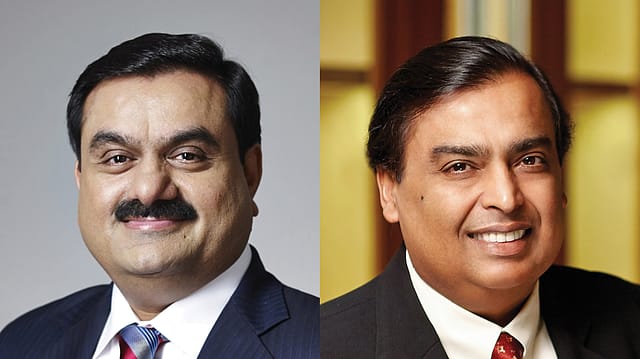

Ambani, Adani join hands as RIL buys 26% stake in Adani Power project

ADVERTISEMENT

In a first collaboration between two of the biggest billionaire rivals in India, Mukesh Ambani's Reliance Industries (RIL) has picked up a 26% stake in a power project of Gautam Adani-led Adani Power Ltd (APL) in Madhya Pradesh.

The two tycoons have signed an exclusive arrangement for 500 MW of power purchase by Reliance Industries on a 20-year long-term basis. The agreement between Adani Power, Mahan Energen, and RIL was signed on 27th March 2024.

The company says one unit of 600 MW capacity of MEL’s Mahan thermal power plant, out of its aggregate operating and upcoming capacity of 2800 MW, will be designated as the captive unit for this purpose.

"In order to avail the benefit of this policy, RIL has to hold a 26% ownership stake in the Captive Unit in proportion to the total capacity of the power plant. It will accordingly invest in 5,00,00,000 equity shares of MEL, aggregating to ₹50 crore for the proportionate ownership stake," Adani Power says via an exchange filing.

RIL, in its statement, said it has agreed to subscribe and Mahan Energen has agreed to allot 5,00,00,000 equity shares of face value of ₹10 each of Mahan Energen.

RIL says the proposed investment by the company complies with the provisions of Electricity Rules, 2005, in terms of which the company, as a captive user, is “required to own 26% proportionate ownership in one unit of Mahan Energen of 600 MW capacity, with RIL being the captive user of 500 MW generation capacity”.

Mahan Energen, a company engaged in the generation and supply of power, was incorporated on October 19, 2005. The turnover of Mahan Energen, as per its audited standalone financial statement, for financial years 2022-23, 2021-22 and 2020-21 was ₹2,730.68 crore, ₹1,393.59 crore and ₹692.03 crore, respectively.

Adani Power, in another exchange filing, says after the enhancement in the credit rating of Adani Power to AA-, which followed the merger of its six special purpose vehicles with itself, it has consolidated the standalone term loan facilities of the SPVs into a single long-term Rupee term loan facility of Rs 19,700 crore under a consortium financing arrangement comprising eight lenders. The move, says Adani Power, will allow the company to benefit from uniform terms and greater financial flexibility in addition to reducing the effective rate of interest.

The RIL share closed 0.37% down at ₹2,976.80 on the BSE today, while Adani Power surged 3.32% to ₹533.70.

Global brokerage Goldman Sachs this week reiterated a ‘buy’ rating on RIL and raised the target price, citing that despite the recent rally, “risk-reward is still favourable”. The brokerage house has raised its 12-month target price to ₹3,400 from ₹2,925 estimated earlier in a base-case scenario, indicating a potential upside of 18% from RIL's last closing level of ₹2,884. In a bull-case scenario, the country’s most valued stock is seen surging to ₹4,495 by FY26, suggesting a 56% upside from the current market price.