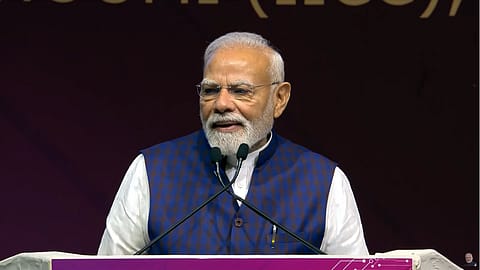

PM Modi hails GST reforms as double dose of support and growth for the nation

“Families will see their kitchen budgets fall, students and youth will benefit from lower costs, and even vehicles like scooters and cars will carry reduced tax,” PM Modi said.

Prime Minister Narendra Modi on Friday described the latest Goods and Services Tax (GST) reform as a “double dose of support and growth” for India, saying the move will provide relief to households while strengthening the economy.

While interacting with the national awardee teachers, the Prime Minister said the government, in coordination with states, has decided to simplify the GST structure by reducing it to two key rates – 5% and 18%. The next-generation reform will come into effect from September 22, on the first day of Navratri, he said.

“From paneer to shampoo and soap, everything will now become cheaper. Families will see their kitchen budgets fall, students and youth will benefit from lower costs, and even vehicles like scooters and cars will carry reduced tax,” Modi said. He emphasised that the reform will not only ease household expenses but also give the Indian economy fresh momentum.

“I had said from the Red Fort this 15th August that to make India self-reliant, next-generation reforms are absolutely essential. I had also promised the people of the country that before Diwali and Chhath Puja, there would be a double dose of happiness,” he said.

The Prime Minister recalled that when GST was rolled out eight years ago, it fulfilled a decades-long aspiration of replacing multiple indirect taxes with a single unified levy. “Now, in the 21st century, GST too required next-generation reform – and that has been done,” he said.

Highlighting the contrast with the pre-2014 tax regime, Modi said earlier governments imposed multiple levies on everyday goods, agriculture-related products, medicines, and even life insurance. “If those rates were still in force today, a household buying an item worth ₹100 would have to pay ₹20–25 in tax. Our government’s focus is on maximising savings and minimising expenses for families,” he said.

The Prime Minister expressed confidence that the revamped GST would add sparkle to the upcoming festive season, with lower prices making essentials and consumer goods more affordable for millions of households.

Recommended Stories

The announcement follows the 56th meeting of the GST Council, held in New Delhi on September 3 under the chairmanship of Finance Minister Nirmala Sitharaman, which cleared a major rationalisation of tax rates. The Council approved the streamlining of the four-tier structure (5%, 12%, 18% and 28%) into two principal slabs – 5% and 18% – with a special 40% rate retained for luxury and sin goods such as high-end cars, tobacco, and cigarettes.

Rates have also been cut on a range of essential and personal-use items, including hair oil, cornflakes, televisions, and health and life insurance premiums. The government expects the move to spur domestic consumption, provide relief to households, and cushion the Indian economy against the impact of rising U.S. tariffs.