RBI’s 4th hike in a row takes repo rate to 5.9%

ADVERTISEMENT

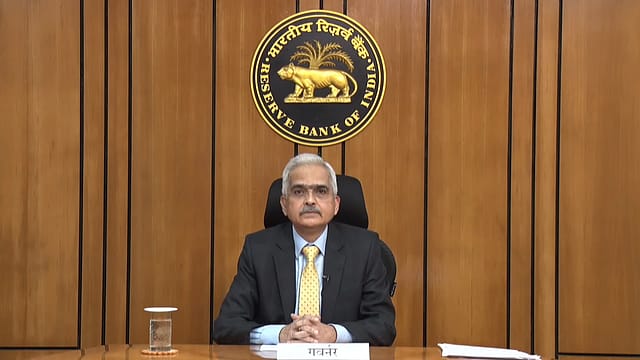

Reserve Bank governor Shaktikanta Das-led Monetary Policy Committee (MPC) has decided to hike the key policy rate for the fourth time in a row by 50 basis points to 5.9%. The repo rate hike is in line with market expectations, given the global inflation conditions and depreciation in domestic currency.

The central bank has also decided to remain focused on the “withdrawal” of the "accommodative" policy stance to control inflation but will keep on supporting the economy, against high inflation, rupee depreciation, unemployment, and supply chain issues. "There is nervousness in financial markets. The global economy is in the eye of a new storm. But the Indian economy remains resilient. The financial system remains intact, with improved parameters," says the RBI Governor.

The latest rate hike will burden the common man, with high-interest rates on their monthly home loan, car loan and other EMIs. When the RBI increases the repo rate -- a key lending rate for banks -- the interest on loans (such as home loans) rises as retail loans are benchmarked to the RBI’s repo rate, with a quarterly reset clause.

Das says the SDF or standing deposit facility stands adjusted to 5.65%, while the marginal standing facility rate and bank rate have been revised to 6.15%, says the RBI governor.

In this fiscal year so far, the RBI has raised the repo rate by a cumulative 1.9% – 40 bps in an off-cycle meeting in May, 50 bps in June and 50 bps in its previous policy and 50 bps today.

Before the RBI, the US Federal Bank had last week set the tone for another round of key lending rate hikes by raising the repo rate by 0.75% to 3.5%, the fifth hike from 0% during the start of the year. The Fed vowed to continue with its "aggressive" policy stance to curb record inflation and expects the policy rate to rise to 4.4% by the year's end.

Similarly, the Bank of England, too, has raised key interest rates by 50 basis points to 2.25% from 1.75%, its 7th consecutive hike and the highest level since 2008. Barring Japan's central bank, which has maintained an ultra-lose monetary policy, other key economies like Switzerland, Norway, South Africa, UAE, Saudi Arabia, Hong Kong, Indonesia and the Philippines have raised interest rates.

In spite of the efforts made by the central bank and the government, the country's retail inflation or consumer price index (CPI) remained elevated above the RBI’s upper threshold of 6% for the seventh consecutive month, thereby hurting the country's economic growth.