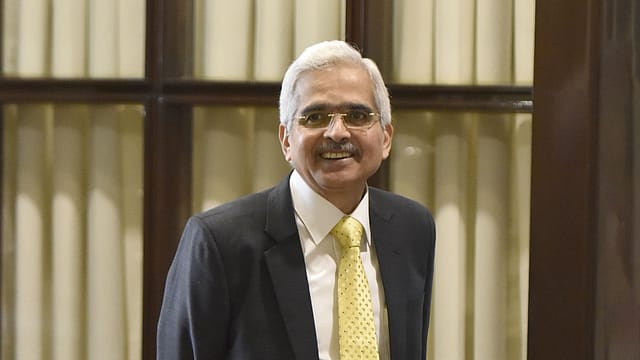

CIMS to help RBI handle massive data: Shaktikanta Das

ADVERTISEMENT

Reserve Bank of India governor Shaktikanta Das on Friday launched the Centralised Information Management System (CIMS), which is touted to be the central bank's next-generation data warehouse.

The new system is starting with reporting by scheduled commercial banks and will be gradually extended to urban cooperative banks (UCBs) and non-banking financial companies (NBFCs).

"With today's launch of CIMS, we embark on a major change in our information management framework for handling the massive data flow, aggregation, analysis, public dissemination and data governance," the RBI governor says.

"This system uses state-of-the-art technology to manage Big data and will serve as a platform for power users to carry out data mining, text mining, visual analytics and advanced statistical analysis connecting data from multiple domains, such as, financial, external, fiscal, corporate and real sectors as well as prices," Das says, adding it would lead to a paradigm shift in the Reserve Bank's economic analysis as well as supervision, monitoring and enforcement across multiple domains.

"Incidentally, with the CIMS going live, the first weekly statistical supplement (WSS), which is the Reserve Bank's weekly data release on its own operations and on developments in banking and financial markets, was compiled and processed in the CIMS for the week ended June 23, 2023," the RBI governor says.

January 2026

Netflix, which has been in India for a decade, has successfully struck a balance between high-class premium content and pricing that attracts a range of customers. Find out how the U.S. streaming giant evolved in India, plus an exclusive interview with CEO Ted Sarandos. Also read about the Best Investments for 2026, and how rising growth and easing inflation will come in handy for finance minister Nirmala Sitharaman as she prepares Budget 2026.

CIMS will disseminate more data for public use and will also support online statistical analysis by external users at their end. Regulated entities will also have access to their past data and their assessment on quality parameters in the new system.

The banking regulator established its first enterprise-wide data warehouse – the Central Database Management System (CDBMS) – which was accessible to its internal users since 2002. A large part of this data system was placed in the public domain as the 'Database on Indian Economy (DBIE)' portal in November 2004. Over the years, DBIE has evolved from a simple data repository to an information processing and management system, which has become the Reserve Bank's data dissemination platform. The DBIE remains very popular among domestic and international researchers, analysts, and the general public, especially students. It received over 2.5 lakh hits in May 2023.

The Reserve Bank's Regulations Review Authority 2.0 (RRA 2.0) recently made several recommendations on streamlining reporting mechanism and reduction in regulatory compliance burden, says Das. Many of these recommendations have already been implemented and others are in various stages of implementation. A major recommendation on system-based submission of the remaining email-based reporting will be implemented through the Centralised Information Management System (CIMS) in the coming months, he says.

"Our investment in technology for information management, periodic reviews, continuous engagement with reporting entities and technological upgradation at their end, have paid rich dividends in terms of improving coverage, quality, and timeliness of data. During the COVID-19 lockdown period, our reporting system ensured business continuity: the flow of validated information was seamless; the 'work from home (WFH)' environment was actively supported; and the public dissemination of information went uninterrupted," Das says.