odds. Post Independence, some of these businesses declined with the rise of the Left parties in West Bengal and the resulting flight of capital to more friendly destinations, and the Dravidian movement in Tamil Nadu, which resulted in a huge brain drain when the Tamil Brahmins sent their children abroad to study and work. It’s not that Bombay had no troubles; apart from political problems, industry faced the rise of militant trade unions. Despite this, conglomerates such as the Tata group, the Wadia group (with companies such as Bombay Dyeing, Britannia and GoAir), and the Singhanias (J.K. Group) still flourish.

The Singhanias represent the entrepreneurial Marwari community, originally from the edge of the Thar desert. Their approach to business, like that of the Banias, a clutch of trading castes from various parts of North India, has historically been simple: buy low, sell high, keep expenses in check. A 1977 study by Ravi K. Hazari, a leading economist and bureaucrat, described Marwaris as the most aggressive community in India. “They are not emotionally attached to any location, unlike the Parsis, Gujaratis, or the South Indians. They would travel wherever the political capital was,” says Kaushik Dutta, author of a forthcoming book, India Means Business: How the Elephant Earned its Stripes, on the transformation of Indian business.

The Marwaris flourished during the licence-permit raj, but when the economy was opened up in 1991, many were unable to cope. “No longer protected by an entry barrier, they soon realised that their skills of working the system were no longer enough to fight competition,” says Dutta. The early 1990s saw the fall of many northern business houses.

Ironically, while these communities had thrived because of their proximity to the seat of power during the licence-permit raj, their business counterparts down South fell because they were far from the centre. Southern companies also felt the lack of a strong stock exchange; the Bombay Stock Exchange, Asia’s oldest, was set up in 1875, while the Calcutta Stock Exchange was incorporated in 1908. The oldest exchange in the South is the Madras Stock Exchange, which was established only in 1937.

RISK TAKERS

Perhaps because of their historical familiarity with, and proximity to, the stock market, the average North Indian business is more willing to raise funds from the stock market than a southern company. Only two South Indian companies find a place on the benchmark 30-stock BSE Sensex. Both these are infotech companies, and both were moved to the South. Wipro was founded in the North by a North Indian business family belonging to the Ismaili community. Infosys, started by a Kannada Brahmin, N.R. Narayana Murthy, was set up in Pune, near Mumbai, before it moved to Bangalore.

“Groups in the South have not been strong on the stock markets. By comparison, northern groups latched on to them,” says Rajeev Gupta, managing director of the Carlyle Group, India. When asked why the South was poorly represented on the Sensex, Kushagra Bajaj, joint managing director of Mumbai-based Bajaj Hindusthan (total revenue of Rs 2,266.8 crore in fiscal 2010), says: “It could be because of their conservative attitude.”

Southern business houses call this prudence. They are not in favour of chasing stock markets for better valuations and leverage, and do not want to be driven by quarterly expectations. Mallika Srinivasan, chairman of tractor major TAFE (part of the Rs 7,000 crore Amalgamations Group), explains why she does not want to take her Chennai-based company public. “We are looking to build shareholder value but not necessarily monetise it until we actually need it for growth.”

Even when there is a need for funds, she adds, her first option would be internal accruals. Raising money from the market, she says, is the most expensive form of fundraising, so she would rather borrow from banks.

Unlike TAFE, several Murugappa Group companies are listed. But the group’s strategy when it comes to raising funds is still conservative. “Our forefathers said, ‘You should always have the banker coming to you.’ We do not believe in stretching ourselves,” says Arunachalam Vellayan, executive chairman of the $3 billion (Rs 13,635 crore) group based in Chennai.

Compare this with Delhi-based real estate company DLF, which raised more than Rs 9,000 crore from the primary market in 2007. By March 2008, the company had made a loss of Rs 2,000 crore, which it tried to paper over with the IPO proceeds. Since that was not enough, it raised fresh debt. By end-2008, its debt stood at around Rs 12,600 crore.

FOCUS ON GROWTH

The stark difference between businesses on either side of the Vindhyas is, in many ways, a product of the way they look at growth. Chennai-based historian and businessman V. Sriram says the South has been insulated from foreign invasions and depredations. So, businesses set up in this part of the country behave like the tortoise in the fable: They move slowly but steadily. Companies are legacies to be inherited and passed on, not just cash cows to be milked dry.

The North, however, which has seen several invasions, has provided fertile ground for entrepreneurs and risk takers. For those who have witnessed periodic destruction, being aggressive and acquisitive and living for the moment comes naturally. The mayhem following Partition only strengthened that feeling, especially among those who had to abandon flourishing businesses in what is now Pakistan.

“We are risk takers because we know how to lose everything and then build from scratch. You can call it a refugee or immigration mentality,” says Onkar Singh Kanwar, chairman, Apollo Tyres.

Rajan Nanda, chairman of the Escorts group, explains his community’s appetite for risk. “We are neither burdened by the weight of traditions nor are we expected to be keepers of the wealth of four or five generations.”

That’s possibly why diversification is more common in North Indian companies, while core competence is valued down south. The hunger for growth saw Mahindra Finance, which started as a captive vehicle finance company for auto major Mahindra & Mahindra in 1995, diversify into related businesses such as insurance distribution, and rural housing. It also has plans to start an asset management company. “The company is very keen to get a banking licence for its non-banking financial arm,” says Ramesh G. Iyer, managing director, Mahindra Finance.

Mahindra Finance’s southern counterpart, Shriram Capital, also wants a banking licence, and is looking to become a financial services conglomerate. The difference? Shriram is more than 35 years old; Mahindra Finance, 15. But, as the managing director of Shriram Capital, G. Sundararajan, explains, the group has been preparing for this for long. “It is only now that we talk of it. We have been practising inclusive growth since 1974,” he says.

When it comes to growing inorganically, North Indian businesses lead. Take two companies in the same business: EID Parry (part of the Murugappa Group), and Bajaj Hindusthan (part of the Shishir Bajaj group). Vellayan is proud of the group’s sugar business, and refers often to his integrated strategy for sugar in Kakinada in Andhra Pradesh, where the company has its sugar plants and refinery within 500 km of each other. “It gives us a tremendous connect with the farmers,” he says. Vellayan is clear that sugar is a regional play “because you have to keep talking to the farmer and deal with local conditions”. Reason enough for him to stick to the sugar producing regions in the South. He does not plan to take his sugar business north of the Vindhyas.

Meanwhile, 33-year-old Bajaj wants to take his company, the country’s largest sugar producer, global. It is well entrenched in Uttar Pradesh, the country’s largest sugar producing state, so he’s not looking at opportunities outside the state. Bajaj Hindusthan has a subsidiary in Brazil, but Bajaj is looking to set up a greenfield project in the country. He adds that he’s also open to the idea of acquiring an existing sugar company there, but has not found any likely prospects. At the same time, Bajaj has his eye on the next big thing: power. “It will be bigger than telecom.”

MERGERS AND ACQUISISTIONS

The ability and willingness to risk capital means that North Indian businesses are more open to going global. South Indian firms are content to grow organically and in their home territory. This despite the fact that South India’s richest business community, the Chettiars, has a history of functioning abroad (much of their money was made in Burma, where they functioned as quasi-financial institutions).

Almost all recent big acquisitions (except information technology and IT-enabled services) are northern. These include Tata Steel’s $12 billion acquisition of the Anglo-Dutch Corus, Hindalco’s $6 billion purchase of Canada’s Novelis, Tata Motors’ $2.3 billion buy of Jaguar and Land Rover from Ford, and Bharti’s $9 billion buyout of Zain Telecom.

There have been a few instances of companies on the other side of the Vindhyas going global; Sundram Fasteners and the Murugappa Group have made some moves in the global arena. But such examples are rare. It’s possible that fiscal prudence and frugality in the scale of operations prevents South Indian companies from making expensive global plays. But even when they have matching resources, they are reluctant to enter the global arena. Take Chennai-based MRF and Gurgaon-based Apollo Tyres, both large companies. MRF is content to export tyres to 75 countries, while Apollo has made two global acquisitions so far.

“Apollo is looking to build volumes and has never been too focussed on return on shareholders’ equity. Logically, I can see why MRF has not spent capital to acquire what could be rights to a brand that may not add significant value,” says Y. Rama Rao, managing director, Spark Capital Advisors, a Chennai-based investment bank. However, he adds that by ignoring acquisitions, MRF stands the risk of being seen as a large player only in India and not be a global brand at all.

It’s not just global forays; companies in the South are often unwilling to cross the Vindhyas. Sun TV, the largest entertainment network in the South, has not made any serious attempt to crack the North Indian market. Hansraj Saxena, chief operating officer, Sun Pictures, says that Kalanithi Maran, chairman and managing director of the Sun network, believes that the North Indian market is too crowded. “Our heart is not set on going there,” says Saxena.

On the other side of the Vindhyas is Zee Entertainment Enterprises, North India’s largest entertainment network. Punit Goenka, managing director and CEO of the company, is very clear he has no plans to leave the southern market despite Sun’s dominance. “The South accounts for 28% of advertising revenue,” he says.

Slow and steady growth has its advantages, but the focus on stability could cost a group in terms of missed opportunities. The Murugappa Group, which manufactured bicycles as well as cold-rolled steel and chains, never looked seriously at the motorcycles and scooters industry. Today, Vellayan rues the fact, and says: “We could have become a major player in the two-wheeler segment; we had better credentials than others.”

SUCCESSION PLANNING

The same conservatism that might hamper growth comes to the South’s aid in avoiding family feuds. “Their businesses are far more mature than ours. Hence, we see less fragmentation and fewer conflicts compared to the North Indian families,” says Nanda. Historian Sriram disagrees. It is not that disagreements do not erupt in southern business families, he says. “Those involved in the disputes tend to talk it out, directly or through family or non-family elders. Rarely does it end up in court or the newspapers.” Also, he adds, South Indian businesses are generally seen as legacies, so importance is given to succession plans, and handing over begins during the patriarch’s lifetime.

Lack of this has dragged down many North Indian businesses. Bitter, open battles between brothers, uncles and nephews led to court battles that lasted for years. The focus invariably moved from business issues to legal ones, ending up in the fragmentation of the existing company. Conglomerates such as the Modi, Birla, and Thapar groups broke up amid battles between sons, brothers and nephews. Most of these feuds resulted in one splinter group becoming powerful; the rest invariably faded away.

Ranbaxy, once the largest Indian pharmaceuticals company, had been nurtured by Bhai Mohan Singh, who gave it to his eldest son Parvinder Singh to run. When Parvinder Singh died, Bhai Mohan Singh bequeathed the entire empire (other than Ranbaxy) to his youngest son, Analjit Singh. The will was bitterly contested by the other son, Manjit Singh, as well as Parvinder Singh’s widow and two sons. In all, 33 complaints and suits were filed in various courts, before the brothers and nephews agreed on a settlement.

Compare this with Chennai-based Malladi Drugs & Pharma. Like Ranbaxy, Malladi was hotly contested in an inheritance dispute. But when the family found things were getting ugly, it brought in a management consultant, Raghu Ananthanarayanan, who specialised in reorganising family-run businesses. Ananthanarayanan helped to transform Malladi into a professionally run company.

Malladi is not an exception in the South. “Professionalism is not about banishing the proprietor,” says 73-year-old R. Thyagarajan, chairman, Shriram Group. The Murugappa Group realised this in 1999, when the chairman decided to separate ownership from management, to take the competition head on. “The group decided the family should play the entrepreneurship, ownership, and trusteeship roles and leave management of the business to those who have trained for that,” says Sridhar Ganesh, director, HR, Murugappa Group.

Dr. Prathap C. Reddy of Apollo Hospitals has already defined the role and functions of his four daughters so that there is no confusion once he steps down. Preetha Reddy, his eldest daughter, will be the next chairperson of Apollo Hospitals. “It’s all about the age factor—being the eldest. Otherwise all of us are equal,” she says.

That is not to say that all North Indian business families end up fighting. The Dabur Group’s CEO is not a member of the family, and five out of nine members on the board are nonfamily professionals. “As part of the reflective exercise, they created a Family Business Council and provided for venture capital funding for new business ideas,” writes K. Ramachandran, professor at the Indian School of Business, in a paper on Indian family businesses.

PROCESS OF AMALGAMATION

In the past decade, things have changed. As a new crop of leaders takes charge, the great divide of the past is slowly being replaced by a new set of values that absorb the best of both worlds. This generation works the same way in the North and the South, says Nanda. It understands the importance of values, capital, and competition. “Competition itself will correct all the deficiencies within the two regions. It will also help transform India.”

That amalgamation is most visible in their offices. For long, the average South Indian office was known for its basic decor, while its northern counterpart was known for flash. “Our North Indian clients often told us to focus on the reception area alone. When we had to design an office for a South Indian company, however, we were told to avoid frills,” says Anuradha Rao, a Chennai-based architect whose firm, Aprobuild, has designed offices for the likes of Ma Foi Randstad and Axis Bank in Chennai and Gurgaon.

But Mumbai-based architect Hafeez Contractor, who has designed offices for companies such as ICICI, American Express, and even the Congress party, says that is changing. “Today, in the South, there are many offices that are flamboyant with a fair amount of money being spent. I think a lot of that has to do with people from the North now working in the South and vice versa. That’s giving rise to a more international approach to architecture.”

The process of amalgamation has begun elsewhere too. Says the founder of the Zee network, Subhash Chandra: “In the last decade, there’ve been many cases of southern businesses taking more risks than their counterparts in the north.” Businesses from Andhra Pradesh—the GMR Group, GVK Group, Lanco, Nagarjuna Construction, et al—have taken the lead in bidding and winning contracts. Their aggression and appetite for risk matches that of traditional North Indian businesses.

Meanwhile, northern businesses are trying to shed the tag of being rough and aggressive, and are adopting the southern regard for education. Dhruv Sawhney, chairman and managing director, Triveni Engineering and Industries, sent his sons to the Wharton School at the University of Pennsylvania, while Kanwar’s son is a graduate of Lehigh University in Bethlehem, Pennsylvania.

In The Ballad of East and West, Rudyard Kipling famously said the twain would never meet. With conservative business leaders like Vellayan showing aggression in acquiring companies, and Sawhney and his ilk absorbing what are considered to be southern traits, it looks like North and South might some day do what East and West will not.

THE NEW NORTHERNERS Aggressive practices and willingness to take risks defines businesses in Andhra Pradesh.

THE ANDHRA GUYS are an aggressive bunch, says Kushagra Bajaj, vice chairman, Bajaj Hindusthan. Add to this their ability to work together as a close-knit community and their strong political connections, and it’s easy to see why the Raos and Reddys of today have replaced the Marwaris and Banias of the licence-permit raj.

In just over a decade, at least six companies founded by Andhra businesspeople—GMR , GVK, Lanco Infratech, IVRCL, Maytas (now IL&FS Engineering and Construction Company) and Nagarjuna Construction—have become key players in the Indian construction and infrastructure space by bagging some of the most prestigious Indian contracts.

GMR Infrastructure’s four-fold increase in revenues—from Rs 1,022 crore in 2004-05 to Rs 4,861 crore in 2009-10— catapulted it in a span of five years into the national and international scene. In March 2008, it completed the plush new airport at Hyderabad, and in 2009 became the first Indian company to run an overseas airport—the Sabiha Gökçen International Airport in Istanbul—after completing its modernisation within 18 months. Only two years ago, it outbid Anil Ambani’s Reliance-ASA consortium and Anil Agarwal’s Sterlite Industries to bag the Delhi airport modernisation project.

Similarly, GVK Power and Infrastructure, whose revenues shot up nearly 11 times (from Rs 159 crore to Rs 1816 crore) in the past five years, worsted both Reliance and the DS Construction consortium to win the Mumbai airport modernisation contract.

Most of these companies are promoted by families that made their fortunes in farming. They are comfortable taking risks because they know that they can always fall back on agriculture if all else fails. Like most traditionally agrarian communities, they have a feudal mindset. The typical Andhra-backed business house is seen as more corrupt than its other South Indian business counterparts, an impression fostered by its willingness to go to any lengths to get its work done.

“There is an incestuous relationship between businessmen and politicians in Andhra Pradesh,” says S. Ananthanarayanan, a brand consultant to many Andhra companies. It is this connection that helps them work the system and allows them to bag several projects.