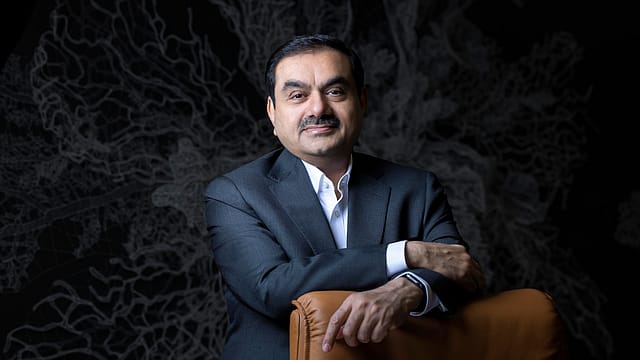

Adani Group to invest $100 billion in 10 years: Gautam Adani

ADVERTISEMENT

Adani Group chairman Gautam Adani on Tuesday said that his conglomerate will invest over $100 billion of capital in the next decade out of which $70 billion will be in an integrated green hydrogen-based value chain.

"We have earmarked 70% of this investment for the energy transition space," Adani says at the Forbes Global CEO Conference 2022 in Singapore.

"We are already the world's largest solar player, and we intend to do far more," the world's second-richest person adds.

In addition to the conglomerate's existing 20 gigawatt renewables portfolio, the new business will be augmented by another 45 GW of hybrid renewable power generation spread over 100,000 hectares of land – an area 1.4 times that of Singapore, says the Gujarat-based tycoon.

This, according to Adani, will lead to commercialisation of three million metric tons of green hydrogen. "This multi-fold business will see us build 3 giga factories in India. We are in the process of building a 10 GW silicon-based photo-voltaic value-chain that will be backward-integrated from raw silicon to solar panels, a 10 GW integrated wind-turbine manufacturing facility, and a 5 GW hydrogen electrolyser factory," says Adani.

On the Indian economy, Adani said India's GDP will go from $3 trillion to $30 trillion by 2050, aided by the digital revolution which is expected to transform every type of activity at a national scale.

"Let me now envision the next 25 years. Over this period, India will comfortably become a country with 100% literacy levels. India will also be poverty-free, well before 2050. We will be a country with a median age of just 38 years even in 2050 – and a country with the largest consuming middle class the world will ever see. We will also be the country that attracts the highest levels of foreign direct investment given the sheer scale of consumption of 1.6 billion people. We will be the country that will go from a 3 trillion-dollar economy to a 30 trillion-dollar economy, a country with a stock market capitalization of 45 trillion dollars, and a country that will be supremely confident of its position in the world," the business tycoon says.

Following our independence, it took India almost 58 years to reach the 1-trillion-dollar GDP mark. It then took 12 years to achieve our 2nd trillion dollars – and thereafter, only 5 years to achieve the 3rd trillion dollars, he says, adding that India is on the path to be the world's third largest economy by 2030.

In 2021, India added a unicorn every nine days, and it executed the largest number of real-time financial transactions globally – a staggering 48 billion. This was three times greater than China and six times greater than the U.S., Canada, France, and Germany combined, he adds.

Adani expects the flow of foreign direct investment (FDI) into India to further accelerate and rise above $500 billion over the next 15 years – making India by far the world's fastest growing destination for FDI.

The global turbulence has accelerated opportunities for India and made the country one of the few relatively bright spots from a political, geostrategic, and market perspective, Adani says.

"The ongoing armed conflict has accelerated its structural weaknesses. Balancing the aspiration levels of the EU's member countries and still keeping the EU united will be harder than ever before. The United Kingdom continues to slide as it struggles with Brexit and a new set of hard-to-optimize economic challenges," he adds.

China – that was seen as the foremost champion of globalisation – will feel increasingly isolated. Increasing nationalism, supply chain risk mitigation, and technology restrictions will have an impact, cautions Adani. China's housing and credit risks are drawing comparisons with what happened to the Japanese economy during the 'lost decade' of the 1990s, Adani says.