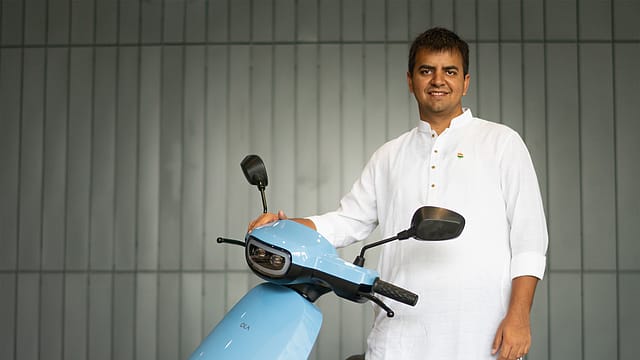

Ola Electric bets on ‘rare earth free’ motors amid magnet shortage

ADVERTISEMENT

Ola Electric Mobility said it plans to introduce “rare earth free” motors in its product portfolio starting next quarter to deal with Chinese export curbs on rare earth magnets.

“For the last couple of years, we have been developing rare earth free motors,” the Bhavish Aggarwal -led company said in a letter to shareholders.

The electric vehicle maker said it accelerated this programme in April when the rare earth supplies stopped coming to India. Ola Electric said it has “already productionised” its rare-earth-free motors. “These motors ensure no business continuity risk, are parity in performance and save money as rare earth magnets are costly,” the EV maker said.

Ola Electric makes the motor, motor controller and software for its EVs in-house. "We have multiple strategies to manage this disruption. For the short term, we have reasonable inventory levels and have been sourcing the rare earth magnets from two countries of origin to keep optionality in case this eventuality occurs. And since we are not reliant on intermediary motor suppliers, we’ve been able to change over quickly and ramp up other sources of rare earth magnets," it said.

January 2026

Netflix, which has been in India for a decade, has successfully struck a balance between high-class premium content and pricing that attracts a range of customers. Find out how the U.S. streaming giant evolved in India, plus an exclusive interview with CEO Ted Sarandos. Also read about the Best Investments for 2026, and how rising growth and easing inflation will come in handy for finance minister Nirmala Sitharaman as she prepares Budget 2026.

Ola Electric’s loss widened to ₹428 crore while its revenue from operations halved to ₹828 crore for the quarter ended June 30, 2025.

Ola Electric said it expects revenue in FY26 to be around ₹4,200 crore to 4,700 crore and volumes volumes to be around 3,25,000 - 3,75,000 units.

“We see strong momentum of our new products - Gen 3 scooters and the Roadster bike leading into the festive season. Our supply chain, engineering and manufacturing teams continue to improve our product quality and BOM cost and the benefits should continue to come into the P&L through the year,” the company said.

Ola Electric said its Q1 Auto gross margin of 25.6% was largely without production-linked incentives (PLI). “Q2 onwards we should get the PLI benefit too, leading our exit GM for FY26 to be around 35-40%. And with operating costs largely flat, auto EBITDA should be 5%+ for the whole year,” the automaker said.

“For Q2, we expect auto EBITDA to turn positive and the auto business to generate operating cashflow later in FY26. For the remaining period of FY26, auto capex would largely be around ₹300 Cr (including capitalised R&D) as we don't plan any major new product or manufacturing capex this year. So FCF required for the auto business should be ₹400 - ₹500 Cr for the remaining 3 quarters and the auto business should generate FCF by exit FY26,” it said.

On battery cell business, the company said it will be fully utilising the 1.4 GWh (gigawatt-hour) capacity by the end of FY26. The company plans to scale consumption to 5 GWh through FY27.

“We are now ready and producing cells that are going to be used in our vehicles. These vehicle deliveries will be starting this Navratri. The transition from the supplier cells we use currently to our own 4680 cells will be a phased transition through FY26, starting this quarter,” it said.

The budget for the 5 GWh cell plant is ₹2,800 crore. “We have an SBI led consortia facility for this project and out of this we have already invested ₹1500 Cr. We will be completing the 5GWh installation by the end of FY26 and most of the remaining capex will come in this year. Some payouts will go into FY27,” it said.

Given that the EV market has evolved slower in recent quarters, we don't foresee the need to expand beyond 5 GWh till FY29, the company stated. “At 5 GWh scale, our cost of making this cell in house will be lower than procuring it from vendors. At 1.4 GWh, we will gain benefit in consolidated GM but not at consolidated EBITDA,” it added.

“For the cell business, we will be completing the 5GWh installation and most of the payouts of about ₹1000 Cr this year. 70% of this will be financed from the existing term loan. The cell business will be FCF (free cash flow) positive at the production scale of 5GWh by the end of FY27,” said Ola Electric.

“While we have these targets, there are many macro elements on supply chain risk, competition and other operational complexities which can make us change our plans a bit. We will keep updating every quarter,” it cautioned.

Given these cash requirements for the business, Ola Electric said it is “well funded” for this year and the next from its June-end cash balance of ₹3197 crore.