Zomato Q4 loss widens to ₹360 crore

ADVERTISEMENT

Net loss of food delivery platform Zomato more than doubled to ₹359.7 crore in the quarter ended March 2022 compared with ₹134.2 crore in the corresponding quarter last year.

The food ordering app's revenue from operations jumped 75% year-on-year to ₹1,211.8 crore in the January-March period compared with ₹692.4 crore in the same quarter of the previous fiscal.

The company expects its adjusted revenue growth to accelerate to double digits in the next quarter and the adjusted earnings before interest, taxes, depreciation, and amortisation (EBITDA) losses to also come down meaningfully.

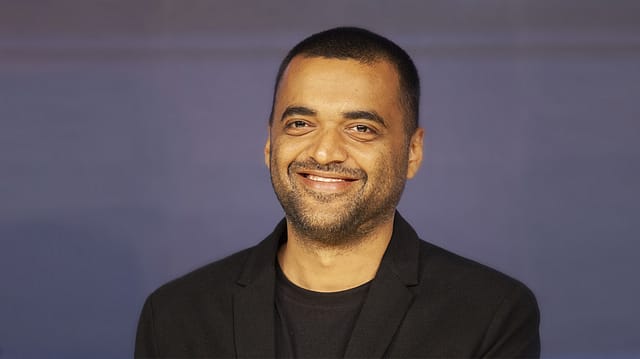

"Reduction in losses will be driven by improvement in contribution margin of the food delivery business and also operating leverage playing out as our revenue is growing faster than our fixed costs," says Akshant Goyal, chief financial officer of Zomato.

For the full financial year 2021-22, the company's loss stood at ₹1,222.5 crore compared with ₹816.4 crore in the previous year. Revenue rose to ₹4,192.4 crore in FY22 from ₹1,993.8 crore in FY21.

Zomato's average order value in FY22 marginally increased to ₹398 compared with ₹397 in FY21. For the top 8 cities, the company saw its average order value increase by 3% in FY22 over FY21.

Its gross order value grew by 6% quarter-on-quarter and 77% year-on-year to a record high of ₹5,850 crore in Q4FY22. This, according to the company, was driven by healthy growth in order volumes while the average order value remained stable.

Zomato also launched its services in over 300 new cities in the fourth quarter. "We are now present in 1,000+ towns and cities across India," the company says.

Average monthly transacting customers were at an all time high of 157 lakh last quarter growing from 153 lakh in the previous quarter.

"We are aiming for accelerated growth along with further reduction in losses (and increasing profits in some time). We are clear on what our long term shareholders expect of us and we are working hard to deliver on both growth and profitability expectations," says Zomato founder and chief executive officer Deepinder Goyal.

The company said its growth trajectory is back on track, and it doesn't foresee post-Covid-19 ramifications affecting its growth rate anymore. "We did see a low QoQ growth in Q3FY22 as dining-out and travel opened up post COVID. We believe that was a one-time correction of our growth trajectory on the back of two strong quarters," says Goyal.

On Blinkit (formerly Grofers), the Zomato CEO says the company continues to remain bullish on quick commerce, especially given how synergistic it is to Zomato's core food delivery business. "While there is a lot to do as the business is at its early stages, there's still a lot of low hanging fruit to drive growth and efficiency. Blinkit has grown well in the past six months, and has also significantly reduced its operating losses. We have committed to give them a short term loan of up to $150 million to fund their short term capital needs. Beyond that, there is nothing to share at this moment," says Goyal.