Budget 2023: Credit Growth Signals Economic Activity

/1 min read

ADVERTISEMENT

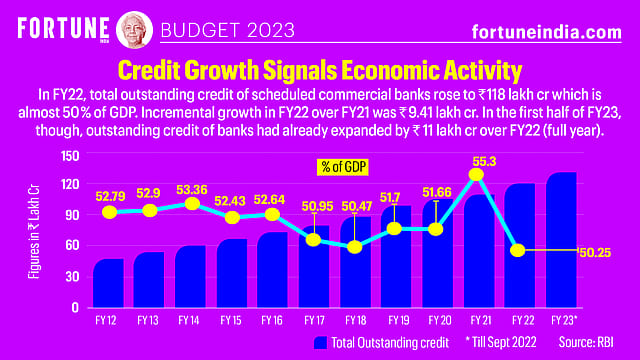

Incremental growth in FY22 over FY21 was ₹9.41 lakh crore.

In FY22, total outstanding credit of scheduled commercial banks rose to ₹118 lakh crore which is almost 50% of GDP. Incremental growth in FY22 over FY21 was ₹9.41 lakh crore. In the first half of FY23, though, outstanding credit of banks had already expanded by ₹11 lakh crore over FY22 (full year).

Explore the world of business like never before with the Fortune India app. From breaking news to in-depth features, experience it all in one place. Download Now