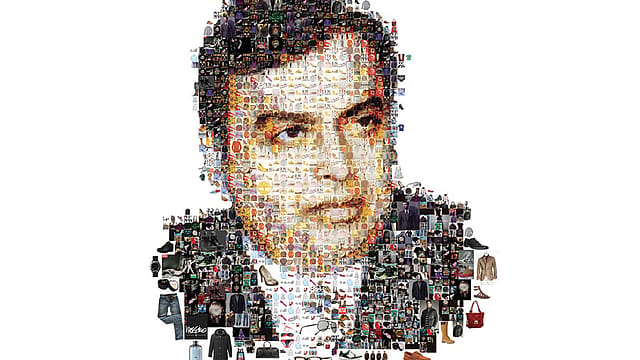

Sizing up Mukesh Ambani: The story of unparalleled ambition

ADVERTISEMENT

The history of the world is a history of curious proportions. Alexander the Great, Napoleon, Pablo Picasso, Mahatma Gandhi, Churchill – some of the most powerful icons in history have been men of short height. And supreme ambitions.

The world has slowly seen the rise of India in bagging top beauty pageants in the 90s and supreme dominance in world cricket on the one hand to India’s rise to the top of fastest-growing economies and the rise of the Indian CEOs running the show at some of the most iconic companies worldwide. What has, however, not made headline yet is the rise of the Indian billionaire atop the league as a Jeff Bezos or a Bill Gates.

Slowly, a big encore has been in the works in India which even most of the Indian media has probably not warmed up to, what to talk of the international media.

The story of the 21st-century wealth is the story of Reliance. And steering it all is a humble person of an unassuming disposition – the Mukesh Ambani.

Humble beginnings

Under Mukesh Ambani, a part-inherited, part-built petrochemicals business has been successfully rechristened after having been split up with brother Anil, into a three-sided power apparatus - Retail, Telecom, and Refinery.

The refinery business has been the historical mainstay where the overarching patriarch dream has received a worthy anchor in the son Mukesh Ambani who has now been in talks with Saudi Arabian Oil Co to sell an estimated $15 billion-dollar stake.

Mukesh has been quick to think of the future even as it is coming sooner than ever. He realises the power of ‘ecosystem thinking’ and has created a platform integrating and aiming to create a technology-driven, e-commerce force carving out a business opportunity canvass of the likes of the best of the American icons of Google, Apple, Facebook, and Amazon and the Chinese giants Baidu, Huawei, Alibaba and Tencent. Yes, Huawei – with Jio’s 5G push and the US and other nations’ growing reservations with Huawei.

The picture is slowly unfolding and the contours are now becoming visible.

The debt resolution game!

With a very late entry into telecom through the launch of Jio a little over three years ago, Reliance has created history by shaking up the industry to get two mega rivals Vodafone and Idea to merge, something unheard of across industries and across global markets. Additionally, leaving the other major player Airtel gasping for breath with Bharti Airtel posting a loss of ₹5,200-plus crores in the recent fiscal-fourth quarter, its fourth successive quarterly loss.

Massive deals of paring debt, position Reliance successfully at par with the world majors Alibaba and Tencent who have built debt-free large-scale operations and sit with large aggregated and engaged consumers. Over no more than the last one month, Jio has raised $10-plus billion across five deals from Marquee investors – Facebook, Silver Lake, Vista Equity Partners, General Atlantic, and KKR. This is when Google is rumoured to have missed the bus in favour of Facebook. Others in the waiting include The Saudi Sovereign Wealth Fund, Microsoft, Abu Dhabi’s state fund Mubadala and more.

These deals serve as the perfect springboard to acting as a debt-resolution warhorse for Reliance which could do with a balance sheet clean-up after a seven-year, $100 billion debt-driven expansion.

Latest news reports suggest that an overseas listing of Jio Platforms could be on the cards in the next two years. This is in line with Mr Ambani’s stated aim last year August to list Reliance’s consumer businesses, Retail and Jio in the next 5 years. A U.S.-China tech cold war era that the world may be heralded into, would only help the cause of Reliance. And so would a true-blue technology business (unlike a moniker of being a tech company being touted like many others) and not a commodity business. The upside for Reliance: access to overseas capital, better visibility and direct foreign investment.

Jio Platforms

Jio Platforms that houses all the digital assets - apps, ecosystems, and most importantly, Reliance Jio Infocomm Ltd, the biggest telecom network in the country of India’s most valuable company - has been valued at USD 65-plus billion in less than six months of existence. Jio Platforms compares with large global digital ecosystem platforms that are largely debt-free like Alphabet, Tencent and Alibaba.

The Jio-Facebook alliance, arguably hailed as a masterstroke, has the power to completely remodel the Indian retail landscape with an ecosystem created around JioMart enabling customers to access local Kirana (mom-and-pop) stores through WhatsApp unleashing the power of both offline and online retail. Jiomart as a digital commerce platform has the capacity to hit Amazon and Flipkart where it hurts the most and completely pull the rug from under their feet what with empowering nearly 30 million small Kirana store owners to start unleashing havoc.

China, Korea and Japan have successful similar models like WeChat in China that deliver consumer stickiness. Jio’s own 400 million-odd consumer base combined with independent 400 million across-all-telecom-majors consumer base of WhatsApp is bound to create a mighty juggernaut. For sure, concerns related to data privacy, market dominance, net neutrality, regulatory structure all loom large for good reasons.

The Jio-Facebook alliance can also herald the arrival of one super app like WeChat combining payments (WhatsApp Pay and Jio App), messaging, communication, and commerce. As also be a potential threat for Google, Walmart, Amazon and Paytm.

The Global Playbook

Around the world, there is a unique phenomenon playing out. Google that started out as a search engine and became the most powerful media company with the highest share of ad revenues is aiming to become a commerce player. Amazon which has been an e-commerce major wants to be an ad giant. Facebook, the world’s biggest social media company has been harbouring commerce ambitions what with the most recent launch of ‘Facebook Shops’. Almost all of big-tech is scrambling to create ecosystem businesses around the core five areas in one way or the other: message, commerce, content, cloud, and payments.

Reliance in India which had no presence as of 2010 in any of these is today successfully creating a most powerful position in almost all of these. Reliance is training its guns further on a range of businesses – online retail, content streaming, digital payments, education, healthcare, enterprise telecom and more.

Homegrown Big-Tech is arriving in India. The difference. It is all rolled into one.

The upside in investing in a beast that towers high across one of the largest e-commerce, internet and telecom markets worldwide is what gets the most powerful tech companies, private equity (PE) funds and sovereign investors to make a beeline in one of the most panic-stuck times. Courtesy the power that has been bestowed upon Reliance by Jio Platforms.

Mukesh Ambani, as the elder son of the patriarch - the late Dhirubhai Ambani - has come a long way. From legacy oil-and-petrochemicals empire to a big-tech behemoth, the path to greatness has been a story of grit, guts and glory evoking awe and grandeur - of greatness, of power and possibilities, and of risks and returns.

Most of all wild, rampant, and preposterous ambition.

Through all of these, the criterion for failure has perhaps been fierce success.

Already the richest man in Asia, is there something that this man cannot do? He might become one of the five richest in the world in the next three years, as per Hurun Research. And a trillionaire in 2033, aged 75, according to a most recent May 2020 study by Comparisun.

A potential Wall Street listing and a probable $100 billion valuation in a year is perhaps the baby step in this new journey. So colossal is the size of ambition that the day when it may be an Indian summer for the tag of the world’s richest man sitting atop the world’s most valuable company seems not far off.

Views are personal.

The author is Executive-in-Residence at ISB and at UCLA, and a global CEO coach and a C-Suite + Start-up advisor.