RBI MPC Meet: Decoding inflation, GDP estimates & why Feb may see rate cut

ADVERTISEMENT

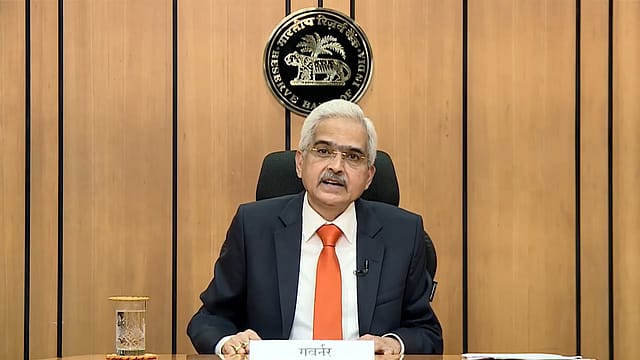

The RBI’s MPC voted 4-2 to keep the repo rate unchanged at 6.50%, with no adjustments to the standing deposit facility (SDF) and marginal standing facility (MSF) rates. The stance was also maintained as “neutral”, as RBI Governor Shaktikanta Das continued to be stern on maintaining price stability, calling it an essential ingredient to ensure sustainable growth.

At the same time, owing to a sharp correction in the growth forecast, the RBI chose to cut the cash reserve ratio (CRR) by 50 bps to the pre-COVID level of 4%, pumping in Rs 1.16 lakh crore of liquidity into the system. The RBI also cut the real GDP growth forecast for 2024-25 to 6.6% from 7.2% earlier, with Q3 projection at 6.8% and Q4 at 7.2%. The RBI raised its inflation projections for virtually all quarters, with FY25 estimates sharply raised by 30 bps to 4.8%. It expects inflation to only reach the target in Q2 FY26.

Governor Das said there is no room for a "knee-jerk reaction" on the repo rate as any action has to be taken when it is going to be most effective and impactful. "One should not regret. Our effort has been to remain in line with the curve and never fall behind the curve," the Governor said in his last MPC announcement of the current tenure.

What do economists and experts think of the RBI's policy announcements today? Is a rate cut likely soon? Experts are divided, though a cut could come as early as February. They also welcome the CRR cut, which will boost bank liquidity and may help borrowers negotiate home loan rates.

Repo rate cut 'expected' soon?

Aditi Gupta, economist at Bank of Baroda, says it's likely that the central would go for a rate cut in Feb’24. "Inflation has started showing signs of relenting. Further, the RBI governor highlighted the importance of balance between growth and inflation and stated that a protracted slowdown in growth “may need policy support”, hinting at the possibility of a rate cut. Neutral stance gives the MPC the flexibility to take a data-dependent cautious approach to the future course of policy," says Gupta.

Aurodeep Nandi, India economist, Nomura, says contrary to our expectations that the RBI would deliver a 25 bp cut in the December meeting, the policy rate was left unchanged, although the RBI delivered a cut in the CRR as anticipated. "The policy decision continues to prioritise inflation control over growth rescue. Our view remains that the growth glass is half empty, not half full and the recent sharp slump in GDP growth should have highlighted the higher growth sacrifice involved in keeping policy rates elevated. Meanwhile, the inflation increase is concentrated primarily in a few food items and underlying inflation continues to remain subdued."

Nandi says there are indications that the policy paradigm could be shifting, which is reflected in additional dissent within the MPC (4-2 vs 5-1 earlier in favour of a pause).

Harsha Vardhan Agarwal, president, FICCI says while the RBI's stance on the "repo rate" was widely expected, the 50-bps cut in the CRR rate is welcomed. "This move is well-timed and practical and should help ease out the liquidity situation supporting credit and overall growth,” Agarwal says as inflation shows some signs of moderation, it's likely that the next lending rate cut would come in February 2025. “On the inflation front, the prices are expected to moderate in the latter part of the current fiscal year. We look forward to a cut in repo rate in the next policy statement,” added Agarwal.

Shishir Baijal, chairman and MD, Knight Frank India, thinks as the growth deceleration is not yet alarming, it provides the RBI with enough leeway to keep interest rates unchanged, focusing on controlling inflation and stabilising the currency. However, the tone of the central bank has shifted towards remaining cautious of growth slowdown as witnessed in a downward revision of GDP projections for FY25, he adds.

CRR cut to boost liquidity

Manish Jain, director, institutional business (equity & FI) division at Mirae Asset Capital Markets says the CRR cut would help in boosting liquidity, and with this, banks don't have to chase deposits at higher rates, thus providing them some comfort. "This should help in NIM improvement albeit modestly as the rate cut is looming in the near future. Rate cut expectation shifts to February; Nov/Dec data are key now."

The CRR cut was much needed in the wake of rupee outflow in recent weeks, draining the system and expected outflows in late Dec’24 owing to taxes. "With the current reduction in global volatility a calm before the storm when Mr. Trump assumes power in Jan’25, the RBI will maintain caution," say analysts at SBI Capital.

Baijal of Knight Frank says the concerns of liquidity have been addressed through a 50bps cut in the CRR, and that it should enable efficient credit flow to key sectors and support growth.

Deepak Ramaraju, senior fund manager, Shriram AMC, says the RBI has opinioned that the slowdown has bottomed out in Q2 FY 25 and indicated a pickup in high-frequency indicators. "The RBI has remained overall accommodative to boost growth and maintain price stability. The cut in CRR and bottoming out of the slowdown will augur well with the equity markets in the medium term. The cut in CRR was a welcomed move and will lead to improved credit growth due to increased liquidity in the system. The earnings are expected to pick up in Q4 FY 25, which will be supported by a pickup in government spending."

Sustained demand for housing expected

Nitin Bavisi, CFO of listed player Ajmera Realty & Infra India says the RBI may want to see the economic situation for another quarter, before reacting in February." The CRR cut will not only ease liquidity but also reduce deposit and lending rates, albeit with a lag effect. "We expect the rate easing cycle to start in H1CY25. Lower rates, ample system liquidity, and a strong pipeline of new projects in 2025 will be a big positive for the sector. The RBI has set the path for growth, now the industry will wait for the FM to deliver in the Union Budget in February 2025.”

Anshuman Magazine, chairman & CEO - India, South-East Asia, Middle East & Africa, CBRE, says the RBI’s decision to keep the repo rate steady reflects its stance to balance economic growth with inflation concerns. "Stable interest rates provide much-needed predictability for homebuyers and developers, fostering market confidence. With steady borrowing costs, we anticipate sustained demand for housing, particularly in the affordable and mid-segment categories."

Madhur Gupta CEO Hero Realty says the real estate sector stands to benefit from continued stability. "For developers, this means sustained demand for residential properties, particularly in the premium segment, as home loan rates stay attractive. This stability fosters confidence in the market, allowing developers to plan and execute projects that align with buyer preferences."