Patanjali Foods stock falls 5% as bourses freeze promoter shares

ADVERTISEMENT

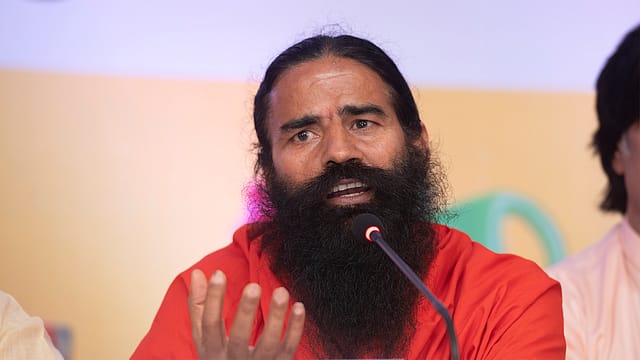

Shares of Baba Ramdev-backed Patanjali Foods dropped 5% in intraday trade on Thursday to ₹916 apiece after stock exchanges – the BSE and the National Stock Exchange (NSE) – froze the fast moving consumer goods company's promoter stake for failing to meet the public shareholding norms.

Currently, the promoter stake in Patanjali Foods is at 80.82%. The company had to increase its public shareholding from 19.18% to 25% as mandated by Securities and Exchange Board of India (SEBI) for a listed business.

"While management of the company was discussing various means and methods for increasing its public shareholding, in the meantime, the company received an e-mail from the Stock Exchanges freezing the shareholding of the Promoters and Promoter Group," the Yoga guru Baba Ramdev-led FMCG giant says in a regulatory filing.

The freezing of Patanjali's promoter stake comes nearly a year after Patanjali Foods, formerly called Ruchi Soya, raised ₹4,300 crore from its follow-on public offering (FPO). The FPO was meant to help Patanjali to achieve minimum public shareholding of 25%.

In April 2022, Ruchi Soya acquired the entire food retail business of Patanjali Ayurved on a slump sale basis for ₹690 crore and renamed itself as Patanjali Foods.

The freezing of Patanjali's promoter stake is applicable till compliance of minimum public shareholding requirements as per regulation 38 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, the filing says.

Meanwhile, the homegrown FMCG major says that the stock exchanges action will not have any impact on its financial position as the company continues its journey of registering robust business and financial performance.

"We have a strong management team in place to steer towards our long-term journey," the filing says.

"We have received a communication from our promoters that they are fully committed to the mandatory compliance of achieving minimum public shareholding and they have been discussing various modes best suited for increasing the public shareholding. They are confident of achieving mandatory MPS within next few months," it adds.

"Our promoters' equity shares are already under lock in as per the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018 till April 2023 (one year from date of listing i.e. April 08, 2023) and therefore, we do not perceive any impact of this action by the Stock Exchanges," the company says, adding it should be noted the promoters' equity shares are not pledged.

Ramdev-backed Patanjali Ayurved had completed the acquisition of Ruchi Soya in a ₹4,350-crore deal in December 2019.