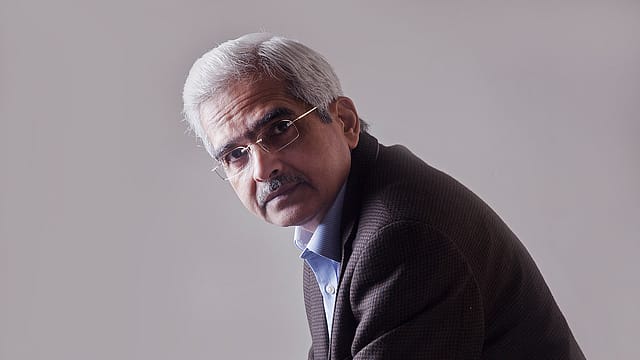

No room for knee-jerk reaction: RBI governor Shaktikanta Das

ADVERTISEMENT

RBI governor Shaktikanta Das today said there is no room for a knee-jerk reaction as any action has to be taken when it is going to be most effective and impactful.

“There is no room for a knee-jerk reaction. Because (if) you take a knee-jerk reaction, you may have to reverse. One should not regret. Our effort has been to remain in line with the curve and never fall behind the curve. We are maintaining that trend,” Das says in the post monetary policy press conference.

The RBI governor says the central bank needs more credible evidence with regard to how the outlook is likely to be and based on that assessment the effort is always to take action in time. “Whatever action we take, it has to be well timed,” he says.

To ease the potential liquidity stress, the monetary policy committee (MPC) decided to reduce the cash reserve ratio (CRR) of all banks to 4% from 4.5% earlier in two equal tranches of 25 basis points each with effect from the fortnight beginning December 14, 2024 and December 28, 2024. This reduction in the CRR would release primary liquidity of about ₹1.16 lakh crore to the banking system.

“We expect tight liquidity in the next few months. We expect tax related outflows from the system both direct tax and GST. Together with that, there is a likelihood of increase in currency in circulation. Capital outflows of foreign exchange have happened in October and November because of FPIs exiting,” Das says.

The RBI on Friday slashed real GDP growth forecast for 2024-25 to 6.6% from 7.2% earlier. The central bank projects Q3 FY25 GDP at 6.8% and Q4 at 7.2%.

Responding to a question on why India posted a GDP growth shocker of 5.4% for the second quarter of FY25, Michael Debabrata Patra, the senior most deputy governor of the Reserve Bank, said the main problem is investment on the demand side and manufacturing on the supply side. “The two are intertwined. In manufacturing, the biggest issue is the slump in sales growth and that is reflected in inflation hitting urban consumers. When sales growth is down, companies do not want to invest in new assets because they see demand as moderate which can be met by existing capacity. Since they don’t want to engage in new capacity creation, investment is down. The underlying slowdown in growth is because of inflation,” said Patra.

On lower-than-expected GDP growth of 5.4% in the second quarter, Das said this decline in growth was caused mainly by a substantial deceleration in the industrial growth from 7.4% in the first quarter to 2.1% in the second quarter due to subdued performance of manufacturing companies, contraction in mining activity and lower electricity demand. The weaknesses in the manufacturing sector, however, was not broad-based but was limited to specific sectors such as petroleum products, iron and steel and cement, the RBI governor said.

“Going forward, high frequency indicators available so far suggest that the slowdown in domestic economic activity bottomed out in the second quarter of this year. It has since been aided by strong festive demand and pick up in rural activities. Agricultural growth is supported by healthy Kharif crop production, higher reservoir levels and better rabi sowing. Industrial activity is also expected to normalise and recover from the lows of the previous quarter. The end of the monsoon and the pick-up in government capital infrastructure may also provide some impetus to iron and steel sectors,” he said.