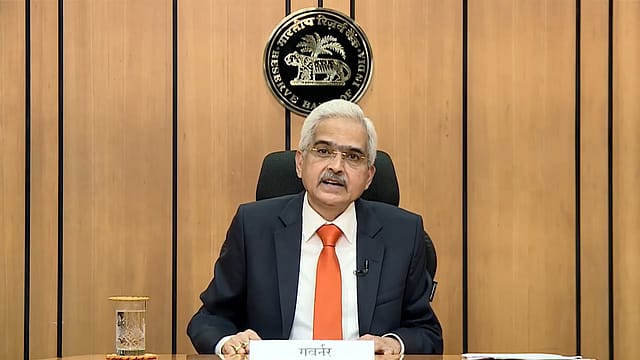

As tomato prices cool down, vegetable inflation will decline by Sept: RBI Guv

ADVERTISEMENT

Reserve Bank Governor Shaktikanta Das, during the 29th Lalit Doshi Memorial Lecture on 'Building Blocks for a Sustainable Future: Some Reflections', says the spike in vegetable prices in July is starting to see a correction, led by tomato prices, and that an "appreciable slowdown" in vegetable inflation is expected from September.

He says new arrivals of tomatoes in mandis are already softening prices, coupled with proactive supply management in the case of onions. "We remain firmly focused on aligning inflation to the target of 4.0 per cent," Das says during a lecture speech at the Y. B. Chavan Centre, Mumbai.

On the reasons behind sky-high inflation globally in 2022, Das says the global landscape is witnessing major structural changes. "The process of globalisation has slowed down and is drifting from multilateralism towards bilateralism and geo-economic fragmentation. Friend-shoring and reshoring have become more pronounced. Global supply chains have been under pressure, which along with rising global commodity prices contributed to multi-decadal high inflation in 2022."

India's headline inflation rose to 7.4% in July 2023, driven by the surge in tomato and other vegetable prices, after reaching a low of 4.3% in May 2023. Notably, the prices of vegetables surged by 37.3% year-on-year, led by an increase of 201.5% in tomato prices. The food group inflation more than doubled from 4.7% in June to 10.6% in July. Inflation in other major economies also remains at a decadal high. Inflation in the UK stood at 6.8% in July, while it remains at 3.2% in the US.

The RBI governor says the high inflation has resulted in aggressive monetary tightening, which in turn dampened the global growth outlook. "Tight financial conditions and volatile capital flows are accentuating the impact of the global slowdown on the prospects of emerging and developing economies. Headline inflation is now easing unevenly across countries but remains above the target in major economies," Das opines.

Notwithstanding food and fuel inflation, says Das, the headline inflation has "softened by around 130 basis points" from its recent peak in January 2023. Although it is still elevated at 4.9%, the steady easing of core inflation over the last five months is indicative of the ongoing transmission of monetary policy, Das asserts.

In the near future, Das thinks as tomato and other vegetable prices are correct, and the prospects for Kharif crops improve in the wake of the progress of the monsoon in July, the retail inflation will come down. "Given the likely short-term nature of the vegetable price shocks, monetary policy can await the dissipation of the first-round effects of such shocks that may produce short-lived spikes in headline inflation."

Das says amid a volatile macro environment globally, India stands out as the "emerging growth engine" for the world. India’s real gross domestic product (GDP) recorded a growth of 7.2% in 2022-23, surpassing its pre-pandemic level by 10.1%, he says, adding that overall, the conditions are "favourable" for the growth momentum to continue and the capex cycle to gain momentum in 2023-24. He asserts that as India’s growth narrative changes from "caution and watchfulness to optimism and exuberance", it is now time to make a mark in the emerging global economic landscape.