High inflation, declining forex forces RBI to hike rates

ADVERTISEMENT

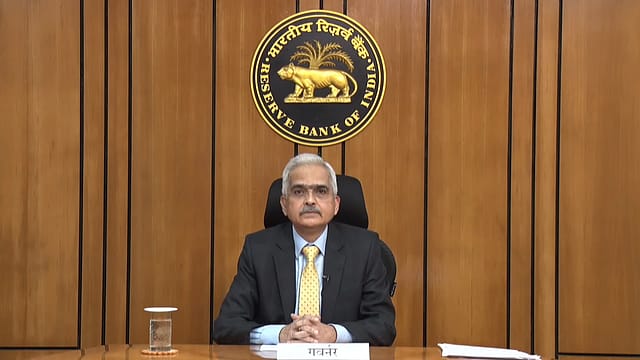

After tolerating double digit growth in WPI Inflation for the past year and facing criticism from many economists who blame RBI for being behind the inflation curve, the central bank finally raised the repo rate with immediate effect. RBI also announced raising cash reserve ratio (CRR) by 50 basis points that will come in effect from May 21.

RBI’s sudden move indicates a paradigm shift from current loose monetary policies to higher interest rate regime, intended to tame inflation.

Today’s move of rate hike by RBI is an U-turn to its long held accommodative stance. Interestingly, RBI’s last regular monetary policy meeting was held on April 08, in which it decided to continue the easy money policy despite high WPI inflation and spiking commodity prices on the back of Ukraine-Russia war.

Declining forex responsible for the policy U-turn of RBI

Between March-end and week ended on April 22, India’s forex reserves declined by $6.88 billion, and slid to a total of $600 billion. At its peak, India’s forex reserves were at $642.45 billion on September 2021. India’s forex reserves declined for six straight weeks and it appears that central bank is selling dollars from its coffers to prevent sharp depreciation of rupee amid surge in global commodity prices, especially crude. India is a net importer of commodities and spiking commodities are a great drain on India’s forex reserves.

Apart from surging commodities, heavy outflow by foreign portfolio investors (FPIs) is also denting India’s forex reserves. Since the beginning of the year, FPIs have sold Indian equities worth ₹1.29 lakh crore, as per NSDL website. Despite heavy selling by FIIs, Indian indices were showing buoyancy on the back of low interest rates that compelled market participants to put money into riskier assets like equities. Retail participants were pouring over ₹10,000 crore to equity mutual funds through SIPs and lump sum investments.

Impact on the Indian equity markets

Indian equity market is so addicted to loose monetary policy and lower interest rates by the central bank that as soon as the RBI hiked repo rates by 40 basis points on Wednesday, all hell broke loose. Both Nifty and Sensex were the immediate casualties of rate hike. At the end of the trading day, Sensex nosedived 2.29% or 1,306 points while Nifty lost 391 points. Interest rate sensitive sectors like banks, financials, real estate, automobiles fell severely on Wednesday.

The shocker from the RBI came just a few hours before the scheduled monetary policy meeting of the U.S. Federal Reserve on Wednesday night. In an intertwined global monetary system where cure for all economic evil was currency printing since the Great Financial Crisis (2008 subprime crisis), any hint of reversing the loose monetary policy is nothing short of an economic earthquake. In mid-March, Fed raised rates by 25 basis points that led to tattered global bond markets, and spike in global yields. Market participants are expecting that the Fed is going to raise 50 basis points in May 04 meeting that may exacerbate blood bath in bond and equity markets globally.

Hike in interest rates may dampen investors sentiments as margins of companies get squeezed in rising interest rate regime. Interest rates are a measure of financial risk — higher the rate of interest, higher the risk. Thus, interest rate indicates the level of investor confidence in a country, company or individual. Interest rate also serves as ‘investment hurdle’, ensuring productive utilisation of capital through debt instruments. Falling interest rates lowered investment hurdles, thereby increasing investors’ risk appetite enormously. Higher interest rates are bad for the economy as well as for equity markets and that is why the market gave a knee jerk reaction on Wednesday when the RBI announced rate hikes.

RBI’s announcement happened just after LIC IPO’s subscription quota for anchor investors was closed successfully. While majority of indices tanked today, due to the rate hike announcement, LIC IPO was saved from dampened spirit of the Indian stock market in the nick of time.