Budget 2026: Industry should take the wheel in semiconductor 2.0 push

Under the Electronics Components Manufacturing Scheme, launched in April 2025, Sitharaman announced an increase in outlay to ₹40,000 crore from last budget’s ₹22,919 crore.

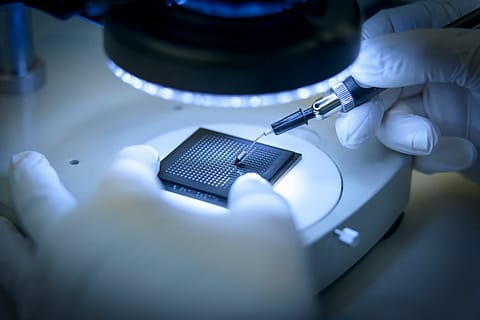

To scale up semiconductor manufacturing, finance minister Nirmala Sitharaman announced the launch of India Semiconductor Mission (ISM) 2.0, shifting the responsibility of shaping its future decisively to the private sector. “Building on this (ISM 1.0), we will launch ISM 2.0 to produce equipment and materials, design full stack Indian IP, and fortify supply chains. We will also focus on industry led research and training centres to develop technology and skilled workforce,” she said in the budget speech.

The government had approved around 10 semiconductor projects with a total investment of Rs 1.6 lakh crore so far, including semiconductor fabrication units and multiple testing and packing facilities of Tata, Micron and CG Power. However, India’s semiconductor industry continues to face critical challenges, particularly a widening talent gap, heavy reliance on imported materials and equipment, and inadequate R&D. The ambition of self-reliance under the Semiconductor Mission is further constrained by high capital costs and stiff competition from well-entrenched countries such as the US, China and Taiwan.

Another serious concern is that none of the cash-rich Indian conglomerates, apart from Tata, has evinced interest in the mission, as rapidly changing technologies pose a major challenge and global R&D spending is difficult to match. It was during the chip shortage triggered by the pandemic that the Indian government seriously began thinking about building a domestic semiconductor industry. ISM 1.0, launched in 2021 with an initial outlay of ₹76,000 crore, focused on attracting private companies to establish semiconductor fabrication, design and manufacturing capabilities. While the country was in the first phase of the mission, the US imposed restrictions on exports of its advanced AI chips to China to curb Beijing’s access to cutting-edge technology.

The government understands that the country needs a deep, dynamic and robust ecosystem, rather than just a few fabs or ATP facilities, said an executive. The biggest chip project in India at present is the Rs 91,000 crore semiconductor fabrication plant being built in Gujarat by Tata Electronics in partnership with Taiwan’s Powerchip Semiconductor Manufacturing Corp. The unit will manufacture chips for power management integrated circuits, display drivers, microcontrollers and high-performance computing logic, which can be used across AI, automotive, computing and data storage industries. Tata Semiconductor Assembly and Test Pvt Ltd has also announced a Rs 27,000 crore investment in Assam.

Micron Technology is making a Rs 22,500 crore investment in Sanand, Gujarat, for a semiconductor assembly, testing and packaging (ATMP) facility. SicSem Private Limited is collaborating with Clas-SiC Wafer Fab Ltd., UK, to establish an integrated facility for Silicon Carbide (SiC)-based compound semiconductors in Info Valley, Bhubaneshwar, which will be a commercial compound fab in the country.

Under the Electronics Components Manufacturing Scheme, launched in April 2025, Sitharaman announced an increase in outlay to ₹40,000 crore from last budget’s ₹22,919 crore.