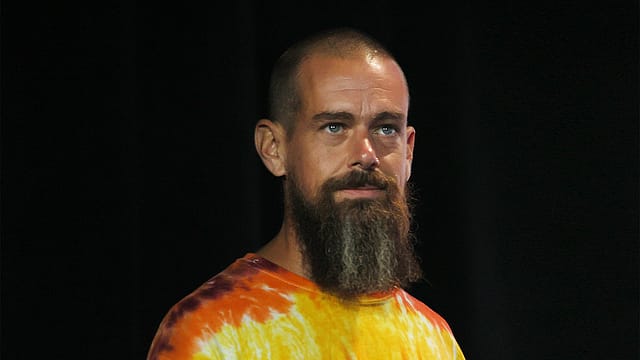

Hindenburg shorts Jack Dorsey's Block; stock tanks

ADVERTISEMENT

U.S. short seller Hindenburg Research on Thursday said it has taken a short position in shares of Block, the digital payments firm founded by former Twitter CEO Jack Dorsey.

Shares of Block tanked as much as 18% after Hindenburg accused Block of misleading investors with inflated user metrics.

"Our 2-year investigation has concluded that Block has systematically taken advantage of the demographics it claims to be helping," the report alleged.

The "magic" behind Block's business has not been disruptive innovation, but rather the company's willingness to facilitate fraud against consumers and the government, avoid regulation and dress up predatory loans and fees as revolutionary technology, it alleged.

The short-seller said its research indicates that Block has wildly overstated its genuine user counts and has understated its customer acquisition costs. "Former employees estimated that 40%-75% of accounts they reviewed were fake, involved in fraud, or were additional accounts tied to a single individual," says Hindenburg Research.

The report alleges that Block's "underbanked" customers were involved in criminal activity. The company's "Wild West" approach to compliance made it easy for bad actors to mass-create accounts for identity fraud and other scams, then extract stolen funds quickly, it says.

The short seller also accused the Block's Cash App of exaggerating user metrics. "Multiple former customer service reps we interviewed described how Cash App’s user data has been inflated by single individuals that have numerous associated accounts, sometimes numbering in the hundreds. Often these were associated with blacklisted accounts banned for fraud or other policy violations," the report says.

Cash App claims to have 80 million annual transacting active users, a highly inflated number given evidence if massive user duplication on the platform, the report alleges.

"Former employees estimated that 40%-75% of accounts they reviewed were fake, involved in fraud, or were additional accounts tied to a single individual," the report said.

Beyond facilitating payments for criminal activity, the platform has been overrun with scam accounts and fake users, the report alleged citing numerous interviews with former employees.

"Even when users were caught engaging in fraud or other prohibited activity, Block blacklisted the account without banning the user. A former customer service rep shared screenshots showing how blacklisted accounts were regularly associated with dozens or hundreds of other active accounts suspected of fraud. This phenomenon of allowing blacklisted users was so common that rappers bragged about it in hip hop songs," says Hindenburg Research.

The report alleged that Block obfuscates how many individuals are on the Cash App platform by reporting misleading "transacting active" metrics filled with fake and duplicate accounts.

"Block can and should clarify to investors an estimate on how many unique people actually use Cash App," it says.