EV startup Ola Electric gets SEBI nod for ₹7,250 cr IPO

ADVERTISEMENT

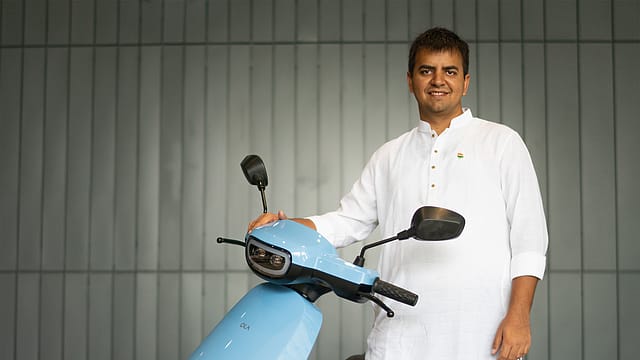

Bengaluru-based electric vehicle (EV) company Ola Electric has reportedly received approval from market regulator SEBI for its initial public offering (IPO). The Bhavish Aggarwal-led company filed its draft red herring prospectus (DRHP) with the regulator on December 22, 2023.

This is going to be the first public offering by a pure EV company, wherein the firm looks to raise ₹7,250 crore, as per sources cited by Moneycontrol. The price band, lot size, and other details will be announced later.

The IPO comprises a fresh issue of equity shares up to ₹5,500 crore and an offer for sale (OFS) of 95,191,195 equity shares by existing shareholders at a face value of ₹10 each. Under the OFS, founder Bhavish Aggarwal will offload 47.3 million shares. Among others, existing shareholders AlphaWave, Alpine, DIG Investment, Matrix, and others will also be paring 47.89 million shares via the OFS.

The company has reserved 75% of the issue for qualified institutional buyers, 15% for non-institutional bidders, and the remaining 10% for retail investors, as per DRHP document.

The IPO document showed that the fund raised from the fresh issue of equity shares will be used for capital expenditure to be incurred by the subsidiary, OCT for the Ola Gigafactory project and repayment of indebtedness incurred by subsidiary, OET. A part of the capital will be used for investment into research and product development, funding organic growth initiatives, and general corporate purposes.

Established in 2017, Ola Electric is a wholly-owned subsidiary of ANI Technologies, the parent entity of Ola Cabs. Over the years, Bhavish Aggarwal-led company has become India's leading manufacturer of electric vehicles with the largest integrated and automated E2W manufacturing plant, spread across 400+ acres in Krishanagiri, Tamil Nadu.

It manufactures EVs and core EV components such as battery packs and motors at Ola Futurefactory, its manufacturing facility in Krishnagiri. The company is in the process of building a EV hub in Krishnagiri and Dharmapuri districts in Tamil Nadu, India, which includes the Ola Futurefactory, upcoming Ola Gigafactory and co-located suppliers in Krishnagiri district.

According to the Redseer Report mentioned in the DRHP, in fiscal 2023, the company topped the charts among Indian incorporated electric 2-wheelers (E2Ws) and original equipment manufacturers (OEMs) in terms of revenue from E2W sales.

The report highlights that India is at the forefront of electrification of mobility due to the favourable total cost of ownership as compared to internal combustion engine vehicles. India is the second largest two-wheeler market globally (by domestic sales volume) and electric two-wheelers (E2Ws) are projected to account for 41-56% of the domestic 2W sales volumes by fiscal 2028.

For the fiscal year 2023, Ola Electric’s revenue from operations stood at ₹2,630.93 crore, rising more than seven times from ₹373.42 crore a year ago. For the three months ended June 30, 2023, revenue from operations was at ₹ 1,242.75 crore.

Kotak Mahindra Capital Company Limited, Citigroup Global Markets India Private Limited, BofA Securities India Limited, Goldman Sachs (India) Securities Private Limited, Axis Capital Limited, ICICI Securities Limited, SBI Capital Markets Limited and BOB Capital Markets Limited are the book-running lead managers, and Link Intime India Private Limited is the registrar of the offer.