Fortune 500 India: Compact cars give Maruti the edge

With sharper pricing and a stronger export push, rising helmet counts outside car showrooms are giving Maruti, ranked 20th on the list, fresh optimism.

This story belongs to the Fortune India Magazine indias-largest-companies-december-2025 issue.

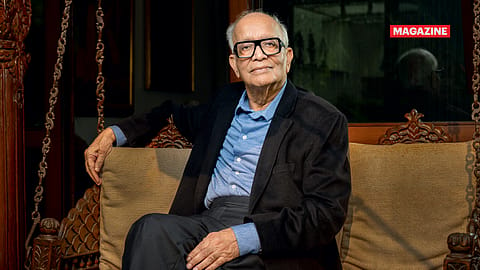

IN APRIL 2022, India’s automobile sector struggled as car sales dropped due to the pandemic and stricter Bharat Stage-VI emission norms. Maruti Suzuki chairman R.C. Bhargava lamented the situation, stating that the small car market, once the “bread and butter” of India, was in decline. “The butter has gone away, now it’s only bread,” he said.

Three years later, the tide is turning, especially after the epochal Goods & Services Tax (GST) reforms, which, among other things, slashed the GST rates on small cars from 28% to 18%. “The government has always been conscious of sustainability. This is not the first time small cars have been encouraged,” Bhargava says. “It was in 2006 when the definition of small cars was brought in, and excise duties on small cars were reduced.”

The key architect of India’s automobile revolution explains the government’s rationale in 2006. “Only because of fewer emissions, fewer material requirements, and less space. We are a congested country. How much more congested would our roads become if, instead of 34 cars per 1,000 people, we had 300 cars per 1,000 people, which is not an unusual number?”

Bhargava has always been of the view that car penetration in India is abysmally low compared to other markets, especially in Southeast Asia, where it is at the 300-level. “Malaysia has almost 400-500 cars per thousand. There is huge scope and need for growth,” he says.

The nonagenarian stresses that India needs to convert its 28 crore scooters plying on roads to something more convenient for people, “whether it be individuals’ own cars, or shared mobility”.

“But the means of travel, the means of commute for people, have to change. It cannot be this unsafe and an inconvenient means of transport,” he adds.

Maruti Suzuki, the company he has been with since 1981, has always been the biggest advocate of small cars. This, even as other OEMs (original equipment manufacturers) redoubled their efforts in the utility vehicle segment. Yet, Bhargava says the market forces will decide if the rate cut has given the carmaker the impetus to re-evaluate its portfolio. “So if the market demand for small cars goes up, Maruti Suzuki will certainly respond to the market… Currently, the SUV design is very much in favour. But over the years, I’ve seen people’s preferences evolve.”

More Stories from this Issue

The GST rate reductions, which were timed right before the Navratri festival, have given small car sales the much-needed boost. Maruti Suzuki’s small car bookings rose by 50% in September; it doubled in the Top 100 cities. The company clocked sales of more than 165,000 units — a decadal high — during the Navratri period.

“Every day, we see around 14,000 bookings. Since announcing the reduced prices, we have received 450,000 bookings, of which 100,000 are for small cars. Retail bookings total 325,000. This has broken all records for Maruti Suzuki, with growth of more than 50% over the same period last year,” Partho Banerjee, senior executive officer, sales and marketing, had told Fortune India in October.

Bhargava notes a perceptible shift in demand towards the smaller segments. “With the GST rate cut, the number of people who want to buy small cars has suddenly spiked. The kind of people who did not come to the showrooms earlier are coming there now.” And many are scooter owners. Bhargava has a quirky metric to drive home his point: one can find a lot of helmets in car showrooms, as opposed to a few months ago. The combination of the rate cut, decreasing interest rates, and increased incomes within a developing economy has allowed individuals, who were previously hesitant to purchase a car, to reconsider now buying a small car.

Sales data for October and the 42-day festive season from the Federation of Automobile Dealers Association (Fada), the apex dealers’ body, showed a clear trend: rural India, often termed ‘Bharat’ in the automotive industry, registered higher sales than its urban counterpart. But Bhargava is not surprised. “Rural India, in terms of population, is much bigger than the so-called 100 main cities. If economic development of India is to take place, it has to extend to the bulk of the people,” he explains.

(INR CR)

Fortunately, this development is happening in Bharat, which indeed drives the demand, the veteran says. “The incomes and facilities in the rural areas and smaller towns, in terms of internet connectivity and all, have changed completely. People there are moving up the economic ladder,” Bhargava says.

However, for both Maruti Suzuki and the industry at large, the bigger question is on the longevity of demand. That depends on the shape of the economy, says Bhargava.

“If the GDP continues to grow at 7-8% a year, which is feasible, and car prices don’t go up unreasonably — as they had increased when all the safety standards were brought in — and maybe there is further consideration about tax levels for people who are upgrading from two-wheelers, along with special entry-level cars for them like the Japanese K-car, then I think the (demand) in the automobile industry has to sustain.”

While the domestic market has been a laggard before the GST reforms, exports have been a strong point for Maruti Suzuki. The carmaker accounted for 43% of India’s total exports in FY25, with the Top 5 markets being South Africa, Saudi Arabia, Chile, Japan, and Mexico. It achieved a record export of 332,585 units in FY25, with the Fronx, Jimny, Baleno, Swift, and Dzire topping the export charts. Exports have played a huge role in Maruti Suzuki’s net sales, increasing from ₹75,660 crore in FY20 to about ₹1,52,913 crore in FY25. Its profit after tax has also risen manifold, from ₹5,676 crore in FY20 to ₹14,500 crore in FY25, according to data compiled by Fortune India Research and Capitaline.

Maruti Suzuki’s market capitalisation nearly trebled to ₹3,62,237 crore in FY25 from ₹1,29,524 crore in FY20.

The company has also begun exporting its first battery electric vehicle, the e VITARA, a car that has been “well accepted,” according to Bhargava.

He says Maruti Suzuki’s export opportunities, which have increased in the past few years, are likely to grow further due to the countries in Africa, South America, and the Middle East. “They are too small markets to manufacture cars on a viable scale individually. It makes much more sense for them to import vehicles, since their requirements are not like those in India, which sells millions of cars a year. Moreover, economies of scale require large-scale production,” explains Bhargava. The expansion of Maruti Suzuki’s export footprint is again contingent on market forces. “The markets are all developing. They are becoming more prosperous. The (export) market is going through a developing phase. We respond to markets. Whatever the market, the consumer wants, our job is to meet that requirement.”

Motilal Oswal expects Maruti Suzuki to deliver a 17.5% earnings CAGR in the next three years between FY25 and FY28, driven by new launches and a strong export growth. The brokerage firm added that the GST rate cut has enabled the revival of demand for small cars, as they are now more affordable, especially for price-conscious customers. The management of Maruti Suzuki has reiterated that reaching a 50% market share in passenger vehicles remains its long-term objective. Given the GST rate cut and its impact on sales, Bhargava has stated that Maruti Suzuki will revise its sales projections for 2030-31.

Until 2031, Maruti Suzuki has earmarked eight new SUV launches (excluding the Victoris). It also targets achieving a 10% Ebit margin in the long run, which is Suzuki Motor Corp.’s guidance for the whole group as well. With more than 200,000 units exported in the first half of FY26, the management expects to surpass its FY26 export guidance of 400,000 units. “Further, any favourable government policy on hybrids may drive a re-rating, as Maruti Suzuki India Limited would be the key beneficiary,” reads the note from Motilal Oswal.

Notably, the GST rate rationalisation did not make any special provision for hybrid vehicles, which Maruti Suzuki and other Japanese carmakers, including Toyota Kirloskar Motor and Honda Cars India, are bullish on. But Bhargava is candid as he says Maruti Suzuki was not expecting a special provision for hybrid cars at this juncture. “We were not expecting anything different. Having got the GST on small cars, we will see how the market responds in a few months. While we expect demand to be sustainable, the proof of the pudding is in the eating. So, we will have to watch for six months and see how the market sustains itself,” Bhargava adds.

The auto visionary suggests that the government must put on its thinking cap. “The government policy is that we have to get to net zero. We have to use electric cars. Electric cars certainly will play a major role going ahead. But India must also look seriously at biofuels.” He reasons that India has a large agrarian economy. “A good amount of land is under agricultural production, and we have good climate conditions for agricultural production; the potential for growing crops and having residues from crops and things that provide inputs to biofuels. My view is that along with electric cars, India needs to seriously look at developing its biofuel resources.”

Naturally, the Maruti Suzuki chairman supports the ethanol-blending programme, as he believes it is superior to current electric cars. “It’s all part of the biofuels programme. They are superior because they do not involve any import, while electric cars have a large import component,” Bhargava says as he cautions against dependency on imports and the zero-emission narrative. “While we do not recognise it, the manufacturing of the batteries is energy-intensive. So it is not that electric cars are totally zero-emission. They are zero emission if you only look from the point of view of tank to wheel.”

Having spent over four decades spearheading India’s largest carmaker, Bhargava says customers’ acceptance of electric cars may not happen quickly. “It’s not happening anywhere in the world. India is not an exception.” He cites the example of China or developed European nations, where hybrids are equal to electric cars in terms of what people are buying. “So, during the transition period, it is obviously better for the customer to buy a hybrid — if they are not buying an electric car — rather than a pure petrol car.”

According to Bhargava, the policy should encourage hybrids over petrol. “The petrol and hybrids should not be treated alike, because hybrids are far superior in all respects to petrol cars, in terms of the environment.”

And that is where Bhargava lands — not on a prediction, but on a principle. India’s mobility future will not be won by any single technology, but will be shaped by economics, energy security, and what millions of first-time buyers choose.