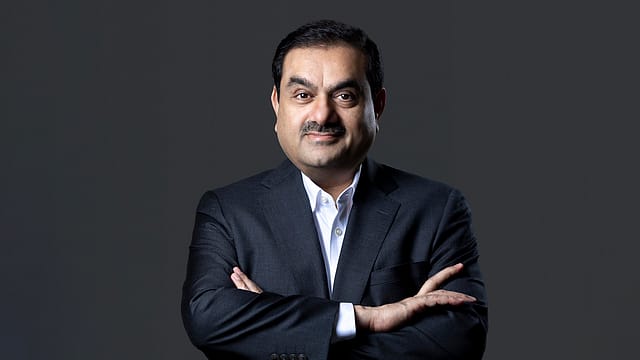

India to add trillion dollars to GDP every 18 months in next 10 yrs: Gautam Adani

ADVERTISEMENT

India will start adding a trillion dollars to its GDP (gross domestic product) every 18 months in the next 10 years, says Gautam Adani at Adani Group's annual general meeting (AGM) on July 18. Adani says this will put India on track to become a $25 to $30 trillion economy by 2050, and will drive the country’s stock market capitalisation to over $40 trillion, which is an approximately 10X expansion from current levels.

"While economic cycles are getting increasingly hard to forecast, there is little doubt that India - already the world’s 5th largest economy - will become the world’s 3rd largest economy well before 2030 and, thereafter, the world’s 2nd largest economy by 2050," says Adani.

According to Adani, over the next 10 years, the country's population is expected to grow approximately by 15% to 1.6 billion. The per capita income, however, will accelerate by over 700% to about $16,000, says Adani, adding that on a purchasing parity basis, this per capita metric will be 3 to 4 times higher.

"My belief in the growth story of our matrubhumi has never been stronger," says Adani.

Speaking on Adani Group's performance, Adani says the cumulative profit after tax of all listed entities grew by 82% to ₹23,509 crore in FY23. The Group’s EBITDA (earnings before interest, tax, depreciation and amortisation) grew by 36% to ₹57,219 crore, where the total income grew by 85% to more than ₹2.62 lakh crore in FY23.

"Our balance sheet, our assets, and our operating cash flows continue to get stronger and are now healthier than ever before. The pace at which we have made acquisitions and turned them around is unmatched across the national landscape and has fuelled a significant part of our expansion," says Adani.

Meanwhile, Adani says that the report released by the US-based short-seller Hindenburg earlier this year was a deliberate and malicious attempt aimed at damaging Adani Group’s reputation.

Terming the report to be a combination of targeted misinformation and discredited allegations, Adani says that he remains confident towards the company’s governance and disclosure standards.

"Our track record speaks for itself, and I am grateful for the support our stakeholders have shown as we went through our challenges. It is worth noting that even during this crisis – not only did we raise several billions from international investors – but also 3 that – no credit agency – in India or abroad – cut any of our ratings. This is the strongest validation of the belief that the investors have in your company’s governance and capital allocation practices," says Adani.

On January 24, Hindenburg in its report alleged Adani Group of stock market manipulation and “pulling the largest con in the corporate history.” Following this, the cumulative market capitalisation of Gautam Adani-led listed entities plummeted to $100 billion. The report also forced Adani Enterprises to withdraw its fully-subscribed ₹20,000 crore FPO (follow-on public offer).