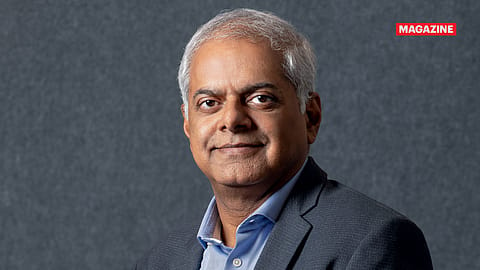

If we don’t leverage technology, it will be difficult to focus on micro segments: Nestlé India's Manish Tiwary

Nestlé India's new chief has a lot on his plate — competition from D2C brands, and being relevant at a time when disruptions are a norm. His gameplan — staying fast, focussed and flexible by infusing technology in the legacy firm’s day-to-day business.

This story belongs to the Fortune India Magazine The base effect: Rebooting data for the new-age economy issue.

You led Amazon India for years. Amazon is a consumer-tech company. What kind of learnings have you brought to a legacy firm like Nestlé India?

I often get asked this question, but let me take a step back. Nestlé has been in India for close to 113 years.(1) Its brands are household names, which means a number of people have brought Nestlé to this level. I am blessed to have worked [first] in a consumer-packaged goods company (HUL), a technology company, and now have a chance to head Nestlé. The one thing that has never changed is customer obsession — whether it has been micro-segmentation or ways to reach consumers, keeping the consumer at the heart of whatever we do is very important. I have seen it in my previous organisations, and now I am seeing it here in Nestlé, too. So, how could I make Nestlé more loved by consumers in India? By leveraging technology.

The last 10 years have been a good learning experience about how to use technology for things that are routine, which can be done by machines, using your valuable resources, and then deploying them in places where you need judgement. I am trying to infuse the role of technology in Nestlé India. A lot of times, people talk about blue sky thinking, about what artificial intelligence will do, about flying cars, etc. That’s not what’s on my mind. We want to address micro segments of consumers. For a large company such as ours, if we don’t leverage technology, it will be difficult to focus on micro segments.

How do you use technology in day-to-day business?

We have our own R&D centre at Manesar, focussed on the Indian consumer palate. I met this really bright lady who works there. She has been working on green tea for some time, and came up with variants of Nestea (for Gen Z and Gen Alpha). A typical process, from innovation to launching, could have taken 12 months — it’s a combination of multiple things, but largely about some of the processes and testing that happen. I gave her the freedom to change the approval system a bit, and we launched products on quick commerce platforms in three months! If you go to Blinkit and search for Nestea, you will see three variants rated four-plus, among the healthiest green teas you can get in terms of sugar content. How did we achieve that? We first changed processes; we said we needed to create small islands of innovation within a larger organisation so that these islands can move with speed. Once you achieve a certain scale, you can integrate into your main processes.

Today, a lot of testing can happen if you use technology, whether it’s ingredients, or stability of the product. Also, most of my brand managers can create digital ads on their own; they don’t need agencies. That’s what the magic is all about.

What kind of mindset change does that require?

More Stories from this Issue

The launches I talked about were done in three months, but that’s not the standard we have achieved across the portfolio, though we would definitely like to do so. At times, I get the feeling that legacy has a bit of a negative aspect. I see legacy as a positive aspect. We deal with foods and that’s something people really need to trust. For instance, I was brought up on Cerelac, my son has also been brought up on Cerelac, and that’s 35 years apart! Trust, therefore, is critical. The kind of thoughtfulness, testing and deep research that goes into our products is an important part of who we are. I would never want to change that. What happens is, and I will give you an example — during Covid, in my previous organisation (Amazon India), we launched same-day shipping, so if you ordered a product in the metros, you would get it the same day. I thought that was fast, but today’s definition of fast is you get a product in nine minutes. Everyone in Nestlé South Asia talks about being fast, focussed and flexible, but the definitions change. We need to make sure we know what consumers need.

Let me give you another example. If I were to create a new variant of KitKat, earlier, I might have said, I need a certain volume to manufacture it, or a certain number of consumers because my processes demanded that. I was not going consumer-forward; I was going process-forward. It’s my job now that if I find a micro-segment attractive, I tailor my processes.

Coming back to your question of what I want to infuse into Nestlé India: a little more technology to make us faster, more focussed and flexible.

Doesn’t micro-segmentation make the business more complex?

(INR CR)

My consumer — and it is true for any business — will not pay me a premium for complexity in my processes. Why would she? She wants the best noodle at the right price and it’s our job to tailor-make our processes. If your consumer proposition is right, you can model [your] financial process to suit the same. It doesn’t work the other way. What do I mean by that? I may have an awesome financial model, but not a strong consumer proposition. When I try to force fit it, the sequence doesn’t work.

There could be 6,000 quick commerce dark stores across the country(2), but then, what is most critical for them? They need to be in stock. When someone searches for coffee and Nescafe is in stock, they will buy that. So, more than margins and innovations, we need a stable supply chain(3). We have changed our processes. Today, we could service dark stores twice a day in dense areas.

Process changes were needed and we did it without adding too much cost. If we had added too much cost, we would have had to pass it on to consumers. [Here] the tech piece is helping. Now we can pick up signals much faster, and plan much better. Flexibility and speed should not come at the cost of either more working capital or additional logistics costs. Eventually, it comes to how you leverage technology in the process.

Let’s talk about specialty coffee. The narrative around Indian specialty coffee is picking up with brands such as Blue Tokai, ARAKU Coffee and Third Wave Coffee building formidable businesses...

I have been fortunate to work with some of these brands in my previous roles. We are living in the golden moments of innovation in India. People with the right ideas have an ecosystem where financing, route-to-market and performance advertising are available. They add value to the entire process. From a chai-loving nation, a lot more coffee consumers have got added.

When I talk about our coffee business, I start with a ₹2 sachet of Nescafe and the range goes up to Nescafe Roastery (₹720 a can), imported from Japan. It has black roast and medium roast, and the entire range is doing well. If you look at our Nespresso business, it’s been more than a year since we launched the store at Saket City Mall, Delhi. We have plans to open more such stores across cities.

The two businesses which are most talked about are our pet food business, Purina(4), and Nespresso. I am happy with the way the whole cycle is moving.

Do you see growth coming from premiumisation or do you plan to invest equally on the bottom of the pyramid?

There was a time when we would cut India into geographies — rural and urban. I am in Gurugram right now, and if I take NCR (National Capital Region), Mumbai and Bengaluru, there are 30 million households which can consume Nespresso. They have the spending power to buy a Nespresso machine. People order huge range of premium products via quick commerce. This top-end premiumisation will continue for the next decade. I am also equally, if not more, excited about the rural opportunity.

When I joined Nestlé, one number which caught my attention during the orientation process was the contribution of rural India, at 18%. In my earlier role in HUL, rural contributed 48%. However, I understood the reason for [Nestlé India’s] approach — we are a food company, we want products to be fresh, and therefore, we want our distribution to be controlled. From a largely urban company, we have become ‘rurban’, distributing to smaller towns. Now, we cover 80% of 2,000-plus villages, with 30,000 distribution points across the country (against 10,000 about eight years ago). So, the route to market has been established. As incomes grow, so do aspirations. Today, the kid in the village also wants to have Maggi. We have the right price-point packs to be able to serve them. The rural market has grown at least 1.5 times in the last two-four years.

What would be your growth engines for the future?

In confectionery, we have a 17% share. The category is booming, and our shares are low. KitKat is a global powerhouse(5), and that’s the space to watch out for. Even in noodles(6), the monthly penetration would be 18-19% households consuming Maggi at least once a month. So, there’s a lot of elbow room for growth.

Is volume growth back post GST cuts?

They have definitely helped in increasing consumption. I would look at volume-led growth in all my businesses. We grew 13% in Q2, and in four out of five categories, it was volume growth.

Unlike legacy FMCG firms, Nestlé hasn’t been too active in scouting for D2C brands. What’s the game plan?

If we see something promising, we would definitely be interested. We have advantages. We are a listed company, and we have made investments. But if you ask me, can you achieve your growth targets without inorganic acquisition, I would say yes. We don’t exclude inorganic as a strategy, but I am not desperate for it. The market is a little frothy, valuations are very high and, therefore, we have to be thoughtful about it.