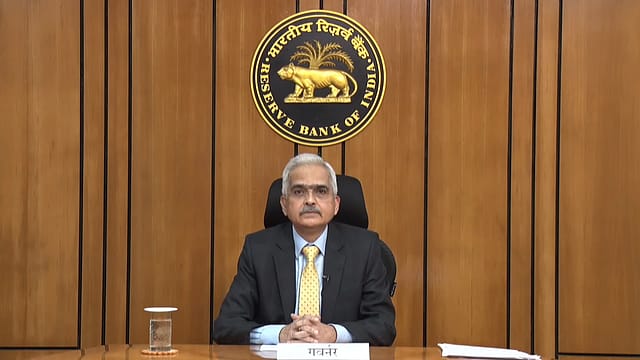

RBI directs banks to ensure 2 whole-time directors on boards

ADVERTISEMENT

The Reserve Bank of India (RBI) has advised banks to ensure the presence of at least two Whole Time Directors (WTDs), including the Managing Director (MD) and Chief Executive Officer (CEO), on their boards. It'll, as per the RBI, help facilitate succession planning, especially in the background of the regulatory stipulations in respect of tenure and upper age limit for MD & CEO positions.

The number of WTDs will be decided by the board of the bank by taking into account factors such as the size of operations, business complexity, and other relevant aspects.

"Banks that currently do not meet the minimum requirement as above are advised to submit their proposals for the appointment of WTD(s) under Section 35B(1)(b) of the Banking Regulation Act, 1949, within a period of four months," the RBI says in its latest notification.

Those banks which do not already have the enabling provisions regarding the appointment of WTDs in their Articles of Association may first seek necessary approvals expeditiously, the RBI adds.

"While ensuring compliance to the above instructions, careful consideration shall also be given to meet the requirements under other applicable statutory/regulatory provisions," says the central bank.

The RBI is of the view that given the growing complexity of the banking sector, it has become imperative to establish an effective senior management team in the banks to navigate ongoing and emerging challenges. "Establishment of such a team may also facilitate succession planning, especially in the background of the regulatory stipulations in respect of tenure and upper age limit for Managing Director and Chief Executive Officer (MD&CEO) positions."

Sustainable Finance and Financial Inclusion

Separately, Swaminathan J, Deputy Governor, RBI, at a conference on priority sector lending at College of Agricultural Banking (CAB), Pune, today said a remarkable shift is being seen towards sustainable finance globally. "Initiatives like the United Nations Principles for Responsible Banking and the Task Force on Climate-related Financial Disclosures (TCFD) are driving change at the global level," says J.

The global sustainable finance market is expected to grow from $3.6 trillion in 2021 to $23 trillion by 20313, and in India, sustainable finance has gained significant momentum in recent years as awareness of the need for sustainable development has grown.

Talking about the RBI's initiatives in green and sustainable finance in India, J says in May 2021, the RBI established the 'Sustainable Finance Group' (SFG) to proactively address climate change-related financial risks and lead regulatory initiatives in the realms of sustainable finance and climate risk. In July 2022, it released a discussion paper on climate risk and sustainable finance, furthering its commitment to driving this critical agenda forward.