Adani Enterprises board approves ₹20,000 crore fundraise via FPO

ADVERTISEMENT

The board of Adani Enterprises Ltd. on Friday approved a fundraise of ₹20,000 crore by way of a "further public offering through a fresh issue of equity shares by the company."

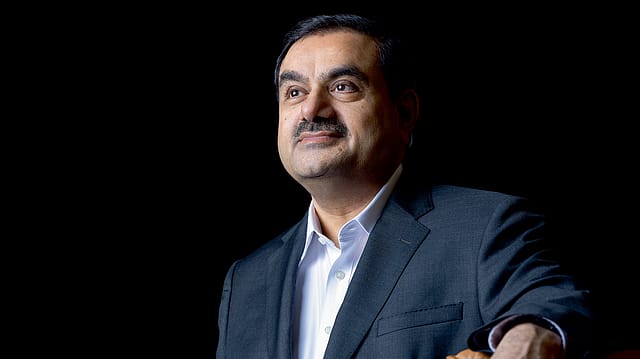

The Gautam Adani-led company will now seek approval of the shareholders for the follow-on public offer (FPO) by way of postal ballot process. A follow-on offer is when a company issues additional shares after an initial public offering.

Upon completion of required formalities and procedures, the details in respect of the offer will be disseminated in accordance with the provisions of the SEBI, Adani Enterprises says in a stock exchange filing.

The move is being seen as part of the company's strategy to diversify its shareholder base and reinforce credibility among investors. As per the latest shareholding pattern available on the BSE, the Adani family holds 72.6% stake in Adani Enterprises, while foreign institutional investors (FIIs) and mutual funds own 15.6% and 1.3%, respectively.

This comes three months after Fitch Group subsidiary CreditSights said it remains cautiously watchful of the Adani group's growing expansion appetite, which is largely debt-funded. Over the past few years, the Adani Group has pursued an aggressive expansion plan that has pressurised its credit metrics and cash flows, CreditSights said in its report.

The debt research firm had flagged "elevated" leverage for Adani Green Energy and the risk of future acquisitions hurting the credit profile of Adani Ports and Special Economic Zone.

The ports-to-power conglomerate has been investing aggressively across both existing and new businesses, predominantly funded with debt. In order to meet its ambitious growth plans, the Adani group is also active in expanding through the inorganic route. The Gautam Adani-led conglomerate earlier this year had acquired Holcim's controlling stake in Ambuja Cement and ACC Limited for $10.5 billion, thereby becoming the country's second largest cement maker virtually overnight.

A majority of these businesses are capital intensive, and require large investments and constant funding in the initial years, considering these projects have long gestation periods, Creditsights warned.

"In the worst-case scenario, overly ambitious debt-funded growth plans could eventually spiral into a massive debt trap, and possibly culminate into a distressed situation or default of one or more group companies," Creditsights had said.

Meanwhile, the combined market capitalisation of the Adani group this year has exceeded $200 billion. "Our rising market capitalisation has been supported by a robust and sustained growth in our cash flows," Adani had said while addressing Adani Enterprises' annual shareholders meeting.

In September, Asia's richest man Adani overtook Amazon founder Jeff Bezos to become the third richest person in the world. Adani had earlier pipped Bill Gates after the Microsoft co-founder donated $20 billion to the Bill & Melinda Gates Foundation. The steep rise in Adani's net worth this year has already made him richer than Google co-founder Larry Page and billionaire investor Warren Buffet. The Gujarat-based billionaire had entered the centibillionaires club—businessmen having a fortune of $100 billion or more—in April.