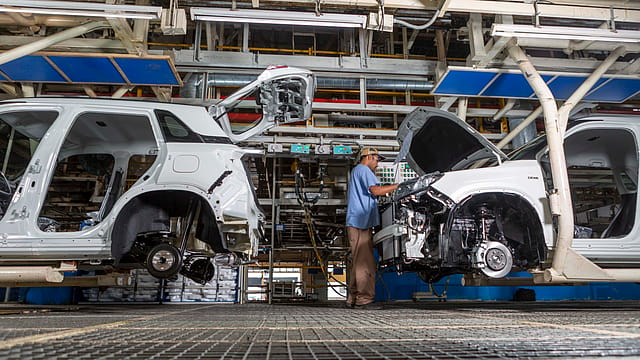

India's auto industry to grow in high single digits in FY24: Report

ADVERTISEMENT

India's automotive industry is expected to grow at high single-digit levels in the financial year 2023-24, according to ICRA.

The domestic automotive industry has seen a healthy revival in FY23, aided by a recovery in economic activities and increased mobility, ICRA says in a report.

The demand sentiments for a majority of the automotive segments such as passenger vehicles, commercial vehicles, and tractors have remained healthy, the ratings agency says.

However, the two-wheeler industry continues to struggle with industry volumes still below the pre-Covid peak levels. Even as improved offtake in the recent festive and marriage season has provided optimism, a sustained recovery in demand sentiments is yet to be seen, the report says.

A similar trend of relatively weak offtake has been seen for the entry-level car segment, implying that the purchasing power of the consumers at the bottom end of the pyramid has been eroded to an extent over the past few years by the significant rise in vehicle prices and disruptions caused by the pandemic, it adds.

"We expect growth across automotive industry segments to remain at high single-digit levels in FY2024. While the passenger vehicle, commercial vehicle, and tractor segment volumes would continue to trend upwards, aided by favourable demand drivers, the two-wheeler industry is also expected to record moderate growth in volumes aided by a low base. The Union Budget 2023-24 is expected to include enhanced budgetary outlays towards rural employment under MGNREGA, rural infrastructure development, enhancement of irrigation facilities, crop insurance scheme, as well as an increase in targets for agricultural credit. With measures to help rural communities expected to be at the heart of its policies, the budget is expected to aid in boosting the rural led demand across segments," says Shamsher Dewan, senior vice-president and group head of Corporate Ratings at ICRA.

Meanwhile, the electric vehicle segment has seen a significant upturn in prospects over the past 18 months, spurred by Government support in the form of subsidies under the FAME-II policy, enhanced awareness, and increasing product launches, the report says.

"Even as e-2W’s have accounted for approximately 85-90% of the total EV sales (excluding the e-rickshaw segment) aided by subsidies offered by the Government, electric vehicle penetration across segments is increasing at an exponential rate," says ICRA.

Amid the ongoing electrification transition, original equipment manufacturers (OEMs) are expected to incur significant investments in the development of ground-up electric vehicle platforms and enhance manufacturing capacities, the ratings firm says.

In the past few years, the government has rolled out several schemes, such as the FAME II scheme and production-linked incentive schemes, to help the local manufacturing ecosystem grow. The government is likely to make more announcements in this area, such as better financing terms for electric vehicles.

Over the near term, domestic industry volumes will continue to drive growth, with export prospects remaining weak amid a shortage of dollar availability in some key markets and inflationary pressures, the report says, adding that many nations have put restrictions on imports to conserve forex, which is expected to curtail export volumes in the near term.

Over the medium term, however, competitive manufacturing capabilities and ongoing efforts by OEMs to enhance the distribution network are likely to aid export volumes, it adds.

ICRA has a forecast of a CAGR of around 6-9% across automotive segments over the medium to long term.