ArcelorMittal’s entry a game changer for Indian steel industry

ADVERTISEMENT

Lakshmi Mittal, chairman and CEO of ArcelorMittal, has always thrived on turning around sick steel assets and making them profitable. No wonder, his empire extends from eastern and western Europe to the U.S. and China, and he is now making a re-entry into India with ArcelorMittal Nippon Steel India, the erstwhile Essar Steel. His company’s growth mantra has always been inorganic: buy bankrupt steel mills at throwaway prices, make significant changes in organisations, invest heavily, improve union-management relations, and launch new high-value product lines.

A case in point is the acquisition of a bankrupt steel mill in Cleveland Ohio in 2005, which today is one of the most productive steel mills in the U.S. His other major acquisitions include Siderúrgica Del Balsas in Mexico in 1992, Sidbec in Canada in 1994, and Karmet in Kazakhstan, and Hamburger Stahlwerke in Germany in 1995.

However, it was only when he acquired Arcelor NV in mid- 2006, the biggest steelmaker at the time, that ArcelorMittal became the biggest steel player in the world. The battle for Arcelor NV was bitter and long-drawn, with the top brass of Arcelor repeatedly refusing to sell their company to an Indian.

Arcelor’s India debut, however, wasn’t that spectacular. The acquisition of bankrupt Uttam Galva in 2018, which was languishing in the National Company Law Tribunal (NCLT) did not bring in the kind of results Mittal expected. On December 16, 2019, ArcelorMittal got what it wanted, something that had been on its radar ever since Essar Steel was declared bankrupt and sent to the NCLT for resolution.

“We believe that ArcelorMittal, together with Nippon Steel Corporation, has the most relevant credentials and experience and is the most credible owner for Essar Steel given our decades of steel industry expertise, backed up by industry leading research and development and a wide range of innovative product capabilities, ” Mittal had said last year.

The acquisition of the 10 million tonnes per annum capacity integrated steel plant at ₹42,000 crore has not come easy or cheap. Even though it is the single biggest recovery under the Insolvency and Bankruptcy Code, Arcelor has acquired a large, running steel asset with port-based facilities at the time of an economic slowdown and a downturn in the steel industry, with growth stalling. However, it can be considered a bargain as setting up a large greenfield steel plant in India is not that simple especially as land acquisition becomes harder.

The erstwhile promoters of Essar Steel have also been reluctant to let go. In October last year, the shareholders of Essar Steel offered to pay a total of ₹54,389 crores to various creditors, which was higher than what the resolution plan had asked for. Under the proposal made by the shareholders, all classes of creditors would receive full recovery of their claims. But the plan could not pass muster.

The acquisition of Essar Steel, argues Mittal, is an important strategic step for ArcelorMittal. “India has long been identified as an attractive market for our company and we have been looking at suitable opportunities to build a meaningful production presence in the country for over a decade,’’ Mittal said in a statement. The transaction, he added, also demonstrated how India benefits from the Insolvency and Bankruptcy Code, a genuinely progressive reform whose positive impact will be felt widely across the Indian economy.

Moreover, he believes, the company’s long-term partnership with Japanese steel major Nippon Steel will bring “many new opportunities” and “allow them to make a positive contribution to India’s target to grow steel making capacity to 300 million tonnes per annum by 2030, and for its manufacturing sector more broadly.”

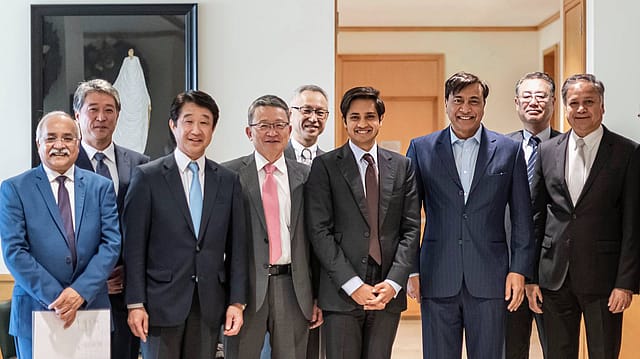

For Aditya Mittal, president and CFO of ArcelorMittal, who has been appointed the chairman of the new India entity, the acquisition gives the combined entity an opportunity to contribute to India’s expansion in infrastructure and urbanisation in the coming decades. “To do this, we have in place a targeted capital expenditure plan designed to build on our combined management strength, operational expertise, commitment to safe, sustainable steelmaking and industry-leading research and development,” he adds.

For Nippon Steel, the deal brings a presence in one of the fastest-growing steel markets in the world. “AM/NS India manufactures flat steel, steel plates and steel pipes mainly at its integrated steel mill with nominal crude steel production capacity of 9.6 million tonnes per year in India, one of the most promising steel markets in the world," said Eiji Hashimoto, representative director and president, Nippon Steel.

However, the entry of ArcelorMittal in the country is going to be a game-changer not just because of the company’s financial muscle, but also because of the innovations that it has brought in the steel sector, especially for high-end cars and other high-value products, where the margins are wider. As former steel secretary Aruna Sharma points out Arcelor Mittal can weld five different kinds of steel together to make the door of a car. Something that Indian steelmakers may find difficult to match.

But ultimately what will matter is how it runs the business, the investments it makes and how aggressive it becomes in the market when output rises. While India is critical to the profitability of other domestic steel firms, it is only one of the many markets that ArcelorMittal is present in. The presence of Mittal, who has spoken of investing ₹8,000 crore in India, is seen intensifying the competition in the sector.