Hindenburg effect: 7 Adani group stocks lose ₹86,000 cr in m-cap today

ADVERTISEMENT

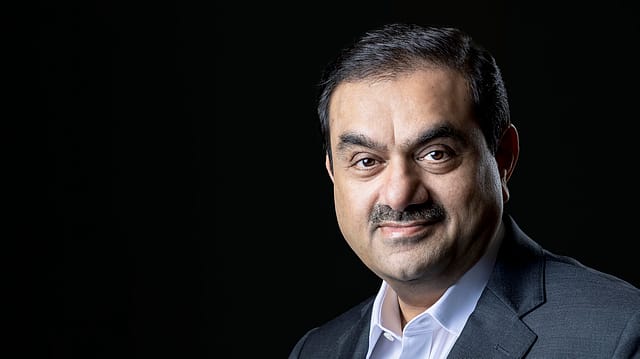

Shares of Adani Group companies witnessed sharp selling pressure on Wednesday following a report by Hindenburg Research that accused billionaire Gautam Adani-led firms of manipulating stocks and accounting fraud scheme over decades. In a report, titled 'Adani Group: How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History', the investment firm said that multiple firms under Adani were highly leveraged relative to industry averages, and that the situation was worsening. The agency said it has taken a short position in the Adani group firms, citing that 7 listed companies are 85% overvalued.

Reacting to the report by the U.S. short-seller, seven listed Adani group companies fell up to 9% on the domestic stock market. Adani Transmission was the biggest loser with an 8.9% fall, followed by Adani Ports and Special Economic Zone, which ended 6.3% lower.

Among others, Adani Total Gas shed 5.6%, while Adani Power and Adani Wilmar fell 5% each. Adani Green Energy settled 3% lower, whereas Adani Enterprises, the flagship company of the conglomerate, dropped 1.5%. Overall, the Adani group companies lost a cumulative market capitalisation of nearly ₹85,760 crore. At the end of today’s trade, the total m-cap of 7 listed entities of Adani group stood at ₹16.89 lakh crore, which is the second largest after Tata Group. Billionaire Mukesh Ambani-led Reliance Industries (RIL) is the third largest conglomerate in India with m-cap of ₹16.12 lakh crore.

The biggest loser in the ₹16.9 lakh crore conglomerate was Adani Transmission, which eroded ₹27,263 crore in market value. It was followed by Adani Total Gas and Adani Port, which lost ₹23,899 crore and ₹10,358 crore, respectively. Among others, m-cap of Adani Green Energy dropped ₹9,203 crore, while Adani Enterprises lost ₹6,030 crore. Adani Power and Adani Wilmar saw its m-cap dropping by ₹5,284 crore and ₹3,724 crore, respectively.

Hindenburg said that multiple firms under Adani were highly leveraged relative to industry averages, and that the situation was worsening. “Key listed Adani companies have also taken on substantial debt, including pledging shares of their inflated stock for loans, putting the entire group on precarious financial footing. 5 of 7 key listed companies have reported ‘current ratios’ below 1, indicating near-term liquidity pressure,” it said in the report.

The investment research firm alleged that Adani Group has engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades. “Gautam Adani, Founder and Chairman of the Adani Group, has amassed a net worth of roughly $120 billion, adding over $100 billion in the past 3 years largely through stock price appreciation in the group’s 7 key listed companies, which have spiked an average of 819% in that period,” it said.

The agency also cited a report by CreditSights, published in August 2022, which had called the Adani Group “deeply over-leveraged” and suggested it could “unravel Adani’s vast business empire”. The report was “toned down” in September 2022 after CreditSights met with the company.

Responding to Hindenburg’s report, Adani group has refuted the claims terming them “malicious, mala fide and brazen”, whose intention is to damage the group’s upcoming follow-on public offer. "The timing of the report’s publication clearly betrays a brazen, mala fide intention to undermine the Adani Group’s reputation with the principal objective of damaging the upcoming follow-on public offering from Adani Enterprises, the biggest FPO ever in India," says Jugeshinder Singh, group CFO, Adani group.

He said the investor community has always reposed faith in the Adani Group on the basis of detailed analysis and reports prepared by financial experts and leading national and international credit rating agencies. "Our informed and knowledgeable investors are not influenced by one-sided, motivated and unsubstantiated reports with vested interests."

Singh said the Adani Group holds a diverse portfolio of market-leading businesses managed by CEOs of the highest professional calibre and overseen by experts in various fields for several decades. "The group has always been in compliance with all laws, regardless of jurisdiction, and maintains the highest standards of corporate governance."

It is notable that the report by Hindenburg came days ahead of Adani Enterprises’ ₹20,000 crore follow-on public issue, which will open on January 27 and close on January 31. The bidding by anchor investors will start on January 25, as per the company’s filing with the SEBI. The FPO committee of the board of directors of the company has fixed the floor price for the issue at ₹3,112-3,276 per share, a discount of 13.5% at the lower end of January 18 closing price. The board also approved a discount of ₹64 per FPO equity share for retail individual investors. The conglomerate plans to use nearly ₹10,869 crore out of the ₹20,000 crore for funding capital expenditure requirements of its subsidiaries in relation to certain projects of the green hydrogen ecosystem, improvement works of certain existing airport facilities, and construction of greenfield expressway. Besides, it intends to utilise ₹4,165 crore for repayment of certain borrowings of the firm and its three arms - Adani Airport Holdings Ltd, Adani Road Transport Ltd and Mundra Solar Ltd. As of September 2022, Adani Enterprises had a total debt of around ₹40,000 crore.