Revenue Secy rules out GST cut on cement, hints at rate rationalisation

ADVERTISEMENT

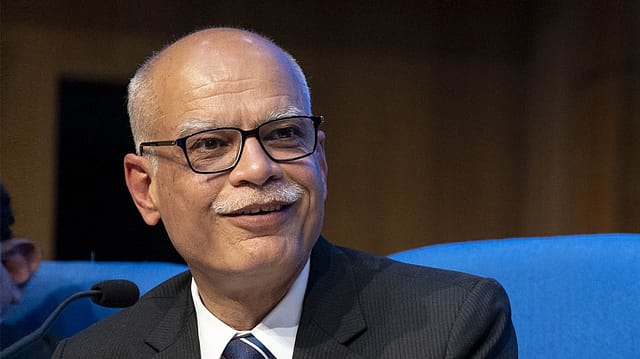

Revenue Secretary Tarun Bajaj on Monday ruled out any relief on GST on cement, which is currently in the 28% tax slab.

Responding to a query on whether the government would consider reduction of GST on cement as the Centre has lined up mega investment in infrastructure, Bajaj said at a post budget industry interaction in Bangalore, "It is a GST Council matter, so I would not like to dwell in detail on it."

"I would say that the revenue neutral rate RNR under the GST was 15.3%. Today we are at 11.6%. I think we need to rationalise and ensure that the tax revenue come to both Centre and the states, otherwise we will again start having these potholes in the roads as well as other areas," Bajaj added.

It may be noted that the GST Council is expected to meet later this month and it will consider a report from the Group of Ministers (GoM) on GST slab rationalisation constituted under Karnataka chief minister, Basavaraj Bommmai. The GoM has not submitted its recommendations yet to the panel. It is, however, likely that the panel may suggest increasing the 5% slab to 8% in the upcoming meeting of the Council.

The GST Council may also look at slab rationalisation under which a three-tier tax structure may be created against the current four tier tax slabs. The proposed slabs could be 8%, 15% and 28% in place of the current GST slabs of 5%, 12%, 18%, and 28%. The 12% and 18% slabs is likely to be merged to arrive at a midway slab of 15%.

The Fifteenth Finance Commission headed by N K Singh said in its recommendations last year that the annual GST loss on account of lower rates is to the tune of ₹4 lakh crore. According to the commission findings the effective tax rate under the GST comes at 11.8%, which is below the RNR.