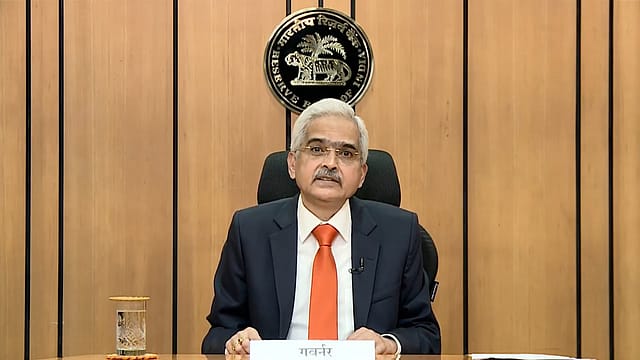

RBI MPC keeps repo rate unchanged for seventh time

ADVERTISEMENT

The Reserve Bank of India's monetary policy committee today kept the repo rate unchanged at 6.5% for the seventh time in a row.

In its bi-monthly policy announcement, the MPC decided to keep the standing deposit facility unchanged at 6.25%. It also kept the marginal standing facility and bank rates unchanged at 6.75%.

The RBI governor says the rate-setting panel remains focused on its 'withdrawal of accommodation' stance, and five out of six members have voted its favour.

"Domestic economy continues to expand at an accelerated pace supported by fixed investments and improving global environment. The second advance estimates placed the real GDP growth at 7.6% for 2023-34, the third successive year of 7% or higher growth," says RBI governor Shaktikanta Das.

"Strengthening of rural demand, improving employment conditions in informal sector activity, moderating inflationary pressures and sustained momentum in manufacturing and services sector should boost private consumption," Das says.

With rural demand catching up, consumption is expected to support economic growth in 2024-25, he adds.

The RBI governor, however, says that the headwinds from protracted geopolitical tensions and increasing disruptions in trade routes pose risks to the overall outlook. Taking these into consideration, the real GDP growth for the current financial year 2024-25 is projected at 7% with Q1 at 7.1, Q2 at 6.9% and both Q3 and Q4 at 7% each.

On the inflation front, Das says frequent and adverse climate shocks pose upside risk to the outlook on domestic and international food prices.

"Cost push pressures faced by firms are seeing an upward bias after a period of sustained moderation. Deflation in fuel is likely to deepen in the near term following the cut in LPG prices in March," he says, adding that the recent uptick in crude oil prices need to be closely monitored.

Assuming a normal monsoon, CPI inflation for 2024-25 is projected at 4.5% with Q1 at 4.9%, Q2 at 3.8%, Q3 at 4.6% and Q4 at 4.5%, says the RBI governor.