India must secure real GDP growth of at least 7% in FY25: RBI

ADVERTISEMENT

The Reserve Bank of India (RBI) believes the objective in 2024-25 should be to sustain the growth momentum by securing real GDP growth of at least 7% in an environment of macroeconomic stability.

"In India, potential output is picking up with actual output running above it, although the gap is moderate," the RBI says in its monthly bulletin for January.

Inflation needs to align with the target by the second quarter of the year, as projected, and get anchored there, the RBI says.

"Balance sheets of financial institutions need to be strengthened and asset quality improved even further. The ongoing consolidation of fiscal and external balances needs to continue," the central bank says.

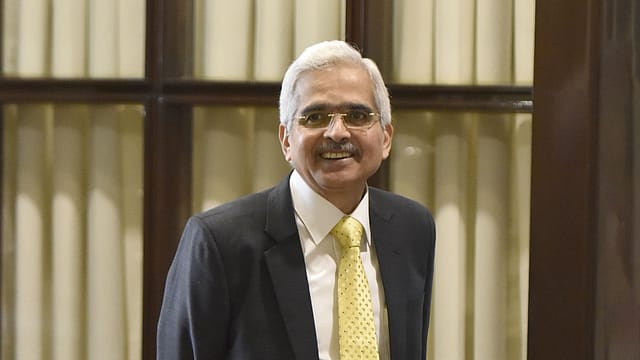

This comes days after RBI governor Shaktikanta Das said India's gross domestic product (GDP) growth will touch 7% in the financial year 2024-25. “I am saying this on the basis of strong momentum of economic activity seen in India. Consequently, growth would be 7% and above for four consecutive years starting from FY 2021-22,” Das said on the sidelines of the World Economic Forum in Davos.

Global trade growth, which had flatlined in 2023, is expected to recover in 2024, although it will likely remain below its pre-pandemic trend. On global trade, the RBI says significant headwinds continue to prevail. Global trade in goods and services grew at a tardy pace of 0.2% in 2023 – the slowest expansion outside global recessions in the past 50 years. PMIs for new export orders remained in the contractionary zone in December as export orders for both services and manufacturing recorded sequential declines, it says. The World Bank has, however, projected global trade to pick up to 2.3% in 2024.

“As far as the Indian economy is concerned, it is now poised for a long haul of higher growth. There are challenges, but they have to be dealt with effectively. With a confluence of factors in its favour, the confidence on India’s prospects is at an all-time high. We have to make this happen in reality,” says Das.

The Indian economy recorded stronger than expected growth in 2023-24, underpinned by a shift from consumption to investment, according to the RBI. The government’s thrust on capex is starting to crowd-in private investment,” the banking regulator says.

“With the current account deficit remaining modest, domestic saving is financing growth in India in a world buffeted by daunting headwinds. On the flip side, private consumption, which accounts for 57 per cent of GDP, languished in the backwash of the slow but steady revival of the rural economy. This only serves to underscore our consistently held view that inflation has to be restrained to its target for growth to be inclusive and sustained,” it says.

The slowdown in exports has emerged as a drag on growth, the RBI cautions.