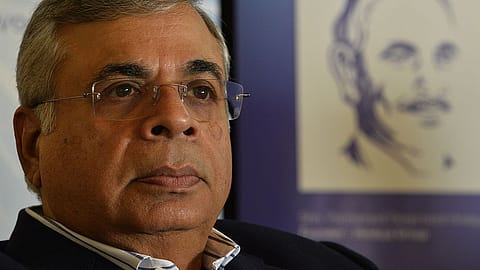

IIHL plans listing of Reliance Capital's insurance biz after 2 years: Ashok Hinduja

IIHL chairman Ashok Hinduja estimates the value of Reliance Capital units on a conservative basis to be ₹20,000 crore.

IndusInd International Holdings Ltd (IIHL) chairman Ashok Hinduja said IIHL is planning a public listing of Reliance Capital’s insurance business after two years.

IIHL has completed the transaction to acquire Reliance Capital by transferring the entire bid amount to lenders. “The transaction from our side is over. As we are speaking, money is moving from one escrow to another... We have two years to go to add value creation to this and then plan for listing,” Hinduja told reporters at a press conference in Mumbai.

The IIHL chairman said he estimates the value of the Reliance Capital business on a conservative basis to be ₹20,000 crore.

“Most of the Reliance Capital companies are shell companies. There is a broking company, Reliance Securities, which we would like to continue and grow and the other one is an asset restructuring company. Other than these two, all other companies we would exit,” said Hinduja.

Hinduja said the brand name of the acquired entity will be changed to IndusInd.

IIHL had emerged as the successful resolution applicant by winning the bid for Reliance Capital under the Corporate Insolvency Resolution Process (CIRP) in April 2023 with an offer of ₹9,650 crore.

In November 2021, Reliance Capital was put under the administration of the Reserve Bank of India (RBI) due to governance issues and payment defaults linked to the Anil Ambani-led Reliance Group. The RBI appointed Nageswara Rao Y as the administrator, who later called for takeover bids for the company in February 2022.

Recommended Stories

On IndusInd Bank’s derivative transaction discrepancies and the subsequent erosion in investor wealth, Hinduja said whenever the bank requires capital, the promoter has injected money. “Their capital adequacy is more than 15%. They don’t need any further capital,” said Hinduja.

“It is beneficial for the promoter to put money in at this rates but it is not good for the institution,” he added.

On March 10, IndusInd Bank announced that it had identified discrepancies in the accounting of derivative transactions conducted over the past 5-7 years for hedging its foreign currency borrowings. The bank has appointed an external adviser to review the processes, determine the root cause, and assess the impact of mark-to-market losses which is expected to be completed within the next 3 months.

Credit rating agency Moody’s said although it expects the near-term negative impact on the banks' profitability and capital due to this issue to be manageable, it highlights inadequate internal controls , which is a credit negative.

(INR CR)

Moody’s said the impact of the derivatives transactions, coupled with the ongoing stress in the retail unsecured loans, is likely to hurt the IndusInd Bank’s profitability, capital and funding, potentially leading to a downgrade of the BCA (Baseline Credit Assessment).