Nirav Modi through Firestar numbers

ADVERTISEMENT

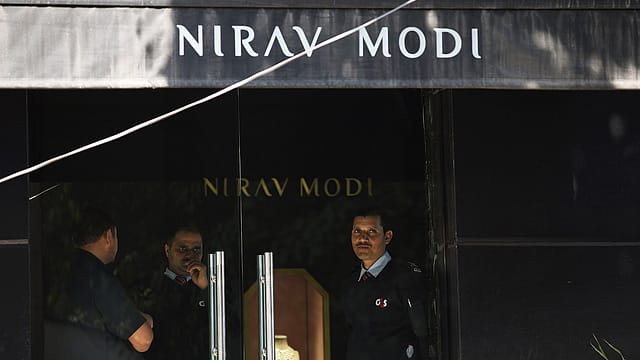

Bankers often mark the profile of prospective borrowers associated with the diamond industry as negative. But, perhaps, Nirav Modi was not among them, with the state-owned Punjab National Bank reporting corporate fraud to the tune of $1.8 billion that largely benefitted his diamond business.

Though the spotlight today is largely on Modi, and his rather spectacular rise in the diamond business, here is a look at the financials of two of his companies: Firestar International and Firestar Diamond International.

Firestar International’s total standalone income grew at a compound annual rate of 24.25% in 12 years from March 2005 to March 2016. The company being unlisted, the financials beyond March 2016 are not available.

As a standard practice, the value of purchase of finished goods—a common expenditure for gems and jewellery companies—is deducted from the revenue while compiling the Fortune India 500 list. On standalone basis, Rs 888.01 crore of purchase of finished goods accounted for over 19.58% of Firestar International's revenue in March 2016.

Consolidated figures of Firestar International were available for only two fiscals—2014-15 and 2015-16. As at March 2016, Firestar International's consolidated revenue of Rs 12,562.49 crore would have been adjusted to Rs 5,843.69 crore, after deducting Rs 6,718.80 crore worth purchase of finished goods. Compared to 19.58% in the standalone business, the consolidated non-value adding proportion here was 53.48%.

Thus, if Firestar International’s consolidated figures were made available in time, the company, with Rs 5,843.69 crore revenue, would have ranked 217 in Fortune India 500’s 2016 list. (The cut-off date for the list is October 31). This would have placed the company just after Jubilant Life Sciences, and would have pushed textiles major Raymond down by a rank.

Though the interest costs—on standalone and consolidated basis—were not alarmingly high, the consolidated profit of Rs 454.79 crore would have been third largest among the five gems and jewellery companies that did make it to the 2016 list: Rajesh Exports, Titan Company, Gitanjali Gems, Asian Star Co and PC Jeweller.