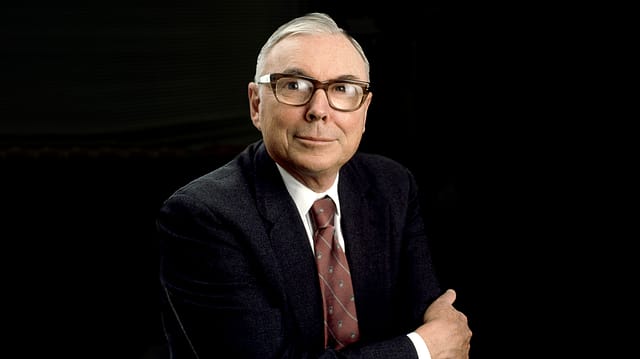

Charlie Munger, longtime business partner of Warren Buffett, dies at 99

ADVERTISEMENT

Charles Munger, the longtime business partner and right-hand man of billionaire investor Warren Buffett, died aged 99 on Tuesday.

Munger's family tells Berkshire Hathaway that he passed away peacefully at a California hospital. The family will handle all affairs pursuant to Charlie's instructions.

"Berkshire Hathaway could not have been built to its present status without Charlie's inspiration, wisdom and participation," Buffett says in a statement.

Munger was vice-chairman at Berkshire Hathaway and one of the company's biggest shareholders.

Posting a tribute to Charlie Munger on microblogging platform X, Apple CEO Tim Cook remembers him as "a keen observer of the world". "A titan of business and keen observer of the world around him, Charlie Munger helped build an American institution, and through his wisdom and insights, inspired a generation of leaders. He will be sorely missed. Rest in peace Charlie," Cook writes.

The duo's value hunt for over half a century also demonstrated that equities can deliver better returns when one stays invested over a long period. Buffett and Munger delivered a 20% compounded annual growth rate in the market value of Berkshire Hathaway from 1965 to 2022, twice the gains delivered by the S&P 500 Index, where dividends over the year are also included.

The Midas touch of Buffett and Munger can be seen in the portfolio of Berkshire Hathaway. Apple is Berkshire Hathaway's biggest investment. The company's 5.8% stake in the iPhone maker soared to $176 billion this year, more than five times its cost of $31 billion.

As an investor, Munger called for a ban on cryptocurrencies earlier this year. "I wish it had been banned immediately, and I admire the Chinese for banning it," Munger had said at the annual meeting of the Los-Angeles based newspaper publisher Daily Journal Corp. "I certainly didn't invest in crypto. I'm proud of the fact I've avoided it... I just regard it as beneath contempt." "Some people think it's modernity, and they welcome a currency that's so useful in extortions and kidnappings (and) tax evasion," he said.

This was not the first time when Munger lashed out at crypto. The longtime business partner of Warren Buffet had earlier compared cryptocurrencies to gambling and called it "rat poison". Munger also warned of other "wretched excesses", including the flood of venture capital into startups. "Certainly the great short squeeze in GameStop was wretched excess, certainly the Bitcoin thing is wretched excess," Munger said. "I would argue that venture capital is throwing too much money too fast, and there's a considerable wretched excess in venture capital and other forms of private equity."