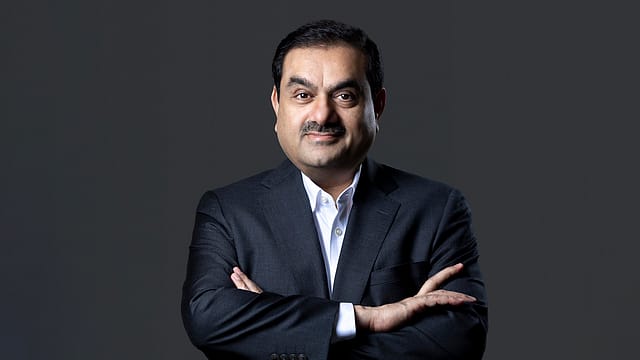

Hindenburg earned profits by driving Adani stock prices down: Gautam Adani

ADVERTISEMENT

Gautam Adani on Tuesday said that Hindenburg Research's report against the Adani Group was a combination of "targeted misinformation and outdated, discredited allegations" aimed at damaging the conglomerate's reputation.

The U.S. shortseller published a report ahead of Adani's plan to launch the largest follow-on public offering (FPO) in India's history, "generating profits through a deliberate drive-down of our stock prices", the Adani Group chairman says in a letter to shareholders.

"Subsequently, despite a fully subscribed FPO, we decided to withdraw and return the money to our investors to protect their interests," India's second-richest man says, adding that the short-selling incident resulted in several adverse consequences that the company had to confront.

"Even though we promptly issued a comprehensive rebuttal, various vested interests tried to opportunistically exploit the claims made by the short seller. These entities engaged and encouraged false narratives across various news and social media platforms," Adani alleges.

On March 2, the Supreme Court formed a panel headed by retired judge, Justice AM Sapre, to examine the alleged violation of market laws by Adani Group and its listed companies. The report of the expert committee was made public in May.

"The expert committee did not find any regulatory failure. The committee's report not only observed that the mitigating measures, undertaken by your company helped rebuild confidence but also cited that there were credible charges of concerted destabilization of the Indian markets," says Adani.

The SC-appointed panel also confirmed the quality of Adani Group's disclosures and found no instance of regulatory failure or any breach, Adani says. "While the SEBI is still to submit its report in the months ahead, we remain confident of our governance and disclosure standards," he adds.

"Over the past three decades, I have learnt that growth comes with its set of challenges. Every challenge we have faced has made us more resilient. And this resilience is vindicated by the outcomes we deliver…Our balance sheet, our assets, and our operating cashflows continue to get stronger and are now healthier than ever before. The pace at which we have made acquisitions and turned them around is unmatched across the national landscape and has fuelled a significant part of our expansion," Adani says.

On Monday, Adani Group clarified that it is not aware of any subpoena to the US investors after a report claimed that U.S. Securities and Exchange Commission was looking into the company. "All of our disclosures are a matter of public record. It is routine that various regulators will seek access to public material in an easy & referenceable manner," Adani Group said in a stock exchange filing.

"Adani Portfolio Companies and its businesses have acted as per the regulations and accounting standards of the jurisdictions in which they operate," the ports-to-power conglomerate said.