Adani Group stocks fall up to 7% after Hindenburg takes short positions

ADVERTISEMENT

Adani Group shares were reeling under selling pressure on Wednesday, in sync with the broader market, after Hindenburg Research said it has taken short positions against the companies controlled by billionaire Gautam Adani. The investment firm in a report said that the seven listed companies of the conglomerate are 85% overvalued. Reacting to the report findings, shares of all seven listed Adani Group companies were floating in negative terrain, falling between 2% and 5% in early trade, led by Adani Ports and Adani Wilmar. The BSE benchmark Sensex was also down 630 points at 60,350 levels.

Adani Ports and Special Economic Zone was the biggest loser, with the share price falling as much as 7.2% to ₹706.05 on the BSE. The stock opened lower at ₹753 against the previous closing price of ₹760.85.

Adani Wilmar, the owner of the Fortune brand of edible oils, also witnessed a surge in selling activities, falling as much as 5% to ₹544.50. Adani Enterprises, the flagship company of the conglomerate, also dropped 3.7% to ₹3,315.70 during the session.

Among others, Adani Green Energy, Adani Transmission, Adani Power, and Adani Total Gas fell between 3% and 5% on the BSE.

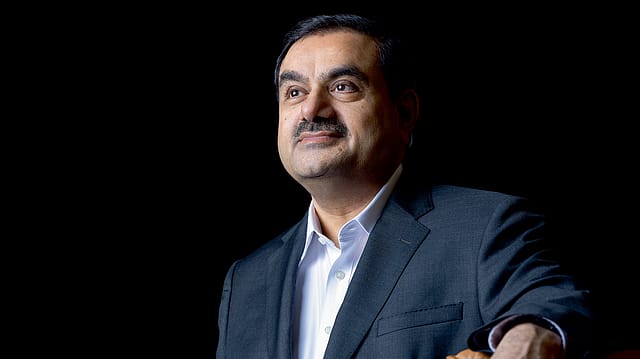

Adani Group stocks were rattled after short seller Hindenburg Research in a report said that it had taken a short position in the firms through its U.S.-traded bonds and Indian-listed derivatives. The firm says that it sees an 85% downside from current valuations for the seven firms, based purely on a fundamental basis owing to sky-high valuations. With a collective market capitalisation of ₹17.8 lakh crore ($218 billion), Adani Group is the second largest conglomerate in India, after Tata Group, run by its chairman and founder Gautam Adani, who is currently the world’s third richest man.

Hindenburg said that multiple firms under Adani were highly leveraged relative to industry averages, and that the situation was worsening. “Key listed Adani companies have also taken on substantial debt, including pledging shares of their inflated stock for loans, putting the entire group on precarious financial footing. 5 of 7 key listed companies have reported ‘current ratios’ below 1, indicating near-term liquidity pressure,” it said in the report.

The investment research firm alleged that Adani Group has engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades. “Gautam Adani, Founder and Chairman of the Adani Group, has amassed a net worth of roughly $120 billion, adding over $100 billion in the past 3 years largely through stock price appreciation in the group’s 7 key listed companies, which have spiked an average of 819% in that period,” it said.

The agency also cited a report by CreditSights, published in August 2022, which had called the Adani Group “deeply over-leveraged” and suggested it could “unravel Adani’s vast business empire”. The report was “toned down” in September 2022 after CreditSights met with the company.