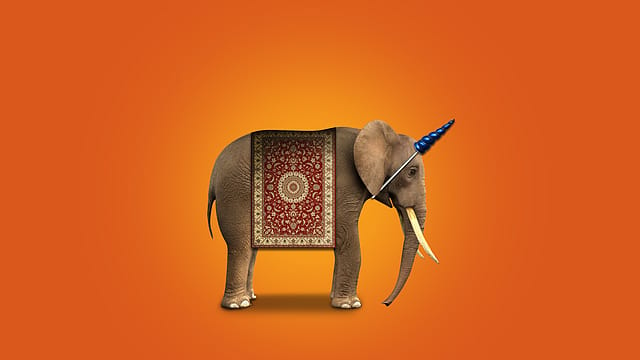

India is becoming a global unicorn hub. Here’s why

ADVERTISEMENT

The year 2020 witnessed a slew of unicorns emerge. A total of 11 unicorns emerged in the last 12 months, and 2021 saw its first unicorn already. The current total stands at 37, a growth of 33% over 2019! What pandemic?

India is the world’s third-largest startup ecosystem and it is surely the fastest growing. These companies have grown exponentially, and not despite, but because of the pandemic. They leveraged changing consumer behaviour and quickly tweaked / swiveled themselves to cater to the needs of the customers. These companies underlined the fact that focus on the market and the customer ensured they grew. And marquee investors from India and around the world backed them with funds. Each of these companies have raised funds and created value for their investors.

India is surely the cynosure of the globe. Large, diverse markets, technology innovation, disruptive propositions, and extremely high-quality talent are a few factors contributing to the startup growth story. The global investor community is keenly focussed on the country and its startups to quickly invest. Over the last five years, from 2015, India has seen an inflow of $250 billion of foreign direct investment. Out of the total, almost 75% of this FDI, i.e. $184 billion, has come in through venture capital and private equity funding, which invests in the unlisted, startup, and growth companies, leading to the creation of unicorns.

Interestingly, India has seen innovation and fast-growing companies across several sectors. Indian unicorns have emerged from sectors such as education, beauty, delivery, retail, fintech, e-commerce, mobility, salon and spa management software, healthcare, trucking services, groceries, insurance, foodtech, analytics, mobile ads, etc. And these companies are both enterprise as well as consumer focussed, with different business models, such as B2B, B2C, and B2B2C.

India’s three decacorns and 37 unicorns have led the way, but the country has just started to see the growth of disruptive companies solving for the world and scaling globally. The ecosystem promises to see an accelerated rate of unicorns emerging from diverse sectors and different parts of the country, including tier 2 and tier 3 cities.

And more importantly, the Indian ecosystem has seen a unicorn breed into two other unicorns. This is truly unique as it not only helps founders build valuable companies but also reflects the value it has created for its investors. Now, India has also started to see decacorns : valued at $10 billion! Today, India is home to three decacorns and some more are on the way!

The lockdown and social distancing pushed several businesses to shift from conventional methods to entirely digitally-driven operations, thereby creating better avenues for market forces. Leveraging new-age technologies such as artificial intelligence, internet of things, data analytics, big data, robotics, etc. several startups worked towards bridging wide-ranging gaps that were introduced in the market. And they leveraged the consumer / customer demand for digital which accelerated their growth path.

India is surely the cynosure of the globe. Large, diverse markets, technology innovation, disruptive propositions, and extremely high-quality talent are a few factors contributing to the startup growth story. The global investor community is keenly focussed on the country and its startups to quickly invest. Over the last five years, from 2015, India has seen an inflow of $250 billion of foreign direct investment. Out of the total, almost 75% of this FDI i.e. $184 billion, has come in through venture capital and private equity funding, which invests in the unlisted, startup, and growth companies, leading to the creation of unicorns.

A joint report by Nasscom and Zinnov also forecasts that India is on track to have a 50-plus strong unicorn club in 2021 and a 100 unicorn club by 2025. This is very achievable. In fact, today the country has a large number of ‘soonicorns’—soon to be unicorns. We will not be surprised if India will over-achieve the 100 unicorns by 2025! And these will unsurprisingly, emerge from sectors not yet covered, such as agritech, healthtech, cleantech, etc. These companies build solutions for India in line with the prime minister’s clarion call for ‘Atmanirbhar Bharat’. But these are also solutions for the world as they have gone global. They have developed best in class solutions, built businesses spanning across countries to cater to the real problems of the world.

These companies, who have built value, are now looking ahead as these founders are conscious of their responsibility to investors, employees, and stakeholders. They realise they need to create exit opportunities so investors get returns, employees and other stakeholders are able to monetise. Over the last five years, interestingly, 60% of Indian companies which went public were backed by VC / PE funds, who are the backers of the startup ecosystem. Led by the decacorns, unicorns, and soonicorns, the VC / PE funded startups have created ~1.3 times more jobs and paid almost twice the amount of taxes than non-funded companies. It is very evident that the startup industry, along with its angel investors, VC, and private equity funds, create disproportionate wealth for its founders, employees, and investors.

India’s three decacorns and 37 unicorns have led the way, but the country has just started to see the growth of disruptive companies solving for the world and scaling globally. The ecosystem promises to see an accelerated rate of unicorns emerging from diverse sectors and different parts of the country, including tier 2 and tier 3 cities.

The Indian unicorn will not be a rare animal. Not anymore. We will see many more, very quickly, and in herds.

Views are personal. The author is co-founder of Indian Angel Network and founding partner, IAN Fund.