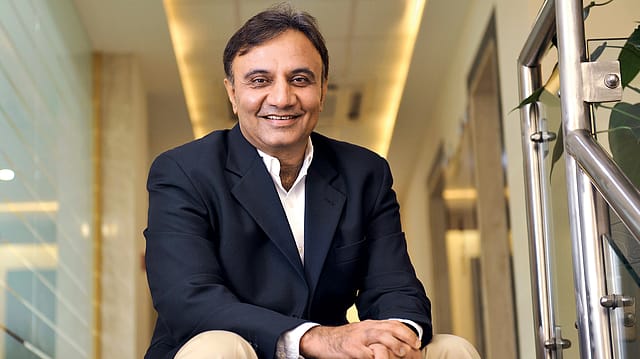

ICICI Bank denies report of CEO Sandeep Bakhshi looking to resign

ADVERTISEMENT

Private lender ICICI Bank on Thursday denied a report published in ‘The Morning Context’ which claimed that ICICI Bank managing director and chief executive officer Sandeep Bakhshi wants to quit.

“This is with regard to an article carried in The Morning Context, a news portal, with the headline “ICICI Bank in a tizzy after CEO move comes out of left field.” We would like to categorically deny the information published in the article regarding ICICI Bank’s MD allegedly expressing willingness to leave his position due to personal reasons. This information is figment of imagination and therefore, completely baseless and misleading,” India’s second-largest private bank says in a regulatory filing.

“It appears that this rumour is being spread with an ulterior motive and malicious intent in order to harm the Bank and its stakeholders,” the filing states.

Shares of ICICI Bank surged to an all-time high this week after the lender’s profit grew 17.4% year-on-year to ₹10,708 crore for the quarter ended March 31, 2024. The stock hit a 52-week high of ₹1,169.30 on the BSE on Tuesday, taking the company's market cap beyond ₹8 lakh crore.

ICICI Bank is India’s fifth company to surpass the ₹8 lakh crore market cap milestone. It is the second lender to achieve this feat after HDFC Bank.

Net interest income of ICICI Bank increased by 8.1% year-on-year to ₹19,093 crore during the fourth quarter compared with ₹17,667 crore in the previous quarter.

The net interest margin was 4.40% in Q4 FY24 compared to 4.43% in Q3 FY24 and 4.90% in Q4 FY23. Net interest margin was 4.53% in FY24.

Fee income grew by 12.6% year-on-year to 5,436 crore in Q4. Provisions were at ₹718 crore.

The board recommended a dividend of ₹10 per share for FY24.

On asset quality, the gross NPA ratio declined to 2.16% at March 31, 2024 from 2.30% at December 31, 2023. The net NPA ratio declined to 0.42% at March 31, 2024 from 0.44% at December 31, 2023 and 0.48% at March 31, 2023. During Q4, there were net additions to gross NPAs of ₹1,221 crore. The gross NPA additions were ₹5,139 crore in Q4 compared to ₹5,714 crore in Q3 FY24.

ICICI Bank’s net domestic advances grew by 16.8% year-on-year during the March quarter. The retail loan portfolio grew by 19.4% year-on-year and 3.7% sequentially, and comprised 54.9% of the total loan portfolio at March 31, 2024.

Deposits increased by 19.6% year-on-year to ₹14,12,825 crore.

With the addition of 623 branches in FY2024, the Bank had a network of 6,523 branches and 17,190 ATMs & cash recycling machines at March 31, 2024.

The value of the bank’s merchant acquiring transactions through UPI grew by 67.7% year-on-year and 8.7% sequentially in Q4. The bank had a market share of about 30% by value in electronic toll collections through FASTag in Q4-2024, with a 14.5% year-on-year growth in collections in Q4.