The billion-dollar fraud

ADVERTISEMENT

Scams and frauds can be disastrous in an election year for the ruling party. Unluckily for the Bhartiya Janata Party, the biggest fraud in the country’s banking sector has just been unravelled. But so far the response from law enforcement agencies has been swift, and that might just save the day for government.

Although if the cases of former IPL chief Lalit Modi and Kingfisher’s Vijay Mallya are anything to go by, whether this will come to a swift resolution is another matter.

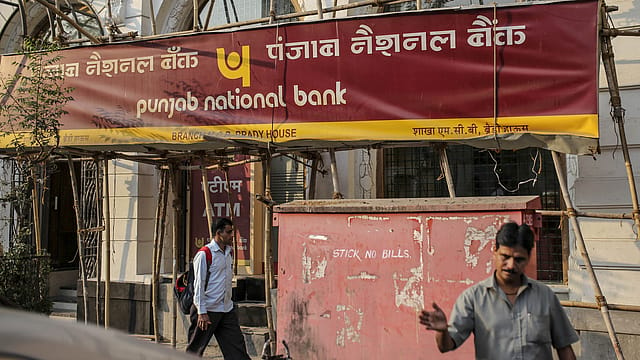

On Wednesday, India’s second largest public sector bank, the 123-year old Punjab National Bank disclosed to the stock exchanges that it had detected fraudulent and unauthorised transactions/messages to the tune of $1.77 billion or roughly Rs 11,400 crore. The beneficiary was billionaire jeweller Nirav Modi. Companies associated with him were issued unauthorised letters of undertakings (LoU) based on which overseas branches of other Indian banks gave buyer’s credit to the jeweller’s companies. The sheer size of the fraud eclipses that of the Rs 9,000 crore Satyam Computers case, which happened nearly a decade ago. And that this occurred at a public sector bank makes matters worse.

The story of the day after was one of multi-agency action and reassurances from everyone including ministers and bank officials.

In a co-ordinated nationwide action on Thursday by the Enforcement Directorate (ED), the agency of the central government, which investigates financial crimes, assets worth roughly Rs 5,100 crore were seized from Modi’s offices, showrooms, workshops and residences in Mumbai, Surat and New Delhi.

PNB’s managing director and chief executive officer Sunil Mehta is confident that more will be recovered and the financial interests of all other banks that are affected will be protected.

“We have already begun the process of recovery. The ED has begun seizing assets. We are confident that a good amount will be recovered,” he said in a media briefing to calm nerves, as PNB’s shares were in a downward spiral in the stock markets.

Mehta’s reassurances did not help arrest the fall as PNB’s shares, which closed nearly 12% lower on the Bombay Stock Exchange at Rs 128.35.

The fear is that since it was PNB that issued the LoUs, they would stand liable for the entire Rs 11,400 crore, which is roughly a third of its market capitalisation and more than 50 times its net profit for the third quarter of fiscal 2017-18.

At a frenzied media briefing, Mehta was flooded with a barrage of questions on whether PNB will be liable for the entire amount. Though he stopped short of committing to a figure, Mehta said, “We will honour all our bonafide commitments.”

“If the investigations reveal that the onus is ours, we won’t shirk our responsibility. We have not received any directive from the Reserve Bank of India yet but they are our regulator and we would follow their orders,” he added.

Mehta also said that not all of the LoUs were converted into funded transactions and the final quantum will be known once the investigations of the Central Bureau of Investigation and ED are over. He even went so far as to say that PNB has the “capabilities and capacities” to come out of this situation unharmed.

There is also a bigger worry amongst market watchers - the level of laxity in loan approval procedures at state-owned banks. In a note to investors, Edelweiss Securities said, “…more worrying is the stark process lax and repeated instance of similar frauds. PSU banks continue to grapple with weak systems, raising questions on why the process are not centralised, unlike most private banks where bypassing the Core Banking System (CBS) is not easy.”

At PNB, the Rs 11,400 crore fraud began in the Brady House branch in Mumbai nearly seven years ago, in 2011. According to Mehta, the fraud was detected by a new team at the branch after Modi’s companies came in for a renewal of the letter of credit on January 25, 2018. It was then found that the past details were not fed into the CBS, and the message of issuance of LoUs was conveyed only through the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system.

Mehta claims the incident is an isolated one. "When this incident came to light, we scanned our other branches and no other such incident was found. This is an isolated incident,” he said. But the rot could go deeper. Mehta added that other accounts where the errant employees were involved could be subject to a forensic audit.

Meanwhile, the Finance Ministry has already issued an advisory asking all banks to review their large exposures. This is even as officials sought to allay fears of a widespread problem. “This is not likely to escalate to other banks. We have already frozen the case,” said the Financial Services Secretary Rajiv Kumar. The Finance Ministry has also sought a status report from the ED.

PNB’s Mehta still says that the bank is committed to clean and responsible banking. To his credit, the fraud was unearthed internally and 10 employees from the Brady House Branch have already been suspended. But the manner in which Nirav Modi and his maternal uncle Mehul Choksi have allegedly defrauded India’s second largest public sector bank for seven years, shows just how easy it is to con the system. No wonder then that the Finance Ministry is insistent on structural reforms at public sector banks for more stringent approval of large loans, before it recapitalises them with Rs 2.11 lakh crore.