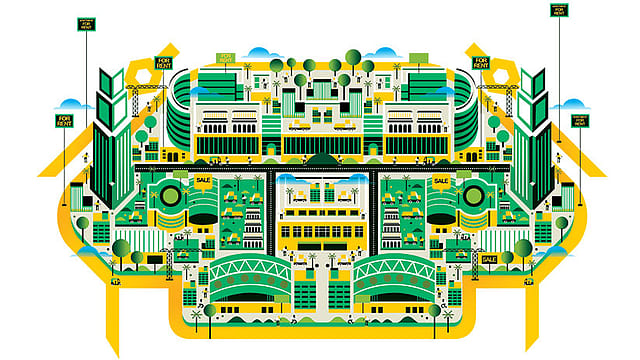

Settling to move

ADVERTISEMENT

Priyanka Koijam has been living in Mumbai for eight years. She is 31, has a comfortable job with a big Indian company, and rents a little place close to work in the heart of the city. Conventional wisdom says it’s the right time for her to put down money on an apartment. But Koijam doesn’t think so. “Just for the sake of buying a house, I don’t want to move to the fringes of the city. Right now, I live so close to my office that I cycle to work and that’s simply because I choose to rent,” she says. “Also, I don’t want to be tied down with a lifelong EMI. Renting also gives me the flexibility to go on a sabbatical.”

Owning a home has always been every Indian’s biggest dream. And until about 20 years ago, it wasn’t impossible for that dream to come true. A schoolteacher earning around Rs 20,000 a month could comfortably buy a flat in a Delhi or Mumbai suburb for around Rs 15 lakh without spending his entire life paying off a back-breaking loan. Not anymore. Today, it is virtually impossible to buy a house in a big metro even with an annual package of Rs 15 lakh, thanks to the astronomical increase in property prices over the past two decades. People have to fork out at least Rs 2 crore-Rs 3 crore for apartments in the suburbs and the sky is the limit in prime areas in the city.

It is hardly surprising then that people like Koijam are turning their back on investing in property. They might still be a small minority at the moment but with real estate prices hitting the roof, experts say renting is the future of housing in India’s metros. Real estate consultants believe it is the only way forward because it doesn’t block your capital, is more tax efficient, and gives you the flexibility to move whenever you want. “Rental yields are so low that you don’t lock your capital and you can utilise it in a smarter way. This is capital that most of us don’t earn again in a lifetime,” says Gulam Zia, executive director at property consultant Knight Frank India. “Rental housing also gives you the flexibility to experience a change.”

January 2026

Netflix, which has been in India for a decade, has successfully struck a balance between high-class premium content and pricing that attracts a range of customers. Find out how the U.S. streaming giant evolved in India, plus an exclusive interview with CEO Ted Sarandos. Also read about the Best Investments for 2026, and how rising growth and easing inflation will come in handy for finance minister Nirmala Sitharaman as she prepares Budget 2026.

Look at land prices today and you know why the middle-class prefers to rent. In Gurugram, for example, average prices in areas close to the Delhi border have jumped to a massive Rs 10,000 per sq.ft. from an affordable Rs 1,294 in 1997. Similarly, property rates in Mumbai’s Nariman Point, the heart of the financial capital, have shot up to Rs 117,000 per sq.ft. from just Rs 12,000 two decades ago. With land rates rising up to 10 times, Kartik Jhaveri, director, Transcend Consulting, a financial planning and wealth management services firm, says renting makes more financial sense. “In large cities like Delhi and Mumbai, if the EMIs that people have to shell out are instead invested in SIPs (systematic investment plans) and mutual funds, they can even plan on retiring by the time they are 45,” he says. “By investing that EMI money in the right products, you can easily have enough money to start a new business and save up for the rest of your life.”

Quora, a popular question-and-answer website, is full of young professionals who consider renting the better option. One tech professional, for example, had to shift to Delhi after he bought a house in Bengaluru. He is now struggling with a home loan EMI and rent because he hasn’t been able to get the right price for his flat. No wonder a 2009 National Sample Survey showed nearly 35% of urban households were living on rent. Another study by independent researcher Arjun Kumar, published in Economic & Political Weekly in June 2016, pegged the total number of rented households at 27.4 million in 2011.

Affordable housing is an alternative for people on a budget. The government is encouraging real estate developers to take up affordable housing projects, but acquisition of land is a problem. “Affordable housing at this point of time cannot be done in the cities. It has to be the peripheries of cities,” says Jaithirth “Jerry” Rao, former banker and champion for affordable housing. “Affordable housing for now will be restricted to areas like Thane, New Mumbai, Mysuru Road-NICE Road junction, beyond Electronic City [near Bengaluru] and other such ‘peri-urban’ areas which are on the outskirts of the city,” adds Rao, executive chairman of affordable housing developer Value and Budget Housing Corporation.

While the merits of owning a house remain undeniable, no one seems to disagree that the time has come for India to learn from urban housing models in the developed world where rental housing is an important part of the solution. Property prices in Delhi and Mumbai are comparable to cities like New York, London, and Singapore. In New York, already more than half the population lives on rent and in London, the number is just short of 50%. In Britain, developers are increasingly making ‘build-to-rent’ projects in which developers themselves rent out to tenants on a long-term basis, suggesting that the Thatcherite dream of everyone being a home-owner is dead.

Tejas Patil, head of real estate at Sanctum Wealth Management, says that with rental yields expected to grow in the future, real estate developers are exploring business models in which they rent out flats directly to customers. “We are working with a few developers and there are signs of new business models. Developers who have inventory and their own rental arm, enter into a model where the rental arm acts as an intermediary and rents it out to bigger companies. These would be like serviced homes which offer facilities as good as a hotel,” he said.

Some experts say the real push for rental housing will have to come from the government. For example, China runs a government-sponsored low-rent-housing programme which also offers tax exemptions to companies that build and manage public-rental housing projects. But the government’s role shouldn’t be limited to providing rental housing. Laws also need to be strong enough to dispel fears of rent control for investors and to enable tenants to build a life in a rented home without being thrown out every few years. “The big problem for a tenant is that nobody wants to enter into a 10-year lease. If the property market was more structured and the legal system was stronger, I think renting would be such a wise thing to do,” says Transcend Capital’s Jhaveri. “But because we don’t have a system which is end-user friendly, we end up having no choice other than spending a lifetime’s savings on that one property.”

The time seems ripe for the Narendra Modi-led government to shake off the dust from the draft National Urban Rental Housing Policy released in 2015. The policy—which proposed to promote public-private partnership for construction, management, and maintenance of rental housing stock, among other ideas—remains in limbo at the Ministry of Housing and Urban Poverty Alleviation.

Still, many experts believe property is the best investment. Sceptical about the public discourse around renting, their arguments range from the emotional value of being a home owner to the growth prospects of the market. According to consultancy firm PwC, the Indian real estate market is expected to grow to $180 billion (Rs 11.4 lakh crore) by 2020 from $126 billion at the end of 2015. A report by global management consulting firm Bain & Company estimates the residential segment accounts for 85% of the market. It forecasts total demand will increase to 1.35 billion sq.ft. by 2020 from 880 million sq.ft. in 2015. “There is some psychological value to purchasing your own home. If you are a young couple working in a place like Pune or Gurugram, and you have pretty much decided you will live there for the next few years, then it makes sense to purchase a house in a radius of 5 km-10 km,” says Rao.

Proponents of buying point to the tax benefits of investing in real estate. Sanctum’s Patil says that with mortgage rates down to 8.5%, the borrowing cost works out to just 6%-7% after the tax benefits. Renting, on the other hand, does not offer such benefits apart from house rent allowance exemptions.

Patil adds that rentals will keep increasing in metros with high demand for good rental homes and move towards the global average of 5%-6% from 2%-3%. Mohit Goel, chief executive officer at real estate development firm Omaxe, also says that rental yields will continue to grow while EMIs will remain stable. “Buying a house also gives an individual a sense of ownership, besides there is an emotional attachment. There are some other obvious advantages of owing a house. For instance, one can renovate and upgrade facilities. Thus, it is always better to buy a house,” he says.

Yet, the reality is there aren’t many buyers, or there aren’t many who can afford to buy. However, India’s over 23,000 developers—including big players such as DLF, Parsvnath Developers, Tata Value Housing, and Godrej Properties—continue to build. Between 2010 and 2016, roughly 1.9 million residential units came into the market across the top eight cities of Mumbai, Delhi NCR, Bengaluru, Pune, Chennai, Hyderabad, Kolkata, and Ahmedabad, according to industry reports from PropEquity, Knight Frank, PropTiger, and others. However, the number of takers has fallen because of the economic slowdown. At the end of December 2016, these eight cities had an unsold inventory of nearly 6,15,000 residential units. According to PropEquity, the total unsold residential inventory across 42 cities is 1.1 million units valued at Rs 872,078 crore.

Though renting as a long-term housing solution has its critics, many millennials consider it a wiser financial decision and not just throwing money away. Rajat Guha, a 34-year-old with a PR business in Delhi, for example, rents in a posh south Delhi neighbourhood. He and his wife, Vishakha Talreja, who runs a hotel discovery website, don’t want to be saddled with mortgage payments. “I do not have an EMI sword dangling over my head. My disposable income increases and also I can invest my money into my business,” says Guha.