Labour-intensive sectors gain as India-EU FTA removes tariffs on $33 billion exports

The agreement is also expected to have a wider social impact by supporting workers, artisans, women-led enterprises, young entrepreneurs, and MSMEs, while helping Indian firms integrate more closely into global value chains.

India’s labour-intensive industries stand to gain significantly from the India–EU Free Trade Agreement, with tariffs of up to 10% set to be eliminated on nearly $33 billion worth of exports once the agreement comes into force. Sectors such as textiles and apparel, leather and footwear, marine products, gems and jewellery, handicrafts, engineering goods, and automobiles are expected to see an immediate improvement in price competitiveness in the European market.

The agreement is also expected to have a wider social impact by supporting workers, artisans, women-led enterprises, young entrepreneurs, and MSMEs, while helping Indian firms integrate more closely into global value chains.

The agreement is equally important for India’s farm and food processing sectors, which are expected to gain better access to European markets under more balanced trading conditions. Products such as tea, coffee, spices, fresh fruits and vegetables, and processed foods are likely to become more competitive, offering a boost to farm incomes and rural employment.

At the same time, India has ring-fenced sensitive areas including dairy, cereals, poultry, soymeal, and select fruits and vegetables, ensuring that export opportunities are expanded without undermining domestic agricultural interests.

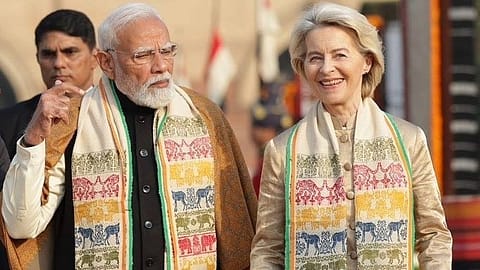

Prime Minister Narendra Modi and European Commission President H.E. Ursula von der Leyen today jointly announced the conclusion of the India–European Union Free Trade Agreement at the 16th India–EU Summit, held during the visit of European leaders to India. The announcement marks a major milestone in India–EU economic relations, ending years of negotiations and significantly deepening trade engagement between two of the world’s largest economic blocs.

The European Union is among India’s largest trading partners, with bilateral trade in goods and services expanding steadily over the past decade. In 2024–25, India’s bilateral trade in goods with the EU stood at ₹11.5 lakh crore ($136.54 billion), with exports of ₹6.4 lakh crore ($75.85 billion) and imports of ₹5.1 lakh crore ($60.68 billion). Trade in services reached ₹7.2 lakh crore ($83.10 billion) during the same period, underscoring the growing depth of economic ties beyond merchandise trade.

Recommended Stories

The impact

Kirit Bhansali, chairman, GJEPC, said, "The India-EU FTA will supercharge market diversification for the gem and jewellery industry. This transformative pact aims to double bilateral trade to ₹91,000 crore within three years. Zero-duty access to the world's largest consumer market empowers export hubs in Gujarat, Rajasthan, Maharashtra, and West Bengal to ramp up shipments of precious jewellery (plain and studded), silver, and imitation jewellery—capitalising on India's renowned design prowess. Especially with exports to the USA down by 44%, this timely pact will help Indian exporters salvage lost ground."

He added, "Amid soaring metal prices and evolving trade dynamics, the deal enhances margins, sharpens our competitive edge in design and craftsmanship, accelerates manufacturing, and generates jobs. For Indian jewellery retailers, it opens doors to expand brands across Europe, building on their rising global footprint."

A key outcome of the pact is the market access secured by India for over 99% of its exports to the EU by trade value. This is expected to give a strong push to domestic manufacturing and reinforce the government’s ‘Make in India’ initiative, particularly in sectors where Indian producers have traditionally faced tariff disadvantages in European markets.

(INR CR)

"The India-EU treaty will be a game changer for the textile sector, currently undergoing massive stress due to the US tariffs. It is now up to the industry to rise to the occasion to meet the other compliance requirements of the EU Markets," said Rahul Mehta, chief mentor, Clothing Manufacturers Association of India.

Market sentiment was buoyed by optimism around the India–European Union free trade agreement and expectations that the US could ease tariff-related measures linked to India’s imports of Russian oil, according to brokerage firm Ashika Institutional Equities.

"The deal is expected to create millions of jobs across both regions, further supporting investor confidence. However, the benchmark index witnessed heightened volatility with moves on both sides, as the session coincided with the January 2026 monthly derivatives expiry. On the sectoral front, buying interest was seen in Metals, Commodities, CPSE, PSE and PSU Banks, while selling pressure weighed on Media, Auto, Realty, FMCG and Healthcare stocks," it added.

Together, India and the EU represent the fourth- and second-largest economies globally, accounting for about 25% of global GDP and nearly one-third of global trade. According to a PIB release, “Integration of the two large diverse and complementary economies will create unprecedented trade and investment opportunities,” with the agreement expected to unlock new avenues for cross-border value chains and long-term investments.

PM Modi said in a post on X, “The historic agreement with EU, which is India’s largest Free Trade Agreement in history, has substantial benefits for the 1.4 billion people of India. It will: Make access to European markets easier for our farmers and small industries. Create new opportunities in manufacturing. Further strengthen cooperation between our services sectors.”

EU's Ursula von der Leyen echoed the sentiment, describing the agreement as a landmark moment in the relationship. “Europe and India are making history today. We have concluded the mother of all deals. We have created a free trade zone of two billion people, with both sides set to benefit. This is only the beginning. We will grow our strategic relationship to be even stronger,” she tweeted.

With tariffs coming down, services cooperation deepening, and safeguards built in for sensitive sectors, the India–EU FTA is set to reshape trade flows and economic engagement between the two partners in the years ahead, especially amid the geopolitical turmoil.