Urban mining: Lift cover for your next ring

ADVERTISEMENT

An hour or so into our meeting, thirtysomething Nitin Gupta takes to drawing flowcharts for me with great enthusiasm. I came prepared to be impressed. After all, Attero, the Noida-based startup Gupta co-founded in 2008, has been to NASA to talk about the challenges of sustainable technology. But now, all the complicated chemical processes involved in metal extraction from electronic waste, Attero’s speciality, are leaving me dazed rather than dazzled.

It’s not a comment on Gupta’s drawing skills; the afterlife of discarded things can be a dreary subject. I find it hard to get over mental images of India’s ubiquitous kabaadi trade: the unorganised junk business characterised by brutal manual labour and nonexistent safety standards.

Perhaps Gupta senses my stupor. He puts away the flowcharts and decides to tell me what I only had a hint of before the meeting, and have really come to hear about. “We are the second-largest extractor of gold in the country,” the NYU Stern grad says, uttering each word with relish. Tanishq, possibly the country’s best-known gold jewellery brand, buys gold from Attero’s patent-holding metal-extraction plant in Roorkee, Uttarakhand. (At the time of going to press, we could not get a response from Tanishq.)

Just like that, tedious chemistry turns into magical alchemy. Gupta starts reeling me in. “E-waste is a multibillion-dollar industry,” he says. Estimates vary, but a report by Allied Market Research says it will be worth about $49 billion (over Rs 3 lakh crore) by 2020. Gupta reckons that the market size in India is between $2 billion and $5 billion, growing at 25% to 30%. “It is a great opportunity to chase as there are not many players,” he says.

In developed countries, e-waste has attracted large waste-management and smelting companies, thanks to the high margins. But in India, the industry is controlled by kabaadis, whose sweatshops penetrate virtually every neighbourhood corner. Still, Gupta says Attero’s revenues have doubled year on year, closing last year at Rs 141 crore on a total investment of Rs 145 crore. The company raised Rs 100 crore last August in a third round of funding and has become the poster child of India’s fledgling e-waste start-up scene.

But I am impatient to hear more about gold. India, the world’s biggest gold guzzler, has only one operational gold mine, at Hutti in Karnataka, which produces a paltry 2 tonnes annually. In March, the country imported 125 tonnes, pipping China as the largest gold importer. Now Gupta is telling me that he has found a way to feed the monster using scrap. “The quantities are of course much smaller than Hutti,” he disclaims, lest I get ahead of myself. “Our gold production on an annual basis would be in lower three digits (in kilograms),” but the potential is huge.

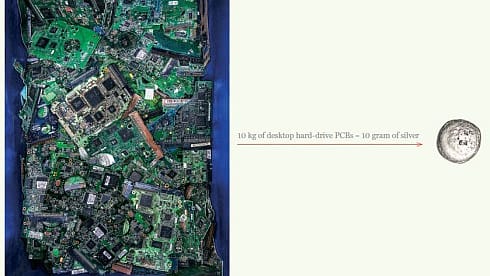

Here’s why: Extracting a gram of gold takes about a tonne of ore in a mine, but you can squeeze out the same quantity from roughly 41 smartphones. Gupta says a typical mine would use at least 10 times more input to extract the same amount of gold compared with e-waste. Even a mine with a high production ratio, such as Kalgold in South Africa, needs a tonne of ore to produce 5 grams of gold; a tonne of e-waste can spit out 50 times as much.

A report by the United Nations University suggests that the gold content in e-waste in 2014 was about 300 tonnes globally, or 11% of the gold production from mines in 2013. That’s just scraping the surface: The volume of global e-waste is increasing by 2 million tonnes a year and will reach 50 million tonnes by 2018—but only 16% of it goes through any kind of recycling.

The U.N. also reports that India is the fifth-largest producer of e-waste in the world. It generated 1.7 million tonnes of the stuff in 2014, or about 1% of the country’s total solid waste. “Every year India imports gold worth $35 billion to $40 billion, and electronics worth over $30 billion,” says Somasundaram P.R., managing director, India, World Gold Council. “So if there is even a little bit of gold [in scrap], recycling becomes important for environmental reasons as well as reasons of value.”

January 2026

Netflix, which has been in India for a decade, has successfully struck a balance between high-class premium content and pricing that attracts a range of customers. Find out how the U.S. streaming giant evolved in India, plus an exclusive interview with CEO Ted Sarandos. Also read about the Best Investments for 2026, and how rising growth and easing inflation will come in handy for finance minister Nirmala Sitharaman as she prepares Budget 2026.

Welcome to the world of urban mining, or using the city as a source of raw material. It’s a quaint concept yet, but not for long given that the production of gadgets, primarily to support our urban lifestyles, is becoming an unviable burden on natural resources, requiring almost $12 billion annually in identifying virgin deposits.

India is a major culprit in the resource drain. It is one of the largest electronics markets in the world, anticipated to reach $400 billion in 2022 from $69.6 billion in 2012, per the India Brand Equity Foundation. Predictably, smartphones will lead the boom: From 90 million users in 2013, India is likely to have 520 million smartphone users by 2020, according to telecom equipment giant Ericsson.

That spells a big payday for all manner of bounty hunters. B.K. Soni, chairman and managing director of Mumbai-based Ecoreco, India’s only listed e-waste management firm, estimates that at any point, the e-waste industry is worth about 5% of the electronics industry. “So if electronics grows to $400 billion, e-waste will be around $20 billion,” he says, explaining why more players ought to cash in.

But any new entrant must first fight the stranglehold of the kabaadis over the business. The collection and disposal of solid waste in India falls under the purview of the municipalities—and even that is frequently pilloried for mismanagement and rampant manual scavenging—but there is simply no formal system for e-waste, leaving the unorganised sector in charge.“Solid-waste management across the world runs on government contracts,” points out Gupta of Attero. “The input feedstock in that industry has little value, and there is little incentive for innovation. E-waste is far more valuable and complex. It needs scientific handling,” he adds.

An organised recycler, says Soni, has to pump in a minimum of $10 million to $20 million. Even after all that cash burn, they struggle to compete with kabaadis, who can be in business for as little as Rs 50,000, for a frustratingly simple reason: Sellers love the convenience of kabaadis picking up junk from their doorstep and paying them cash instantly—even if they are aware of their less-than-ideal methods.

Jehangir Alam, 28, is a kabaadi based in Seelampur in Delhi, one of India’s flourishing informal e-waste hubs, along with Moradabad in Uttar Pradesh and Dharavi in Mumbai. In a month, Alam collects about 500 kg of printed circuit boards (PCBs or motherboards), where much of a gadget’s precious mineral core is lodged, or about 5,000 to 10,000 mobile phones, from a collection network covering a few cities. He makes anything between Rs 1 lakh and Rs 1.5 lakh for his troubles, but won’t say how much he has to spend to get there and what kind of processes he follows.

Does he think the newfangled businesses in this space can become a threat? Not a chance. “Kabaadis can never become redundant,” he tells me dismissively. “Things become old all the time, so we will always have a market. It’s like e-commerce; websites cannot kill physical shops.”

Alam says the only advantage organised players have is that they hold licences, so sometimes it is easier for them to get raw material. “But most of them still fail because they are unable to get enough. It is impossible for them to compete with the networks we have built over decades.” Most companies I spoke to grudgingly confirm that increasing supply remains their biggest headache.“A kabaadi’s cost advantage is also much higher because they don’t pay minimum wages, and they use child labour,” frowns Gupta of Attero. The Associated Chambers of Commerce and Industry estimates that between 35,000 and 45,000 children aged 10 to 14 are involved in handling e-waste in Delhi alone.

The implications of that are ghastly. Kabaadis generally desolder PCBs by heating them, and then dip them into cyanide and other harsh chemicals to extract gold and other metals. Each of these processes can be life-threatening. In fact, the International Labour Organization warns that India, along with Brazil and Mexico, faces huge environmental and health damages if e-waste recycling is left to the unorganised sector.“We tested water and soil samples from five [kabaadi] locations, and in three we could easily find metal contamination,” says Nivit Kumar Yadav, programme manager, industry and environment, at the Centre for Science and Environment in Delhi. But most residents don’t complain because their livelihoods depend on it, and the government can’t afford to take a tough stance fearing electoral backlash.

There’s also larger citizen apathy. Priti Mahesh, senior programme co-ordinator at environmental NGO Toxics Link, believes Indians are not clued into waste-management issues, except maybe solid waste because it is right on their face. “They aren’t bothered about electronic waste because they don’t see it,” she says.

Many of the industry’s problems can be blamed on inadequate legislation. Currently, it is governed by the E-waste (Management and Handling) Rules of 2011. The centrepiece of these rules is the concept of extended producer responsibility (EPR), which places the primary responsibility of e-waste management on the manufacturer. But critics say manufacturers routinely flout the tenets of EPR by not having enough collection centres

and not reporting collection data transparently. (Samsung Electronics, India’s second-largest smartphone manufacturer, told me by e-mail that they have 280 collection points across the country. While that’s a promising start, it’s difficult to ascertain if it is enough.)

If it is any consolation, even the industry in the U.S.—where people reportedly discard enough phones to cover 50 football fields every day—is grappling with similar problems. “The challenge ... is getting the electronic waste to the facility, because right now only a fraction of electronic waste is effectively recovered for recycling,” Allen Hershkowitz, senior scientist with the Natural Resources Defense Council’s Urban Program, says in a Fortune story (‘Can Urban Mining Solve the World’s E-Waste Problem?’). “From an economic perspective, we need government requirements, as they have in Europe, that obligate the consumer products companies to participate in funding the infrastructure to recover these materials for recycling or refurbishment,” Hershkowitz adds.

A few models are emerging to make selling e-waste easier as well as sustainable. In the U.S., Outerwall (formerly Coinstar), famous for its automated coin-counting and deposit machines commonly seen in American supermarkets, has invested in EcoATM kiosks, which let people drop off electronics, assess the value, and dispense cash or coupons.

Back home, Attero has a home pick-up portal, Atterobay, covering 600 cities. The portal asks you to identify the product you want to get rid of and answer a few questions about its condition, after which it determines a price. It then organises a pick-up, runs a quality check on the product, and sends you your money within three weeks. It also runs buyback programmes for Voltas, Infosys, and Wipro.

However, some allege that recycling companies are choosy about the waste they pick up. “They have been cherry-picking,” claims Mahesh of Toxics Link. “They only accept smartphones, laptops, and tablets, which are profitable, and ignore things like washing machines and refrigerators which aren’t that attractive,” she says. Most recyclers I spoke to deny the charge.

At Attero’s Roorkee plant, workers separate mounds of e-waste into glass and non-glass parts. The latter is fed into a shredding machine, and the output passed through a magnetic field to suck out strips of iron. The residue is sent to an eddy-current separator, which separates the non-ferrous metals from unusable waste.

The real poser is extracting metals from PCBs. In a mine, there are four or five interfering metals; in e-waste there are more than 70. The chemical as well as metallurgical properties of a metal change in the presence of other metals, and as the number of metals increases, the change becomes so drastic that it is difficult to predict on paper, says Gupta.

Globally, few companies specialise in metallurgical extraction. Belgium’s Umicore, Japan’s Dowa, and Germany’s Aurubis are some of the leaders in the field, though they are all large materials and minerals conglomerates for whom it is one of many businesses. Attero claims its focus on extraction has given it a technological edge; it says its patented process is the most cost-efficient in the world. “For most foreign companies, the capex per tonne of PCB is roughly $15,000. For us, it’s only about $1,000,” Gupta says. The size of the plant for most foreign companies is 75 acres. Attero’s facility is less than an acre.

Given that scaling up is tough (“It’s all very well to say you can produce one gram of gold from 41 smartphones, but will you get so many smartphones every day”? asks Soni of Ecoreco), the company is now diversifying deep into the periodic table: Consider that there are more rare-earth elements in discarded phones, laptops, and tablets than in all known natural reserves, and only 1% of all such elements is recycled today. China produces about 95% of rare earths—an industry that is expected to cross $8 billion by 2019, growing at a CAGR of 13%.

Few players in India have the technology to extract rare earths cost-effectively. Attero says it has extracted neodymium, which is found in 90% of the world’s magnets, in the lab, though the technology isn’t market-ready yet. It also claims to be India’s only producer of cobalt, lithium, palladium, and platinum (Fortune India couldn’t independently verify this). “We are also investing in R&D to extract other rare elements like barium and selenium, used in the back panels of LCD TVs,” says Gupta.

Slowly, the excitement is spreading. Take Bengaluru-based recycler E-Parisaraa which started small, extracting gold and silver from e-waste for electroplating watches, jewellery, and temple decorations. P. Parthasarathy, its managing director, says it now plans to build a recycling park under the Narendra Modi government’s Swachh Bharat (Clean India) programme.

But before such ambitions can add up to anything concrete, the industry has to sort out the kabaadi challenge. One way of doing it: Live with them. Though some recyclers source raw material from kabaadis, “they have made little effort to really engage with them”, says Yadav of the Centre for Science and Environment. “They are waiting for a policy which makes the [kabaadis] vanish.”

Soni of Ecoreco agrees that more needs to be done to “educate and uplift” the kabaadis. He isn’t as convinced that e-waste is ready for more entrepreneurs. “I am really an outsider in this industry. It belongs to the kabaadis,” he shrugs. “If you ask me, I would also like to surrender my licence and become one of them,” he says, only half in jest.