RIL’s Jio Financial Services forms JV with BlackRock to tap India’s asset management market

ADVERTISEMENT

Just days after buying a 33% stake in Brookfield-Digital Realty data centre JV, RIL’s newly formed investment company Jio Financial Services Ltd (JFS) and US investment major BlackRock India have decided to form Jio BlackRock, a 50:50 joint venture (JV), to its make a foray into asset management industry in the country.

The partnership brings a new player to the Indian asset management market, with JFS and BlackRock targeting an initial investment of $150 million each in the JV. The company, which will have its own management team, will launch operations post-receipt of regulatory and statutory approvals.

The Jio BlackRock JV is set to leverage the respective strengths and brands of both BlackRock and JFS to deliver “tech-enabled access to affordable, innovative investment solutions” to Indians, says a statement.

“Jio BlackRock brings BlackRock’s deep expertise and talent in investment management, risk management, product excellence, access to technology, operations, scale, and intellectual capital around markets, while JFS contributes local market knowledge, digital infrastructure capabilities, and robust execution capabilities,” says the statement adds.

Rachel Lord, chair & head of APAC, BlackRock, says India represents an enormously important opportunity, with the convergence of rising affluence, favourable demographics, and digital transformation across industries reshaping the market.

“We are very excited to be partnering with JFS to revolutionise India’s asset management industry and transform financial futures. Jio BlackRock will place the combined strength and scale of both of our companies in the hands of millions of investors in India.”

Hitesh Sethia, president and CEO, JFS says the partnership between JFS and BlackRock will leverage BlackRock’s “deep expertise in investment and risk management along with the technology capability and deep market expertise of JFS to drive digital delivery of products”.

He says that Jio BlackRock will be a “truly transformational, customer-centric and digital-first enterprise”, aiming to democratise access to financial investment solutions and deliver financial well-being to Indians.

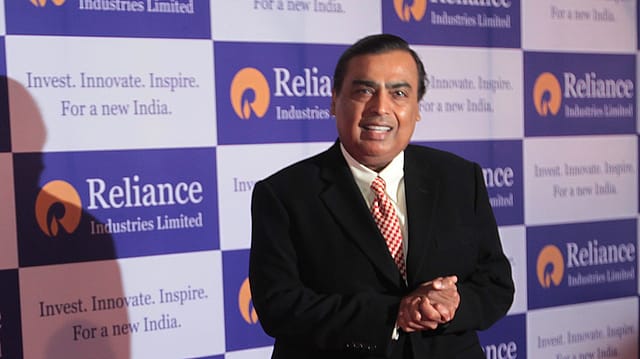

The name of Reliance Strategic Investments, a wholly-owned subsidiary of Mukesh Ambani-led Reliance Industries, was recently changed to Jio Financial Services Ltd, a non-banking financial company, with effect from July 25.

Reliance Strategic Investments was then demerged from its parent RIL on July 20, following which Jio Financial Services (JFSL) was temporarily added as a 51st constituent in Nifty 50 and 31st constituent in Sensex.

Earlier this week, Mukesh Ambani-led Reliance Industries Ltd announced its plans to enter the data centre business, along with Brookfield Infrastructure and Digital Realty.

RIL will hold a 33.33% stake in each of the Indian special purpose vehicles (SPVs) and become an equal partner. The JV aims to leverage Digital Realty’s industry-leading energy-efficient data centre platform design and operating procedures, Brookfield’s in-depth knowledge of the Indian infrastructure market, and Jio’s massive digital and connectivity ecosystem.

Shares of Reliance Industries opened 0.70 points up at ₹2,526.90 on Thursday. The scrip opened gap up at ₹2,529 as against the closing price of the previous session at ₹2,525.7. During the session, the company’s market capitalisation stood at more than ₹17.04 lakh crore, as more than 0.23 lakh shares exchanged hands on the BSE, against the two-week average of 4.22 lakh shares.