FACEBOOK AND JIO INK $5.7-BN DEAL

ADVERTISEMENT

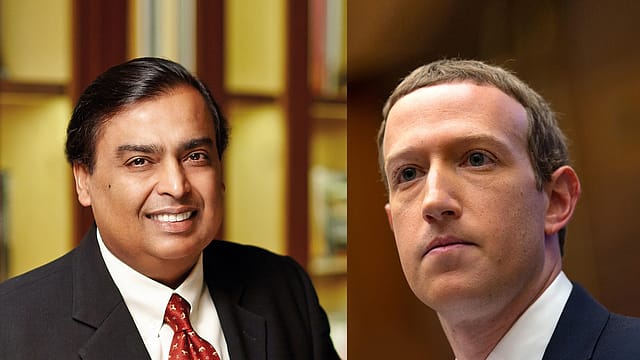

In the mother of all technology deals in India, social media and digital advertising giant Facebook will be acquiring a 9.99% stake in Jio Platforms, the Mukesh Ambani-led technology and digital services company, for ₹43,574 crore (around $5.7 billion).

The overarching rationale behind the deal is that Jio gets access to external capital, as well as the full power and reach of Facebook’s social media and communications platforms, including Instagram and WhatsApp. While the former will help Reliance Industries Ltd (RIL), which owns Jio Platforms, deleverage its balance sheet, the latter will prove to be an important catalyst to grow its new commerce venture—JioMart—which is at the cusp of technology and retail.

For Facebook, the investment gives it ready access to Jio’s 388 million subscribers, to whom it can offer its suite of offerings across social commerce and video content—two verticals on which the Menlo Park, California-based internet giant is bullish. Facebook’s own footprint in India is not small either; while Facebook itself has over 320 million users in India, WhatsApp is used by 400 million Indians and Instagram has 80 million users.

Morgan Stanley acted as the financial adviser to the transaction and AZB & Partners and Davis Polk & Wardwell served as legal counsels.

The deal values Jio Platforms at ₹4.62 lakh crore (around $66 billion). This valuation places Jio Platforms among the top five listed companies in India by market value, indicating the company’s potential as and when it goes for a listing. A Jefferies research report dated November 2019 had pegged Jio Platforms’ valuation between $65 billion and $70 billion. At this valuation, Jio Platforms’ EV/Ebitda (enterprise valued by earnings before interest, tax, depreciation, and amortisation) multiple will be the second highest for any digital platform company in the world after Amazon (ahead of the likes of Alibaba, Alphabet, and Apple), the Jefferies report had noted.

The Mark Zuckerberg-led company’s investment into Jio Platforms, the principal holding company for telco Reliance Jio Infocomm and a suite of digital services and apps, will help the latter repay a large portion of debt in an ongoing effort to deleverage its balance sheet. The consolidated net debt on the books of RIL, which owns Jio Platforms, was ₹1.53 lakh crore at the end of December 2019. The deal, which was first spoken of by the U.K.’s Financial Times on March 24, comes at a crucial time for the oil-to-yarn and telecom-to retail giant, which wants to have zero debt by March 2021.

Its other proposed mega deal to sell a 20% stake in its refining and petrochemicals business to Saudi Aramco for $15 billion is expected to face delays due to the rock-bottom price that crude oil has hit amid disruptions around the world due to the Covid-19 global pandemic. In June last year, RIL agreed to sell its telecom tower assets to Canada’s Brookfield Asset Management for $3.6 billion (around ₹25,000 crore).

The deal follows the restructuring announced in October 2019 when RIL transferred ₹1.08 lakh crore of debt from Jio to the standalone parent, leaving liabilities of around ₹64,000 crore at Jio. According to a Credit Suisse research note dated April 22, the deal with Facebook will help Jio in monetising the suite of digital products and services that it has created.

Beyond the objective of debt reduction, two of the largest technology companies in the world joining hands to tailor digital solutions for India—the largest internet market in the world accessible to global companies, with China being out of bounds—has other strategic objectives in mind.

“Our goal with this investment is to enable new opportunities for businesses of all sizes, but especially for small businesses across India and create new and exciting digital ecosystems that will empower, enrich, and uplift the lives of all 1.3 billion Indians,” a statement issued by RIL on Wednesday morning said. “This partnership will accelerate India’s all-round development, fulfilling the needs of the Indian people and the Indian economy. Our focus will be India’s 60 million micro, small and medium businesses, 120 million farmers, 30 million small merchants, and millions of small and medium enterprises in the informal sector, in addition to empowering people seeking various digital services.”

Concurrent with the investment, Jio Platforms, Reliance Retail, and WhatsApp have also entered into a commercial partnership to further accelerate Jio’s new commerce initiative, JioMart and support small businesses, using Facebook’s popular messaging app. JioMart is being built in partnership with millions of small merchants and kirana shops to digitally empower them and the partnership will allow these small businesses to connect with nearby customers and offer products and services to their doorsteps.

“I am delighted to welcome Facebook as a long-term and esteemed partner. At the core of our partnership is a commitment that Mark Zuckerberg and I share for all-round digital transformation of India and serving all Indians. Together, our two companies will accelerate India’s digital economy to empower enable and enrich you,” RIL chairman Mukesh Ambani said in a video message.

Despite the world reeling under economic turmoil due to the Coronavirus pandemic, the RIL-Facebook partnership comes at an opportune time as the Covid-19 experience is expected to lead to faster adoption of digital services in India as social distancing is set to become the new normal.

“This [the partnership] is especially important right now because small businesses are the core of every economy and they need our support,” Facebook’s founder and chief executive officer Mark Zuckerberg said in a Facebook post. “India has more than 60 million small businesses and millions of people rely on them for jobs. With communities under lockdown, many of these entrepreneurs need digital tools they can rely on to find and communicate with customers and grow their businesses. This is something we can help with—and that’s we we’re partnering with Jio to help people and businesses in India create new opportunities.”

Social commerce is a vertical that Facebook sees as a future avenue of growth for the company, which is valued at $487 billion. Globally, around 90 million small businesses use Facebook’s platform. Ajit Mohan, managing director, Facebook India told Fortune India earlier this year that WhatsApp was the first port of internet presence for a number of small businesses in India. There are several companies, like delivery service provider Dunzo, which were born on WhatsApp. “By bringing together JioMart with the power of WhatsApp, we can enable people to connect with businesses, shop, and ultimately purchase products in a seamless mobile experience,” Mohan and David Fischer, Facebook’s chief revenue officer, wrote in a Newsroom post on Facebook’s website.

Video is another vertical which Facebook wants to strongly promote in India and the RIL partnership may play a role there as well. Like the integration of RIL’s new commerce initiative with Facebook’s mass communication platforms, it is possible that a similar arrangement could also be explored between Facebook and Instagram on one hand, and RIL’s entire content factory—spanning Network18, Viacom18, and Jio Studios—on the other.

News of the RIL-Facebook deal even managed to lift the sentiment on the bourses, which have otherwise been a casualty of Covid-19 as well. At 1:33 pm on Wednesday, RIL’s share price was up 11.34% at 1,376.25 on the BSE. This helped push the benchmark S&P BSE Sensex in green territory, trading 1.77% higher at 31,177.68 points.