Covid-19 and the age of universal basic income

ADVERTISEMENT

At least one top lawmaker in India explained to me in great detail a few years ago how if all Indians were given Rs 5,000 every month, no matter who they were or how much they earned, and all other subsidies were withdrawn, it would significantly boost the economy.

I have been thinking about this conversation this week as the world prepares historic bailout packages to kick-start the economy: the US has a $2-trillion plan (the country’s largest ever), the G20, a $5-trillion one. It is almost certain that we might be transitioning to a world where public expectation of widely distributed income support becomes legitimised in some format or the other, and for most people.

Economists, especially from the Modern Monetary Theory (MMT) School, have long advocated the use of fiscal policy to achieve full employment and the creating of new money to fund state activities. They believe that any fear of raging inflation due to such easy supply of money can be absorbed through better taxation and issuing bonds. With scepticism growing about a V-shaped recovery, meaning a rapid economic recovery from the Coronavirus lockdown, the idea that the Covid-19 crisis may have pushed the world closer to the notion of Universal Basic Income (UBI) is taking ground. Even at the risk of inflation.

In the US, as Stanford historian Jennifer Burns has pointed out, “(UBI, which was) a policy idea that was outlandish and fringe a few months ago is now a major topic of discussion in Washington, DC”.

In India, the idea is even less radical, not least because the country already has a several trillion rupees food, fertiliser and fuel subsidy programme each year (the budget allocation for 2020-21 is Rs 2.6 trillion).

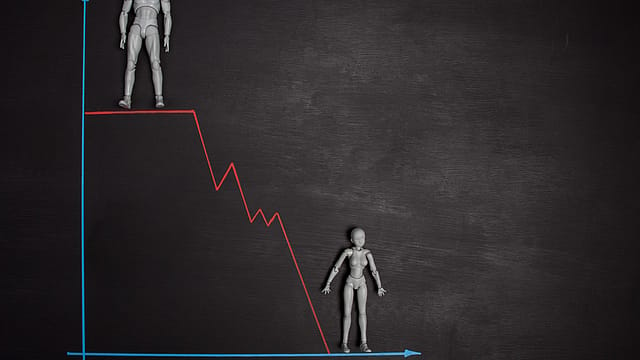

The Covid-19 crisis will also propel the adoption of automation and technology (including artificial intelligence) which was already happening at a rapid speed, and now shall only accelerate. A recent Brookings report suggested that the replacement of routine jobs with automation especially during a time of crisis is inevitable. It provided historical evidence from two papers, one from the National Bureau of Economic Research in the U.S., and another from the W. E. Upjohn Institute for Employment Research which show that across three recessions in America in the last three decades there were seeping losses in routine jobs which were replaced by automation in these periods.

In India, it must be considered that more than 80% of the labour force is employed in the informal sector or in unregistered businesses, where job volatility is even greater than in the formal sector in times of crisis. Also, around half of all labour in India work in agriculture, another area desperately in need of support.

It is therefore to be expected that a post-Covid-19 future would have unprecedented government borrowings and income support of some kind or the other in every other country.

In India it is to be seen what kind of support this translates to and how it is targeted but the initial response of the government has made it clear that agrarian workers, large parts of the informal sector, and especially underprivileged women would be a priority.

The question in India is, if all the subsidy, and any increase of support in the future, should just be through cash. The need for material delivery of goods cannot be underestimated. One of the most popular schemes of the government is the distribution of cooking gas, and a pledge to give free cooking gas was an important part of the $22.6 billion relief announcement by the government.

But the rollout of UBI in India would need to happen side-by-side with the progress of its mushrooming startup ecosystem (now the third largest in the world). MMT or not, UBI brings with it the eventual question of public productivity, and growth of entrepreneurial energies ought to be considered non-negotiable.