RBI MPC to pause rate hike in April policy meet: SBI

ADVERTISEMENT

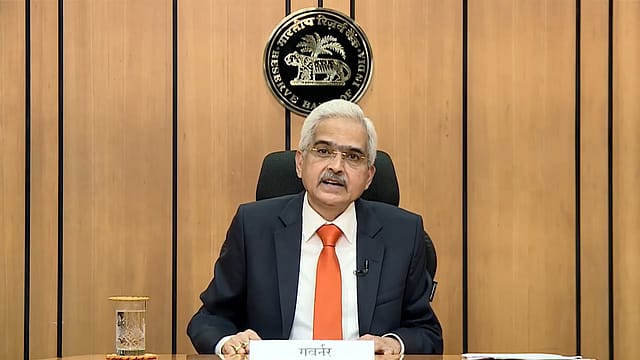

The Reserve Bank of India (RBI) is likely to pause the rate hike in the April policy meeting, according to economists at the State Bank of India (SBI). In its report titled, 'Prelude to Meeting on April 3 to April 6', the country’s largest lender said that 6.50% could be the terminal rate for now. According to SBI, the stance could continue to be withdrawal of accommodation, even as liquidity is now in deficit mode. RBI can always keep the options open in June policy, it said.

In its last MPC (monetary policy committee) meeting, RBI hiked the key repo rate by 25 basis points (bps) to 6.5% while withdrawing the “accommodative stance” to tame high inflation in the country. With this, the RBI has increased the repo rate for the 6th time in a row.

“The RBI has enough reasons to pause in April. There are concerns of a material slowdown in the affordable housing loan market and financial stability concerns taking centre stage. While concerns on sticky core inflation are justified, it may be noted that average core inflation is at 5.8% over the last decade and it is almost unlikely that core inflation could decline materially to 5.5% and below as post-pandemic shifts in expenditure on health and education and the sticky component of transport inflation with fuel prices staying at elevated levels will act as the constraint. By this logic, RBI may then have to go for more rounds of rate hikes,” SBI said.

Apart from hiking the key repo rate, RBI also revised the standing deposit facility rate to 6.25% from 6% earlier, whereas the marginal standing facility and bank rate have been hiked 25 basis points to 6.75%. Meanwhile, RBI expects the country’s GDP to grow at 6.4% for FY24 and 7% for FY23. The GDP growth for Q1 of FY24 has been projected at 7.8%, for Q2 at 66.2%, Q3 at 6% and Q4 at 5.8%.

For FY2022-23, RBI has projected retail inflation to be at 6.5%, whereas for FY23-24 the retail inflation is forecasted to be at 5.3%, with Q1 at 5%, Q2 at 5.4%, Q3 at 5.4%, and Q4 at 5.6%. This is within the RBI’s target range of 6%.

“Inflation data of March and April will only be known to RBI before the June MPC meeting. Our expectations are that March inflation could be around 5.5% -5.6% and April inflation print will be around 4.7%-4.8%. Thus, the RBI will have a delicate balancing job of either looking forward to the June meeting with clear signs of inflation trending downwards or looking backwards at the Jan and Feb prints in the April policy. Thus, it will be a delicate choice,” it added.