When the Going Gets Tough...

As retail inflation continues to rise for the seventh month, RBI aims to restrict it in the range of 2-6%, but has failed to do so despite embarking on a rate hike spree.

This story belongs to the Fortune India Magazine October 2022 issue.

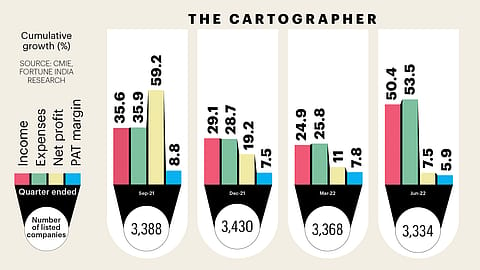

INFLATIONARY WOES HAVE clearly taken a toll on India Inc. over the past four quarters. At 6.71%, retail inflation in July continues to be above the upper limit of the Reserve Bank of India’s prescribed range for the seventh month. The central bank as a policy aims to restrict retail inflation in the range of 2-6% but has failed to do so despite embarking on a rate hike spree. As a result, while cumulative revenue growth (YoY % change) for over 3,300 listed non-financial companies was at a record high at 50% in Q1FY23, the pain of inflation was visible in the bottom line as aggregate costs for companies more than doubled from 25.8% in March 2022 to 53.5% in Q1FY23. The telling commentary is visible in the profitability with profit growth falling from a high of 59% in September 2021 quarter to a four-quarter low of 7.5% in Q1FY23. With the RBI clearly stating that inflation will remain above the 6% threshold in the second and third quarters of this fiscal, the pain for India Inc. is likely to continue.