Govt to tweak NPS rules to boost scheme distribution, says PFRDA chairman at launch of Pensionbazaar

Policybazaar on Tuesday launched Pensionbazaar, a dedicated platform focussed on retirement and pension planning.

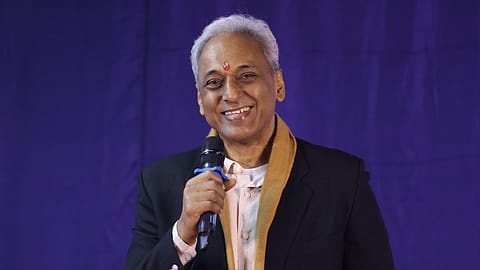

PFRDA Chairman Sivasubramanian Ramann on Tuesday said the government is considering changes to norms governing the distribution of the National Pension Scheme (NPS) to drive higher adoption of the scheme among the general public.

Speaking at the launch of the Pensionbazaar platform by Policybazaar, Ramann said, "Number of NPS account at present is 75 lakh. As of now, this is not something to talk about. We will tweak rules around distribution to ensure more participation in the scheme." Ramann added that the mindset that pension is a government concept needs to change.

Pension is an elephant in the room, says Yashish Dahiya

Yashish Dahiya, co-founder at Policybazaar, said, "Pension is an elephant in the room. We are a young population. Once income stops, we all need support. We will design Pensionbazaar as a holistic product."

"Pension is a government concept. This is the belief that is held in India. As a hard-working population, one doesn't allow oneself or indulge with the idea of having a pension. This is something we need to break," Ramann said while adding, "All these products need to be sold. People do not understand what is good for them. We have simply made NPS a product for non govt sector."

He said, "Pension is not only pension. It is all about wealth creation activity and the power of compounding. That is really the concept one is selling. FIRE is a newer concept. But the fact remains that if you do not save every day, every month, you do not build wealth."

Digital distribution

Ramann also called for more digital distribution. "Distribution must be digital. Pensionbazar is ready within four months of first discussion on the concept with the company.”

He emphasised on the fact that citizens need to stand on their feet when it comes to be adequately insured. "It is the people who have to take care of basic needs. It is unfair to expect the government take care of housing and medical needs, which are the basic needs," Ramann said.

Recommended Stories

"We are talking about a working labour force of 60 crore. It is our moral duty to create products and serve them in a way that it is easy for people to access those products.”

Dahiya pointed out that people do not generally have a fair idea of the quantum of pension required. "It is a crying need. After 15 years we will reach our peak as young society and pension needs will grow.”

"For 35, 40-year-old people, it is the right time to think about pension. Consumers have an idea of current needs, but no one takes care of tomorrow," Dahiya said. "On term insurance in India, the commission was zero for a long time. But we lived, survived, and grew at that time," he added.