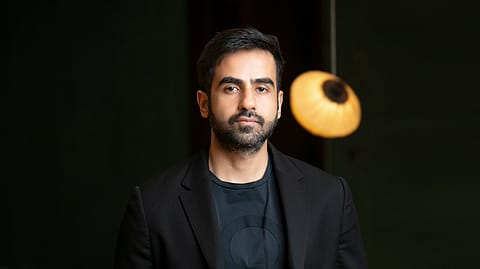

Zerodha co-founder Nikhil Kamath takes on Meta and Google, gives clarion call for an Indian alternative

“It's about time we need an Indian answer to this,” says Nikhil Kamath of Google and Meta's dominance.

Zerodha co-founder Nikhil Kamath on Thursday came down on tech giants Meta and Google, saying that every startup entrepreneur in the country can't spend 100% of their marketing and distribution money on Meta and Google forever.

“It's about time we need an Indian answer to this,” Kamath said in a post on X.

Alphabet-owned Google and Meta corner the bulk of digital marketing monies spent by Indian companies. While Google has Search and YouTube, Meta has Instagram and Facebook.

The statement comes weeks after Nikhil’s brother Nithin Kamath called out US President Donald Trump’s tariffs as proof that the world remains under the shadow of the ‘US empire’, making all others its subjects.

To tax foreign companies that earn from India but don’t have a significant presence here, the new Income Tax Bill, 2025, expanded the 'Significant Economic Presence' (SEP) principle introduced in India’s tax framework to tax foreign digital businesses that earn from Indian consumers without having a physical presence in the country. It ensures that multinational corporations providing digital services to Indian users pay taxes in India, even if they do not have an office or a permanent establishment in the country.

Traditionally, corporate taxation is based on physical presence (i.e., companies pay taxes in countries where they have offices, factories, or employees). However, with the rise of the digital economy, companies such as X, Google, Meta, Amazon, and Netflix earn billions from Indian users but pay little or no tax because they do not have a significant physical presence in the country.

To address this loophole, the Indian government introduced the SEP rule in 2018 under Section 9(1)(i) of the Income Tax Act.

Recommended Stories

The same is likely to be further expanded in the Income Tax Code Bill, 2025, ensuring foreign digital companies contribute to India's tax revenue.

With this provision, foreign digital companies will be taxed if they earn from Indian consumers. Any company offering digital services, content, or e-commerce to Indian users will now be liable to pay income tax in India, even if they do not have an office or subsidiary in the country. This applies to companies providing streaming services (Netflix, Spotify etc.), e-commerce platforms (Amazon), gaming platforms, and social media giants (Meta, X, etc.).