RBI pegs GDP growth at 6.4% for FY24; cut inflation forecast to 6.5% for FY23

ADVERTISEMENT

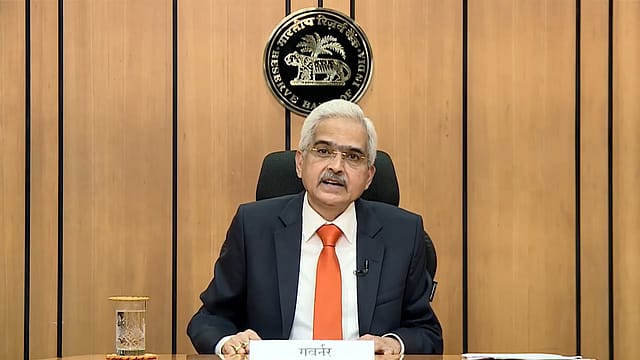

The Reserve Bank of India (RBI) Governor Shaktikanta Das on Wednesday said that the real GDP growth is expected to grow at 6.4% for FY24 and 7% for FY23. The GDP growth for Q1 of FY24 has been projected at 7.8%, for Q2 at 66.2%, Q3 at 6% and Q4 at 5.8%.

"According to our surveys, manufacturing, services, and infrastructure sector firms are optimistic about the business outlook. On the other hand, protracted geopolitical tensions, tightening global financial conditions, and slowing external demand may continue as downside risks to domestic output. Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 6.4% with Q1 at 7.8%; Q2 at 6.2%; Q3 at 6%; and Q4 at 5.8%. The risks are evenly balanced" the RBI Governor said.

The RBI's MPC met for the first time this year, and also after Finance Minister Nirmala Sitharaman presented this year's Union Budget 2023-24 on February 2, 2023. In its MPC meet in December last year, the RBI had pegged the GDP growth forecast for FY2022-23 at 6.8%, with Q3 at 4.4% and Q4 at 4.2%. The GDP growth forecast for Q1 of FY24 was then pegged at 7.1%.

In the Economic Survey FY2022-23, which was released last month, the government outlined the country’s GDP growth at 6-6.8%, making it the slowest annual GDP growth in the past three years.

Meanwhile, Das said that the retail inflation for FY2022-23 is projected at 6.5%, whereas for FY23-24 the retail inflation is forecasted to be at 5.3%, with Q1 at 5%, Q2 at 5.4%, Q3 at 5.4%, and Q4 at 5.6%. This is within the RBI’s target range of 6%.

The governor said that the CPI inflation moderated by 105 basis points during November-December 2022 from its level of 6.8% in October 2022 owing to a softening in food inflation on the back of a sharp deflation in vegetable prices. As a result of this inflation for Q3 of FY2022-23 has turned out to be lower than the RBI’s earlier projections.

The country's headline retail inflation rate eased to a one-year low of 5.72% in December 2022 from 5.88% in the previous month, but continued to remain higher than FY22. Within the food inflation, vegetable prices fell the most, with the index down 12.7% in December 2022 compared to November 2022.

"Headline inflation has moderated with negative momentum in November and December 2022, but the stickiness of core or underlying inflation is a matter of concern. We need to see a decisive moderation in inflation. We have to remain unwavering in our commitment to bring down inflation. Thus, monetary policy has to be tailored to ensuring a durable disinflation process," Das said.

According to the Economic Survey 2022-23 food inflation ranged between 4.2% and 8.6% during April and December last year, while the core inflation rate stayed at around 6% except in April 2022.

On Wednesday, the RBI hiked the repo rate by 25 basis points (bps) to 6.50%, while withdrawing the "accommodative stance" to tame high inflation in the country. The repo rate has been hiked for the 6th time in a row.