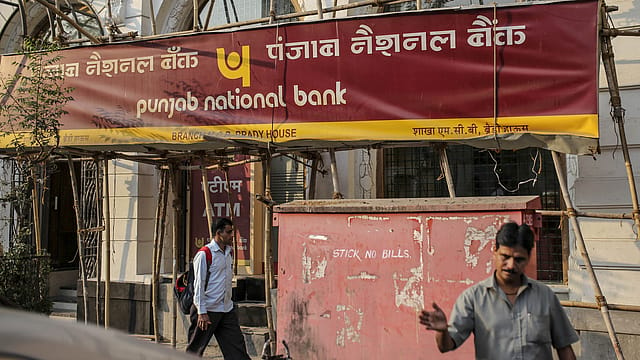

PNB names IL&FS power company in ₹2,060 crore fraud

ADVERTISEMENT

Punjab National Bank has reported a borrowing fraud worth more than ₹2,000 crore to the Reserve Bank of India (RBI) in the NPA account of IL&FS Tamil Nadu Power Company Ltd (ITNPCL).

In an exchange filing on Tuesday, the state-run lender stated that has already made provisions amounting to ₹824.06 crore in this case.

“A fraud of ₹2,060.14 crore is being reported by the bank to RBI in the accounts of the company. Bank has already made provisions amounting to ₹824.06 crore, as per prescribed prudential norms,” the bank told the exchanges.

The report from PNB comes a month after Punjab & Sind Bank reported a borrowing fraud worth ₹148.867 crore in the NPA account of ITNPCL.

“...an NPA account, viz. IL&FS Tamil Nadu Power Company Limited with outstanding dues of ₹148.86 crore has been declared as fraud and reported to RBI today as per regulatory requirement. Bank has already made provisions amounting to ₹59.54 crore, as per prescribed prudential norms,” the bank had said in a statement dated February 15, 2022.

ITPCL was incorporated by IL&FS Group as a special purpose vehicle (SPV) under its energy platform IL&FS Energy Development Company Limited (IEDCL) for implementation of the thermal power project at Cuddalore in Tamil Nadu.

ITPCL parent, Infrastucture Leasing and Financial Services (IL&FS), and several of its group entities had started defaulting on their loan obligations in 2018, stalling several infrastructure projects handled by it. As of October 8, 2018, IL&FS had a debt exposure of over ₹94,000 crore.